Prices

September 3, 2019

CRU: Iron Ore Recovers, But Pellet Market Under Pressure

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

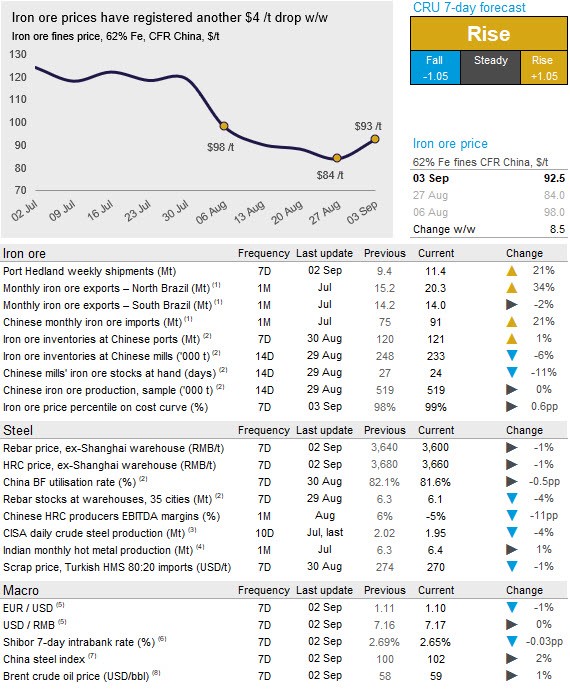

Iron ore prices have bounced back in the past week with a rally on Monday pushing prices back above $90 /t. Renewed market confidence resulted in futures on the Dalian commodity exchange hitting limit up in Monday trading.

Steel prices in China have been stable throughout the week, which is typically a bullish signal for iron ore. Further production cuts in Hebei throughout the month of September are expected to tighten steel supply further. Meanwhile, demand for steel in China is expected to remain solid as construction activities make another push before China’s 70th anniversary celebration at the start of October.

Supply of iron ore, particularly from Australia, has strengthened. The country is an important source of lump, so the strong supply is putting further pressure on the lump premium. Lump inventories in China are currently at the highest level in 2019. Baffinland, a lump supplier in northern Canada, is currently shipping at a high rate, which means lump supply to the European market is looking solid.

Another segment that is under pressure is the seaborne pellet market. In early-2019, the seaborne pellet premium was fixed at levels around $60 /t above the 65% Fe index as pellet supply concerns emerged following Vale’s dam accident. However, in recent months, lump supply has improved and steel production cuts in key pellet-consuming regions such as Europe, MENA and Japan have resulted in lower appetite for pellets. In China, pellet feed supply has improved steadily throughout 2019 and domestic pellet production is strong. In 2019, Chinese pellet exports, which are rarely seen in the market, have occurred frequently in the past months.

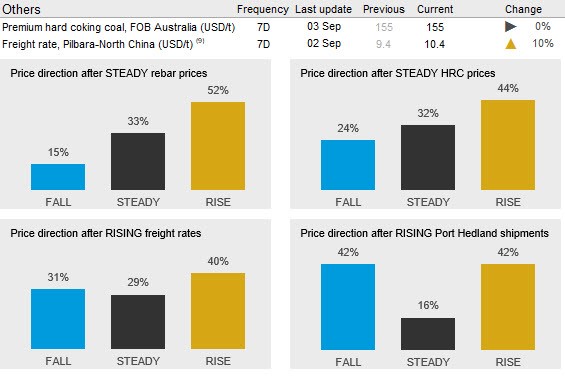

Although supply has improved, the iron ore market is still tight. Our sources are also suggesting that supply from countries such as India and Iran may be weakening, which would cause further supply concerns. Our analysis based on recent key metrics from the market suggests that there is room for prices to increase further in the coming week.