Prices

August 6, 2019

CRU: Iron Ore Continues Its Decline as Supply Picks Up

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

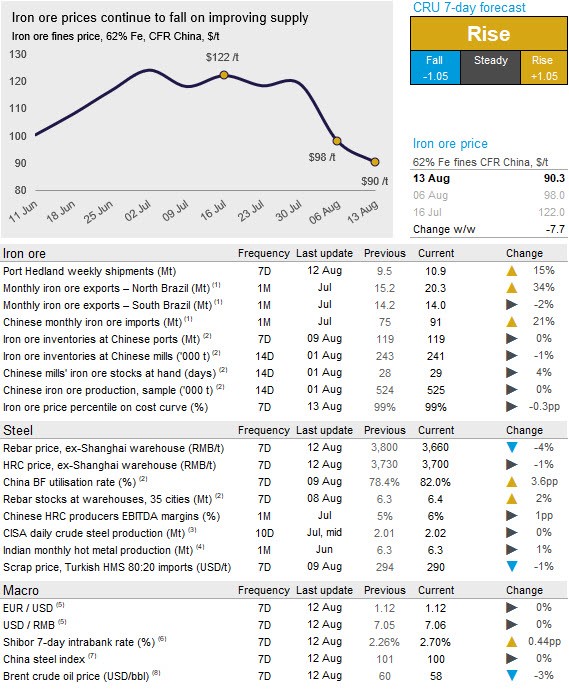

Iron ore prices continued to decline in the past week as international steel prices continued to fall on a weak demand outlook for steel in the coming month. On Tuesday, Aug. 13, CRU assessed the 62% Fe fines price at $90.30 /t, down $7.70 /t w/w.

Steel prices in China have declined significantly in recent weeks as production has remained strong, while trade tensions and a macroeconomic outlook have slowed steel demand. Inventories at traders have kept increasing and several steel mills have in the past week reported production cuts as a result of negative margins. Our sources mentioned that cuts have taken place in places such as Shanxi, Shaanxi, Sichuan and Shandong.

Supply of iron ore has improved in the past week. Brazilian shipments, especially from northern Brazil, were high in July and have remained strong thus far in August. At the same time, our sources suggest that Vale has recently been offering more BRBF in the spot market. This is in line with the start of production at Vale’s Vargem Grande mine, which is expected to supply ~5 Mt/y of low-grade fines used for blending with high-grade material from northern Brazil. Rio Tinto’s exports have, due to recent quality issues, remained limited, while we see an increase in shipments from Port Hedland. BHP and FMG have both raised output in the past week as Port Hedland exports have jumped 15 percent w/w.

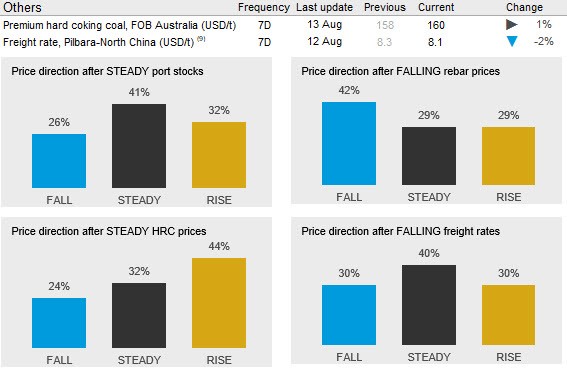

For the next week, we see the potential for iron ore prices to rebound somewhat. Inventories at mills and ports remain low and steel prices have in the past few days stopped declining. We expect iron ore prices to rise.