Prices

August 20, 2019

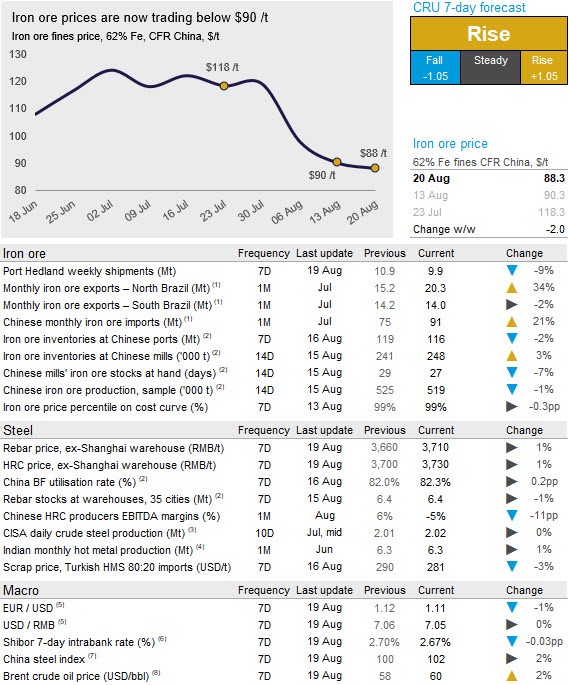

CRU: Iron Ore Price Fall Continues

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

Iron ore prices continued to decline in the past week as margins in the Chinese steel industry continued to decline on weak steel demand and high production levels. On Tuesday, Aug. 20, CRU has assessed the 62% Fe fines price at $88.30 /t, a $2.00 /t decline w/w.

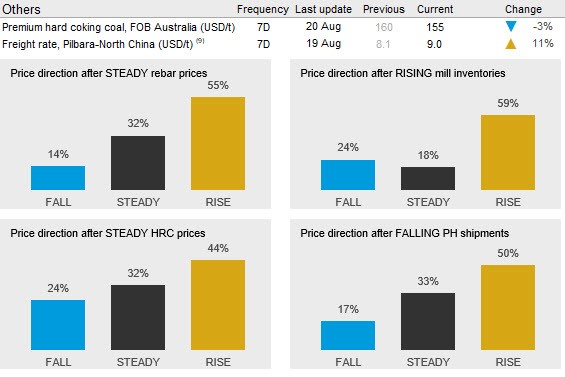

The supply side was hit by some negative news in the past week as Vale announced the temporary idling of beneficiation at the newly acquired Viga site, previously owned by Ferrous Resources. However, production in the mine will continue, meaning that the volumes would either be stockpiled or most likely used for blending with Vale’s higher-grade ore. Port Hedland shipments fell in the past week, mostly due to slightly lower shipments by BHP. The company has thus far in August shipped at a surprisingly high level, reaching an annualized rate of 290 Mt/y. Our sources in the market have hinted at lump supply being exceptionally strong at the moment. Australian lump availability has improved significantly, which is one of the reasons why the lump premium has remained under pressure. Lump inventories at ports in China are currently at their highest level year-to-date.

Typhoon Lekima has also had an effect on the market in the past week. Port stocks in China have fallen w/w, but this change is supply-driven as unloading at ports has been restricted in many parts of the country. Another effect of the cyclone is temporarily lower Capesize availability, which, in combination with aggressive vessel booking by Vale, has resulted in freight rates rising 11% w/w.

Most of our indicators point towards prices rising in the coming week. Steel prices have been rising, which has rejuvenated hopes of a recovering steel market. Mills still maintain low inventories, so it is likely that we will see some restocking in the coming weeks as the iron ore price has reached a lower level.