Prices

August 22, 2019

CRU: U.S. Sheet and Scrap Prices Rise While Inventories Subdue Longs

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores and CRU North America Analyst Ryan McKinley

North America, primarily the U.S., was an outlier to global price trends for scrap and sheet products this month. Multiple mill price increases for sheet have been primarily successful, although current prices remain well below the most recent mill targets of $630 /s.ton for HR coil. These rising HR coil prices supported higher scrap prices in August, which rose by $20-30 /l.ton depending on grade. Still, long product prices continue to face downward pressure as relatively high inventory levels suppress demand.

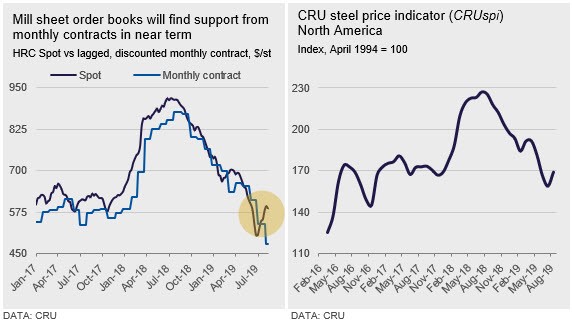

Compared to our July 3 price assessment, HR coil has risen by $83 /s.ton to $588 /s.ton. Recently, we have recorded some lower-priced transactions because competition between mills to place volume into the spot market has intensified. However, even as spot prices are now well above recent lows, the overall volume of transactions has fallen, reaching a low for the year at the beginning of August. This trend is normal as mills fill order books at lower prices ahead of and during the initial price increase announcements. Another reason for lower transaction volume is the structure of monthly contracts. As monthly adjustable contracts have become increasingly prevalent, the majority of these adjust to the prior month’s price. This means that for some contracts, orders placed in August reflect July’s price, often at a discount (see chart).

The upward pressure for sheet prices provided support for U.S. scrap prices. Prices rose by $20 /l.ton m/m for most grades across all regions, even as some dealers sought a $30 /l.ton price increase amid slowing inbound flows. This supply decline, caused by continual price cuts for most of the year, combined with stable buying programs and export market m/m to help support the price increase. August’s scrap price rise was only the second so far in 2019.

There was little regional or grade-based variation to the $20 /l.ton increase this month except for turnings prices, which rose by $30 /l.ton. Steelmakers have increasingly found turnings an inexpensive alternative to other scrap grades, which has increased demand and resulted in stronger prices.

Unlike scrap and sheet products, U.S. longs prices remained on a downward trajectory much like elsewhere in the world. Lackluster domestic demand amid high inventory levels has kept prices under downward pressure, but the pace at which prices are declining has slowed. In part, the uptick in scrap prices has helped provide some price support, and import levels are now lower than earlier in the year. Construction demand, while solid according to most market participants, varied sector-by-sector during the first half of 2019. Single- and multi-family home construction has declined by an average of 4.7 percent y/y, while non-residential construction has grown by an average of 5.8 percent.

Activity in the plate market has tried to mimic the price increase seen in sheet. Indeed, mills have now announced two price increases totaling $80 /s.ton over the course of two weeks. During this time, plate prices steadied at low levels, though like sheet, multiple low-priced transactions were recorded before prices started to rise. This past week, plate prices have increased, gaining $10 /s.ton.

Outlook: Seasonal Pressures to Cap Price Gains

Over the near term, we expect sheet prices to steady as inventories remain plentiful while end demand remains somewhat challenged due to economic and seasonal headwinds. Sheet demand has been poor in 2019 and we do not expect this trend to ease before 2020. In fact, demand pressure is more likely to worsen over 2019 H2. Due to this, we expect sheet prices to turn lower in Q4, though ultimately they should remain higher than the recent lows established in late June. Plate, on the other hand, has room to rise after prices here fell by $100 /s.ton since early June. However, like sheet, near-term demand may ultimately limit the range of price gains.

As for scrap, U.S. mills had little trouble covering their needs in August with the $20 /l.ton increase, which is indicative of little upside for September. For the remainder of the year, we expect scrap prices to remain stable and follow more typical seasonal patterns barring any substantial change to finished steel prices. Prices will likely come under downward pressure in October and November (depending on weather conditions) with seasonal upward pressure likely for December and early 2020.

We expect longs prices to bounce around at current levels for the next 30 to 60 day time period, with seasonal price weakness returning in the fourth quarter. Any potential for higher prices for the remainder of the year would hinge on inventory levels falling off and imports remaining out of the market.