Market Data

July 28, 2019

SMU Steel Buyers Sentiment Index: Price Hikes Giving Attitudes a Lift?

Written by Tim Triplett

Rising steel prices may be giving a lift to industry attitudes. Steel Market Update’s latest Steel Buyers Sentiment Index shows an eight point increase in Current Sentiment and an 11 point increase in Future Sentiment. While a single week’s results can’t reliably predict a new trend, the uptick is a notable change from sentiment data that has been generally declining for the past two years.

Domestic flat rolled producers have announced three price increases in the past month totaling $120 per ton. SMU data indicates the mills are collecting at least part of the increase. Nucor also increased plate prices late on Friday by $40 per ton. If they succeed in reversing the year-long downtrend in steel prices, industry sentiment may rebound, as well. Producers and distributors are hoping for relief from the margin squeeze caused by the 40 percent decline in steel prices since mid-2018.

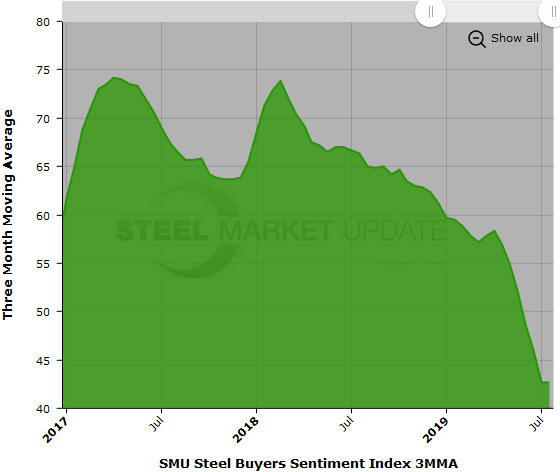

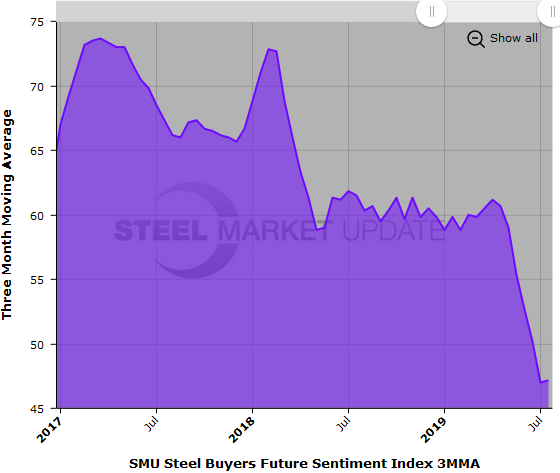

The goal of SMU’s Buyers Sentiment Index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

Current Sentiment measured as a single data point registered +49 in the latest data, up from +41 in early July. At this time last year, Current Sentiment registered +66. Current Sentiment peaked at +78 in January 2018.

Measured as a 3MMA, Current Sentiment averaged 42.67, unchanged from the last canvass. At this time last year, the 3MMA for Current Sentiment registered 66.33, much closer to its peak of 74.17 in April 2017.

Future Sentiment

Respondents were asked to assess their chances for success in three to six months. Measured as a single data point, Future Sentiment registered +57, up from +46 two weeks ago. Future Sentiment peaked at +77 in February 2017.

Measured as a 3MMA, the Future Sentiment Index averaged 47.17, up just slightly from SMU’s last data set. Future 3MMA peaked at 73.67 in March 2017.

Note that any figure above zero falls on the optimistic half of SMU’s scale. Therefore, industry sentiment remains fairly positive on a historical basis.

What Our Respondents Had to Say

“Demand is remaining steady.” Service center

“Demand is the only question as it will determine if this market sustains or continues to slide, particularly with all the new capacity coming on stream over the next few years.” Service center

“I see our business becoming very challenged. Trade changes are creating a very difficult situation for competitive imports. Uncertainty and low domestic prices compared to imports are making imports very risky.” Trading company

“I have a real concern for business volumes in the 2H19. It’s feeling soft now, and more and more people are saying the same thing.” Manufacturer

“Until U.S. prices continue to improve and trade uncertainty is settled, we will have a difficult time with our import segments, while our domestic business might do better.” Trading company

“We see nothing to get excited about, just more of the same.” Service center

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 41 percent were manufacturers and 45 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.