Market Data

August 2, 2019

GDP Report: U.S. Expansion Now Longest on Record

Written by Peter Wright

The government’s first estimate of U.S. GDP growth in Q2 2019 was 2.1 percent, down from 3.1 percent in the first quarter. The current U.S. expansion is now the longest on record at 121 months dating back to June 2009.

![]()

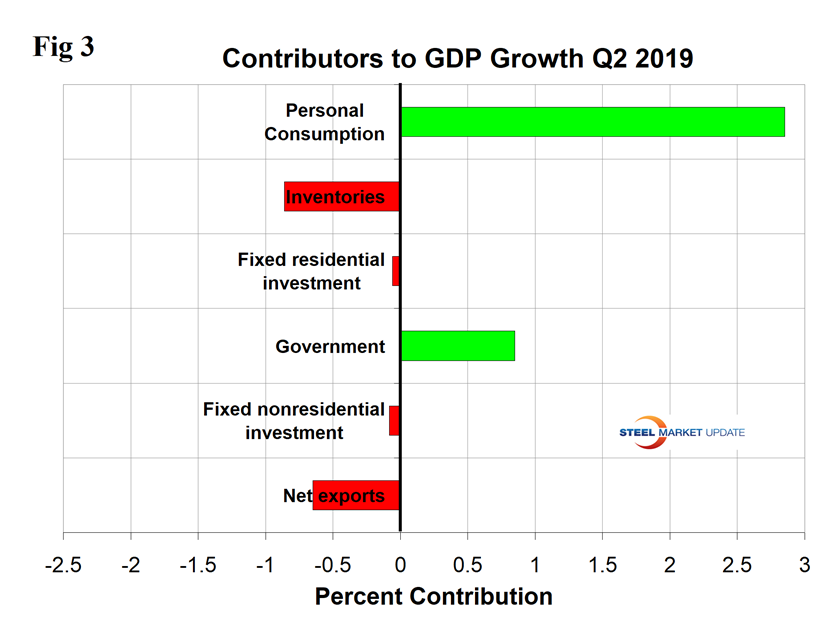

Last Thursday, the Bureau of Economic Analysis (BEA) released its first estimate of GDP growth for the second quarter, stating: “The growth in real GDP in the second quarter reflected positive contributions from personal consumption expenditures, federal government spending, and state and local government spending, which were partly offset by negative contributions from private inventory investment, exports, nonresidential fixed investment and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, increased. However, growth slowed and the deceleration in the second quarter reflected downturns in inventory investment, exports, and nonresidential fixed investment. These downturns were partly offset by accelerations in personal consumption expenditures and federal government spending.”

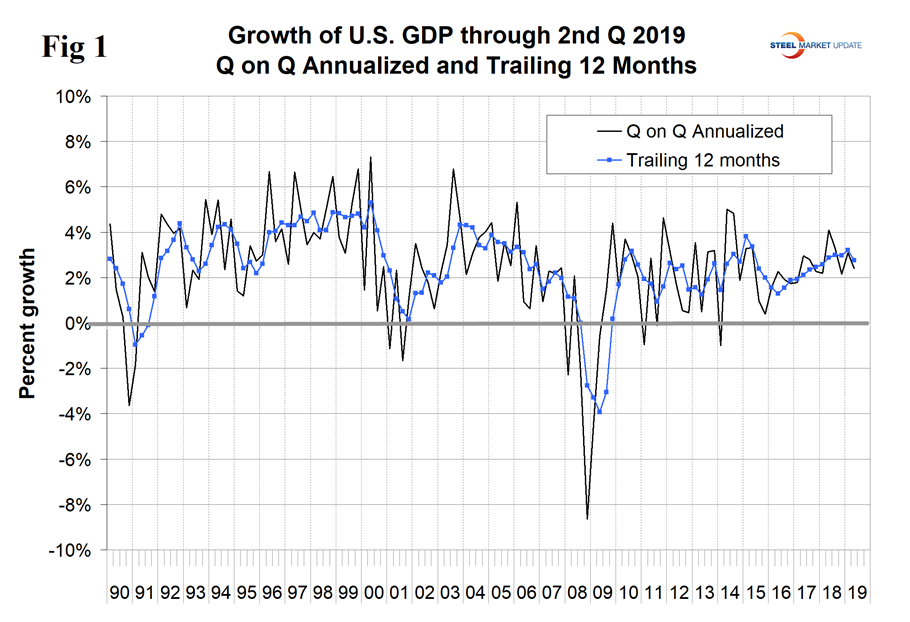

GDP is now measured and reported in chained 2012 dollars, and on an annualized basis in the second quarter totaled $19.024 trillion. The growth calculation is misleading because it takes the quarter-over-quarter change and multiplies by four to get an annualized rate. This makes the high quarters higher and the low quarters lower. Figure 1 clearly shows this effect. The blue line is the trailing 12-months growth and the black line is the headline quarterly result. On a trailing 12-month basis, GDP was up by 2.77 percent in the second quarter, down from 3.20 percent in the first quarter. To put that result into perspective, the average in 38 quarters since Q1 2010 has been 2.28 percent. The blue line in Figure 1 shows the progress of the trailing 12-month result since the second quarter of 2016.

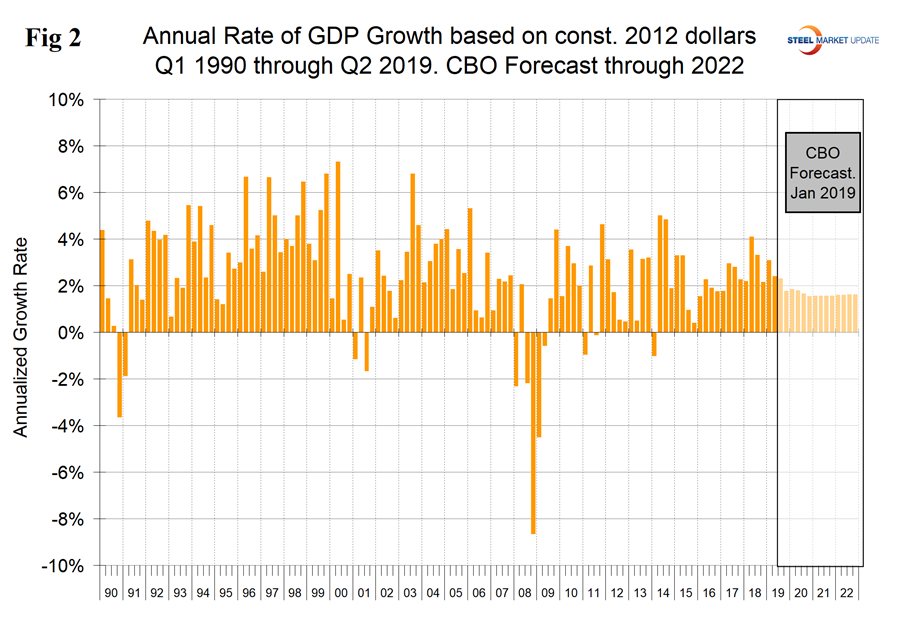

Figure 2 shows the headline quarterly results since 1990 and the January 2019 Congressional Budget Office forecast through 2022. The CBO underestimated the growth rate in the first quarter of 2019, but was exactly correct for the second quarter and expects the boost from the tax break to decline in the balance of 2019.

The mix of the six major contributory components in the final GDP growth calculation is shown in Figure 3. Normally, personal consumption is the dominant growth driver, and this was the case in the second quarter when this contribution was 2.85 percent. Personal consumption includes goods and services, the goods portion of which includes both durables and non-durables. Inventory adjustments and net exports detracted from the overall result. Declining inventories are entered as a negative in the GDP calculation. Over the long run, inventory changes are a wash and simply move the reported growth from one period to another.

On July 26, Economy.com wrote: “U.S. GDP growth slowed in the second quarter, according to the advance report from the Bureau of Economic Analysis. Real GDP grew 2.1%, after growing 3.1% in the first quarter after annual revision. The weakening came despite an acceleration in consumer spending growth as inventory accumulation slowed, the trade deficit widened, and fixed investment fell. Real disposable income growth slowed to 2.5% from a revised 4.4%. The saving rate fell to 8.1%, from a revised 8.5%. Revisions showed faster GDP growth in 2017, but similar annual growth in other years.”

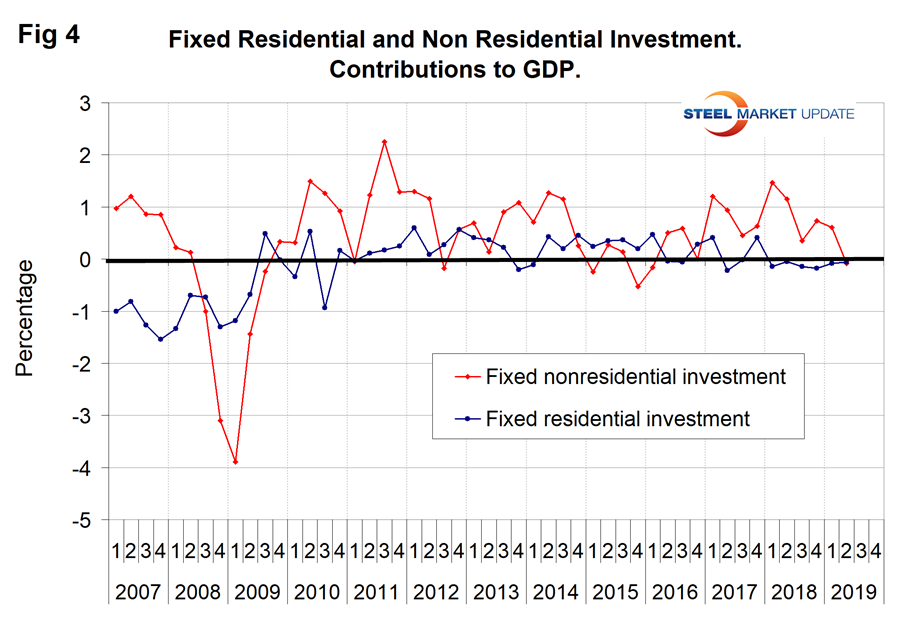

Figure 4 shows the contributions of residential and nonresidential investment. After the recession, nonresidential investment bounced back, but residential did not and has had less than a 1 percent variation since the third quarter of 2010. In the preliminary result for the second quarter, nonresidential investment made a small negative contribution, which was the first time in the red since the first quarter on 2016. The contribution of government expenditures was 0.85 percent in the second quarter, which was the highest since the first quarter of 2009.

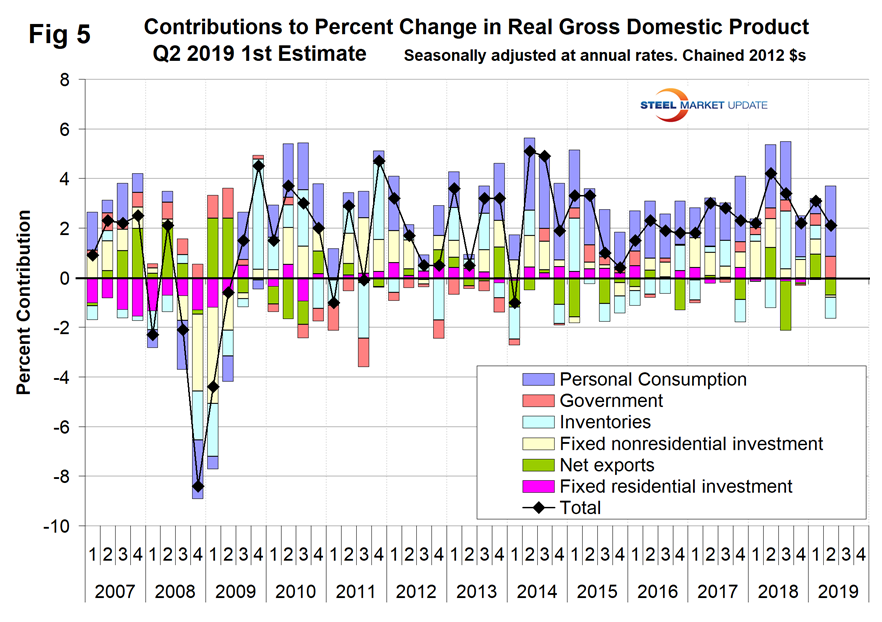

Figure 5 shows the quarterly contributors of the six major subcomponents of GDP since Q1 2007. This chart clearly shows the whipsaw effect of inventory changes, which are coded pale blue. It also shows the unusually low contribution of personal consumption expenditures in the first quarter of 2019.

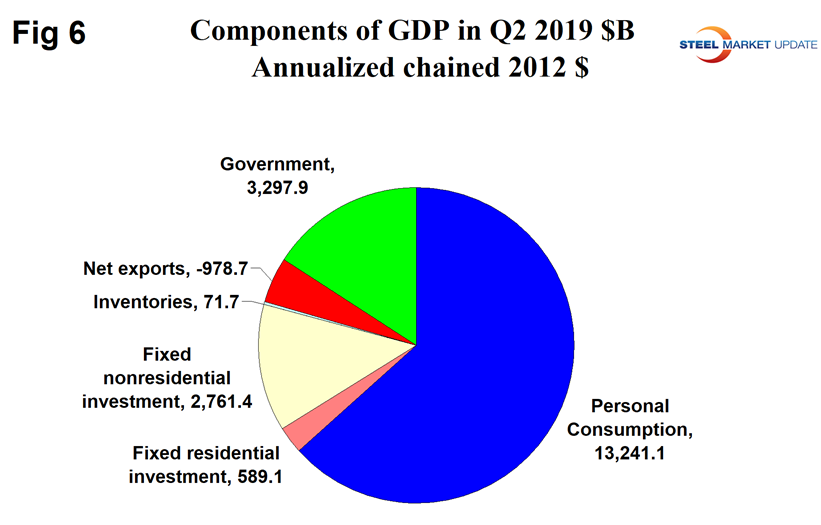

Figure 6 shows the breakdown of the $19.024 trillion economy.

SMU Comment: Personal consumption expenditures bounced back in the second quarter from an unusually low result in the first. The trailing 12-month growth rate, which we think is the best way to look at this data, declined in the second quarter for the first time since the second quarter of 2016.

Definition of GDP: Gross domestic product (GDP) is the value of the goods and services produced by the nation’s economy less the value of the goods and services used up in production.

GDP is defined as Consumption (C) plus Investment (I) plus Government Spending (G) plus [Exports (E) minus Imports (I)] or: GDP = C + I + G + (E-I)

This equation is known as an identity. An identity is an equality that remains true regardless of the values of any variables that appear within it. That means it is not a guess or an approximation. It is simple reality.

National savings is GDP minus (consumption plus government spending). That means that investment equals savings plus net exports. If there are no net exports, then money must come back into the U.S. from outside the country to finance investments, along with savings.

Thus, if there is a government deficit, there must be savings by both consumers and businesses, plus capital flows from outside the country, to offset that deficit in order for there to be any money left over for investments.

Another definition of GDP states that it equals the growth in working population multiplied by their productivity.