Market Data

July 31, 2019

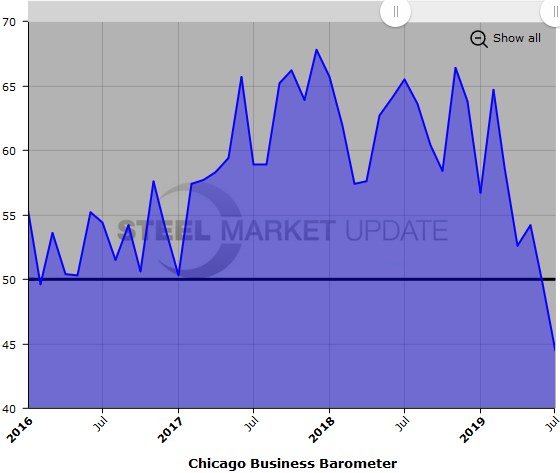

Chicago Business Barometer Shows Weakness Across the Board

Written by Sandy Williams

The Chicago Business Barometer recorded a second month in contraction, falling to 44.4 in July from 49.7 in June and the weakest third-quarter start since 2009.

Production was at a 10-year low, falling 22 percent on the month. Further contraction of new orders indicated subdued demand resulting in trimming of workforce. The employment indicator was at its lowest level since October 2009.

Inventories increased along with longer lead times.

“Sentiment faded further with firms facing weakness across the board. Global risks, trade tensions, slowdown in demand and somber growth expectations, all jeopardize business conditions. Firms are not panicking yet, but the latest report isn’t adding to the cheer. The above risks lend weight to a monetary easing approach by the Fed, albeit a gradual one,” said Shaily Mittal, Senior Economist at MNI.

This month’s special question asked firms about their views on the U.S. economy’s growth in the second half of the year. Two in five firms expected the economy to see slower growth than currently, with some holding tariffs responsible for the slowdown. The majority, at 46 percent, did not expect any change, while only 14 percent expected the economy pick up.

Below is a graph showing the history of the Chicago Business Barometer. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance logging in to or navigating the website, please contact us at info@SteelMarketUpdate.com.