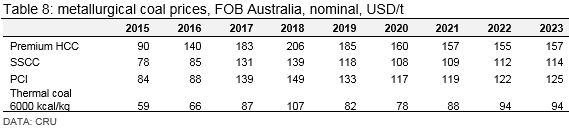

Prices

August 29, 2019

CRU: Metallurgical Coal Market Outlook Q3 2019

Written by Tim Triplett

By CRU Senior Analyst Manjot Singh

China has been at the center of coal price upcycles that have taken place this millennium. The commodity supercycle that characterized the early-2000s was fueled by demand growth, especially in emerging markets like China. That bull market reached a peak in 2011 when slowing demand growth was met with an influx of increased supply in the coal industry. The coal market became massively over supplied in the following years and coal prices went downhill.

What caused the next upcycle in the coal industry had a lot to do with China again. The only difference was that, this time, the upswing in coal prices was not driven by demand but supply reforms that the Chinese authorities implemented in 2016. Coal supply cutback in China, logistical constraints in Australia and a lack of new supply coming on board meant that the metallurgical coal price upcycle was alive and well until a couple of months ago. This has now changed as prices are currently hovering around two-year lows.

Thus, in order to forecast metallurgical coal prices going forward, understanding Chinese demand and supply dynamics and its impact on the global market will be vital.

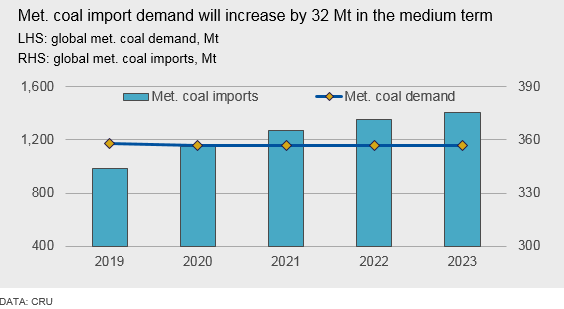

Global Met Coal Consumption Will Stay Flat, But Import Demand Will Increase

We project global metallurgical coal demand to stay relatively flat in the medium term. One reason is the relative slowdown in emerging markets; world GDP growth averaged 3.1 percent between 2002–2018, but CRU forecasts this will slow to 2.8 percent during our forecast period. Furthermore, increasing availability of scrap in China will lead to significant falls in hot metal requirements, although these declines will be offset by increases in India, South East Asia and the rest of the world.

Despite falling demand in China, its reliance on imported HCC specifically will continue to rise because high-grade coking coal reserves in China are scarce and at the same time coastal steelmakers are increasingly relying on imported high-quality hard coking coals to meet their productivity requirements. Chinese steelmakers will also be unwilling to reduce their reliance on imported HCC as it helps them maintain sourcing security from a strategic and pricing perspective. Overall, there will be a net reduction in metallurgical coal imports into China of ~5-6 Mt between 2019 and 2023 (n.b. due to falling SSCC and PCI imports) but import demand from rest of the world will increase by 37 Mt. Therefore, global demand for metallurgical coal imports will increase by ~32 Mt by 2023.

Capital is Still Being Spent to Develop Good Assets

Waning investor interest and the talk of increased shareholder pressure on mining majors to reduce their coal exposure has gathered pace in the last couple of years. While this is true for thermal coal, capital is still being spent to develop additional metallurgical coal supply, albeit not as readily as a few years ago. For example, only in the last month, Coronado Coal has committed A$160 M to expand its Curragh coal mine and Anglo American has committed A$324 M to extend the life of its Aquila HCC mine, which forms a part of its Capcoal complex.

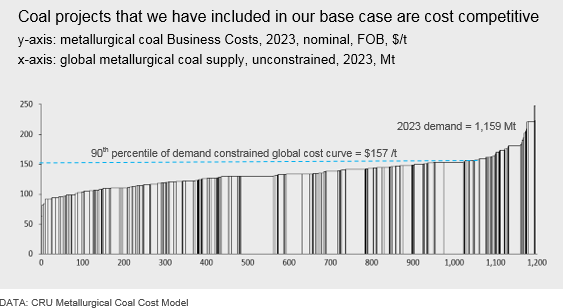

We believe there is ample supply in the pipeline due to numerous projects undergoing brownfield expansions, expected ramp up at recently commissioned mines and development of new projects. The new projects are comprised of mines that we have identified as either “committed” or “probable.” Interestingly, all of the new projects that we have included in our global Business Costs curve for 2023 have costs in the lower half of the curve. This suggests that these projects are capable of generating positive cashflows when they do come online. There are also a large number of projects that we classify as “possible” that are currently quite far from being implemented; therefore, we have not included them in our base case forecast.

In our supply research, we estimate potential new supply available for exports in the medium term (n.b. using 2019 as the base year) by factoring in the following:

• 4 Mt of increased supply from recently commissioned mines

• 8 Mt of increased supply from brownfield expansions

• 0 Mt of supply from “committed” projects

• 9 Mt of supply from “probable” projects

• 7 Mt of supply reduction due to depletion of currently operating mines

This adds up to 56.4 Mt of unconstrained potential supply. Obviously not all of this new supply will be realized due to various reasons such as operational hurdles, financing difficulties, transport limitations or difficulty in obtaining regulatory approvals. Therefore, we believe the following is reasonable to include in our base case forecast for actual new supply available for exports in the medium term:

• 0 Mt of increased supply from recently commissioned mines

• 0 Mt of increased supply from brownfield expansions

• 0 Mt of supply from “committed” projects

• 3 Mt of supply from “probable” projects

• 7 Mt of supply reduction due to depletion of currently operating mines

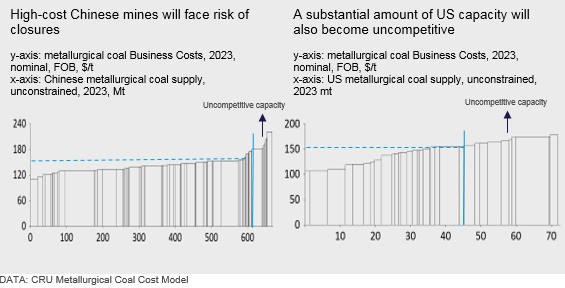

This adds up to 38.6 Mt of export growth in the medium term, which is more than our demand growth projection of 32 Mt between 2019 and 2023. Therefore, in order for the market to balance, ~7 Mt of existing export capacity will need to be taken out of the market, which we believe will largely occur in the USA.

Benchmark Premium HCC prices Will Average $157 /t in 2023

As explained above, while we expect demand for metallurgical coal imports to increase in the medium term, there is also sufficient supply in the pipeline to meet this incremental demand. For this reason, we believe prices will not be significantly different from those one would expect under steady-state conditions; there are neither significant barriers to entry for our base case supply forecast or factors that would result in a particularly weak market for an extended period. Therefore, prices will average around the 90th percentile of the demand constrained global cost curve, which is $157 /t, FOB Australia, nominal basis in 2023.

While a large share of projects under development and operating mines are cashflow positive at $157 /t, FOB Australia, a substantial amount of coal supply is not. At this price point, most of the uncompetitive supply is comprised of high-cost U.S. and Chinese mines, which will lose money and face risks of closure.

The shutdown of these mines in China is also consistent with Chinese domestic coal supply rationalization policies adopted by the Chinese government in recent years. However, this should not be mistaken as the Chinese government’s willingness to let its domestic coal industry shrink. There is also an increasing drive to invest in new coal capacity in China. Reportedly, the Chinese regulator has given the go-ahead to build 141 Mt of new coal capacity in the first six months of this year, compared with 25 Mt over the whole of last year. But we continue to stick to our view that most of this new capacity is being built in coal basins that largely yield thermal coal and not metallurgical coal.

The biggest risk to our medium-term forecast is posed by unpredictable Chinese policies. If the Chinese government proposes policies that, in any sense, aim to prevent the shutdown of these high-cost metallurgical coal mines as demand falls (e.g. by imposing even more stringent coal import restrictions), or if it incentivizes domestic metallurgical coal project developments, then the seaborne metallurgical coal market will enter a state of oversupply. In this case, seaborne prices will fall below the steady-state levels we have forecast.

On the other hand, if there are any delays to the ramp up of recently commissioned mines, brownfield expansions and development of new projects, the average global marginal costs of production will increase and seaborne metallurgical coal prices will be higher than our base-case forecast.

Steel Margins and Thermal Coal Prices Will Dictate SSCC and PCI Discounts

In the past quarter, we have observed a complex trend in Semi-Soft Coking Coal (SSCC) prices. We do not assess spot SSCC prices from Australia, but in the last few months we gathered from our sources that spot prices for Mid Vol. SSCC produced in Queensland were mostly moving in line with the spot HCC prices, which at the time were quite elevated. However, the spot price for High Vol. SSCC coal produced in New South Wales declined considerably in end-May, falling to well below $100 /t, FOB Australia.

This is because most SSCC producers in Hunter Valley are predominantly thermal coal producers and, as thermal coal prices started plummeting, they started offering more quantities of washed thermal coal in the spot SSCC market. Thus, there have been times in the last few months when the differential between spot prices of Mid Vol. SSCC and High Vol. SSCC widened to more than $20 /t, compared with less than $10 /t in February. In this sense, it seems two separate markets in the semi-soft category coals have emerged.

Usually, Hunter Valley SSCC coals are more prone to thermal coal-SSCC switching as Queensland SSCC is mostly tied up in contracts. But this divergence between the spot prices of SSCC coals has made the process of contract negotiations between Japanese steelmakers and Australian producers more complicated. While suppliers insist on SSCC quarterly contracts being tied to PHCC prices, buyers are now insisting on factoring in the extreme price differential between Mid Vol. and High Vol. SSCC.

We believe these misalignments in the two categories of SSCC coals are short-lived and, if thermal coal prices continue to stay depressed, even Mid Vol. SSCC coal prices eventually will be pushed lower.

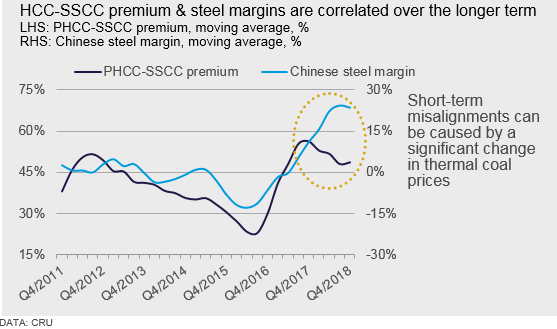

Historically, we have observed a significant degree of correlation between average PHCC-SSCC premiums and average steel margins over a longer period, as you can see in the chart above. But, the switching potential of thermal coal to SSCC leads to misalignments in the short term, all other things remaining constant. In this way, while steelmaking margins are the key driver of PHCC premiums over SSCC, thermal coal pricing can also play a role. Therefore, to forecast SSCC prices going forward, we have used our view of steel industry profitability and thermal coal prices as key inputs.

In short, although steel margins are forecast to be low, we do not expect them to plummet to 2015 levels. Thus, the HCC premium over SSCC will remain higher than in 2015. Also, we believe SSCC supply will exceed demand in the coming years and SSCC discounts will widen. At the same time, a margin above thermal coal prices will set the floor for SSCC prices.

In terms of PCI, we project global average injection rates to increase from 124 kg/thm in 2019 to 126 kg/thm by 2023, but the number of new PCI projects under construction or undergoing expansions is disproportionately lower compared with HCC and even SSCC. Therefore, we have kept our view of PCI discounts unchanged. We forecast PCI discounts to decrease from 28 percent in 2019 to 20 percent by 2023.