Prices

August 15, 2019

Foreign Imports: Semifinished Way Down in August, as Expected

Written by John Packard

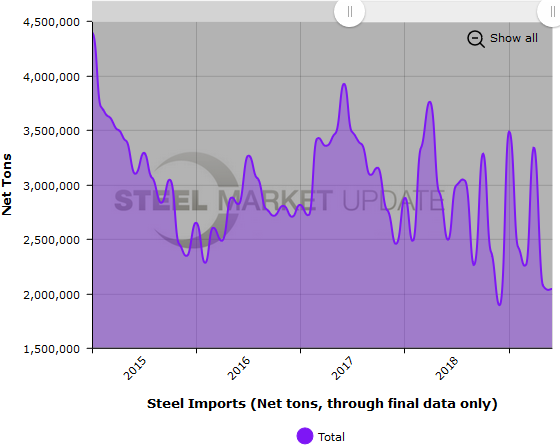

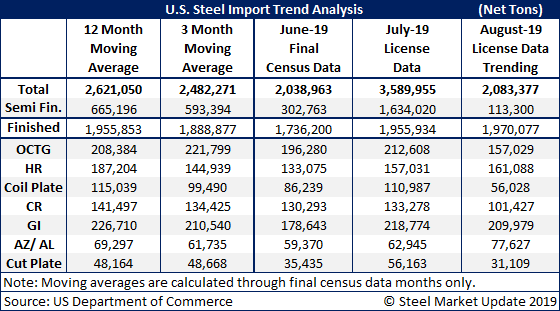

Halfway through the month of August, steel import license data is trending down considerably, as expected following a big bump in July. Taking the rate of license requests and extrapolating it out for the entire month, August is on track to see less than 2.1 million tons of total steel imports, down from nearly 3.6 million tons in July.

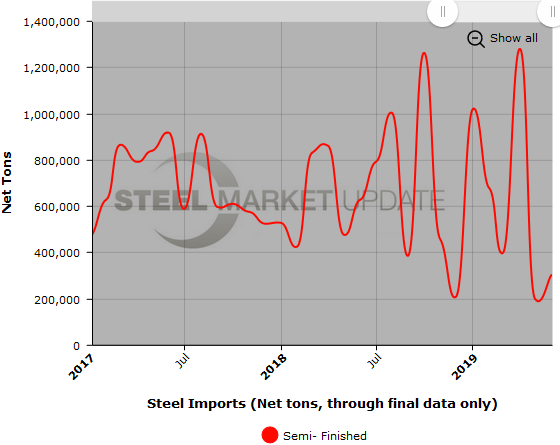

The major difference is licenses for semifinished steel. Domestic mills were quick to secure licenses for imported slabs in July, which was the first month of the third quarter. Semifinished imports from certain countries, notably Brazil, are subject to quarterly quota limits. July semifinished licenses totaled an unusually high 1.6 million tons. For August, that figure has corrected back down to just 113,000 tons.

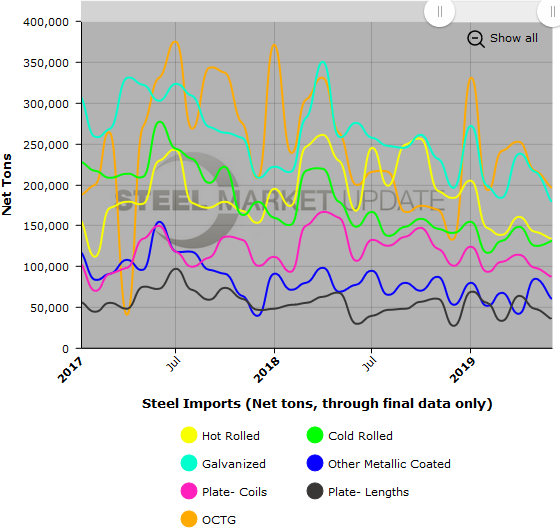

Finished steel imports for August are trending at less than 2 million tons, which is about average. Licenses for finished steel products are all trending down for August except for small increases in hot rolled and Galvalume.

Below are three sample graphs showing the history of foreign steel imports through final June data. You will need to view the graphs on our website to use their interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.