Prices

September 3, 2019

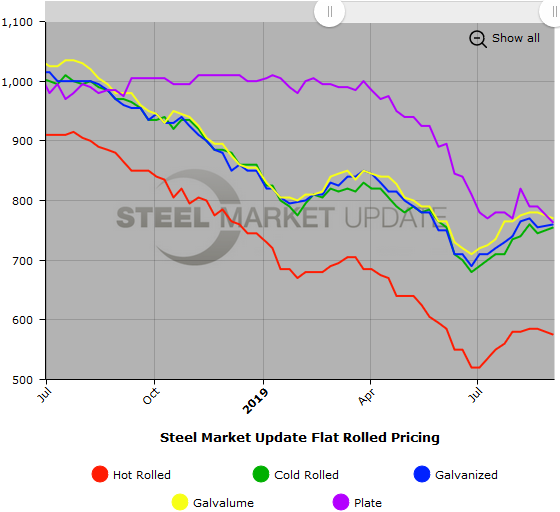

SMU Price Ranges & Indices: Mixed Momentum

Written by Brett Linton

Prices were mixed this week, although we are starting to see signs of weakness in hot rolled, while cold rolled and coated were slightly stronger. We are evaluating price momentum on all products and will have more to say on that subject on Thursday.

Here is how we see prices this week:

Hot Rolled Coil: SMU price range is $550-$600 per ton ($27.50-$30.00/cwt) with an average of $575 per ton ($28.75/cwt) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to two weeks ago (the last time we updated our price indices), while the upper end remained the same. Our overall average is down $10 compared to two weeks ago. Our price momentum on hot rolled steel is now Higher meaning we expect prices to increase over the next 30 days.

Hot Rolled Lead Times: 3-6 weeks

Cold Rolled Coil: SMU price range is $740-$770 per ton ($37.00-$38.50/cwt) with an average of $755 per ton ($37.75/cwt) FOB mill, east of the Rockies. The lower end of our range increased $20 per ton compared to two weeks ago, while the upper end remained unchanged. Our overall average is up $10 per ton compared to two weeks ago. Our price momentum on cold rolled steel is now Higher meaning we expect prices to increase over the next 30 days.

Cold Rolled Lead Times: 4-7 weeks

Galvanized Coil: SMU base price range is $37.00-$39.00/cwt ($740-$780 per ton) with an average of $38.00/cwt ($760 per ton) FOB mill, east of the Rockies. The lower end of our range rose $20 per ton compared to two weeks ago, while the upper end fell $10 per ton. Our overall average is up $5 per ton compared to two weeks ago. Our price momentum on galvanized steel is now Higher meaning we expect prices to increase over the next 30 days.

Galvanized .060” G90 Benchmark: SMU price range is $818-$858 per net ton with an average of $838 per ton FOB mill, east of the Rockies.

Galvanized Lead Times: 4-9 weeks

Galvalume Coil: SMU base price range is $37.00-$40.00/cwt ($740-$800 per ton) with an average of $38.50/cwt ($770 per ton) FOB mill, east of the Rockies. The lower end of our range decreased $20 per ton compared to two weeks ago, while the upper end remained unchanged. Our overall average is down $10 per ton compared to two weeks ago. Our price momentum on Galvalume steel is now Higher meaning we expect prices to increase over the next 30 days.

Galvalume .0142” AZ50, Grade 80 Benchmark: SMU price range is $1,031-$1,091 per net ton with an average of $1,061 per ton FOB mill, east of the Rockies.

Galvalume Lead Times: 6-8 weeks

Plate: SMU price range is $720-$805 per ton ($36.00-$40.25/cwt) with an average of $762.50 per ton ($38.125/cwt) FOB delivered to the customer’s facility. The lower end of our range decreased $60 per ton compared to two weeks ago, while the upper end rose $5 per ton. Our overall average is down $27.50 per ton compared to two weeks ago. Our price momentum on plate steel is Neutral, meaning we are waiting for the market to show a clear direction.

Plate Lead Times: 2-6 weeks

SMU Note: Below is a graphic showing our hot rolled, cold rolled, galvanized, Galvalume and plate price history. This data is available here on our website with our interactive pricing tool. Note that plate prices are not yet available on our website, but we are in the process of adding that dataset. If you need help navigating the website or need to know your login information, contact us at info@SteelMarketUpdate.com or 800-432-3475.