Market Segment

July 30, 2019

Declining Steel Prices Impact AK Steel's Q2 Earnings

Written by Sandy Williams

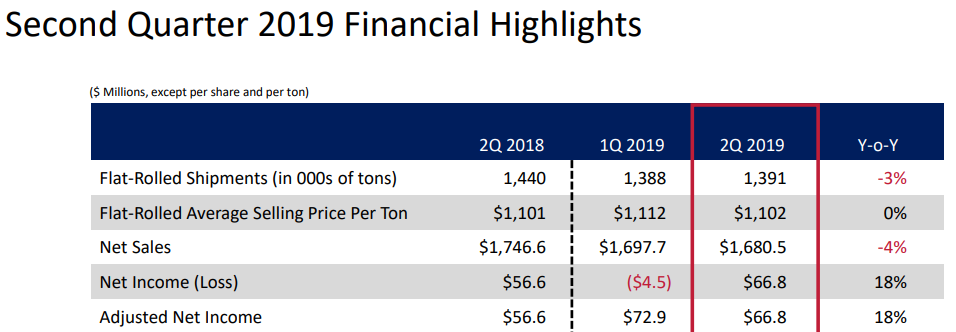

AK Steel’s net sales for the second quarter declined by 4 percent to about $1.68 billion due primarily to lower shipments to the slowing automotive market. Yet the steelmaker’s earnings for the quarter reached $66.8 million, an improvement from the $56.6 million in Q2 2018, though down from $72.9 million in the prior quarter. Hot rolled carbon spot market pricing dropped from $690 per ton to $555 per ton in the second quarter, shaving $5 million to $7 million from annual earnings with each $10 change in market price, the company said during its second-quarter conference call on Monday.

“We reported solid earnings for the second quarter despite a dramatic decline in carbon spot market pricing from a year ago. This reflects our strategy to focus on value-added products with fixed-price contracts and to deemphasize sales to the volatile commodity spot market,” said Roger K. Newport, Chief Executive Officer.

About 70 percent of AK Steel production is directed toward the auto industry. An unusual rampup of automotive production lines in the second half and a bigger auto market share will result in higher shipment volumes for the remainder of the year, the company said. Historically, auto shipments generally decrease 10 percent in the second half of the year due to auto changeover and holidays.

Auto light vehicle production is softer than last year, but still strong at a forecast 16.8 million units. Overall steel demand is strong, service center inventories are balanced, and residential and nonresidential construction demand remains solid, said Newport. The USMCA trade agreement with Canada and Mexico bodes well for steel demand and manufacturing once it is approved, resulting in greater use of domestic and North American steel. Additionally, trade mechanisms in place will swiftly address any surge of imports into the U.S., he added.

AK Steel flat-rolled shipments in the second quarter totaled 1,391,000 tons at an average selling price of $1,102 per ton. Shipments for 2019 are expected to be in the range of 5.5 million to 5.6 million tons. Due to recent price increases, the average flat rolled selling price for the year will be roughly the same as 2018, the company said.

The electrical steel business has been good for AK Steel. “Certainly, it’s a very ultra-competitive market right now,” Newport said. “We’ve got a lot of imports pushing to come in. If they can’t bring it in directly, then they try to bring it in through either Canada or Mexico and import cores or cut up pieces they call laminations to get around the import tariffs.”

President and COO Kirk Reich added, “We’re continuing to work with the administration and the Department of Commerce to address the electrical steel, what I’ll call a loophole, where others are figuring out how to beat the intent of Section 232 and the trade actions that are out there. We believe there may be an opportunity when you look at what’s been set up for monitoring under the USMCA to address surges in circumvention.”

AK Steel’s Ashland Works will be closed by the end of the year and the transitioning of products from the coating line is on track, the company said. The Ashland blast furnace and hot end were idled in 2014.

AK’s Dearborn facility will have a major planned maintenance outage in October that will improve efficiency and operating costs. The blast furnace will be relined and equipment will be upgraded, resulting in savings of $10 per ton.

“Going forward, I don’t feel a need to be announcing billion dollar deals to remain confident, remain competitive or sound sexy. We don’t need to do that,” said Reich. AK Steel plans to spend smaller amounts strategically to upgrade for efficiency and cost savings and to further advance its high-strength steel development, he said.