Overseas

July 25, 2019

CRU: U.S. Sheet Prices Continue to Rise as Mills Again Ask for More

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

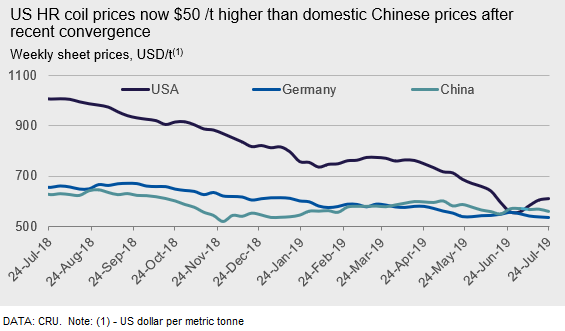

U.S. sheet prices continue to be supported by new mill price announcements as HR coil gained $5 /s.ton, rising to $553 /s.ton. This price assessment reflects transactions taking place last week. On Monday of this week, ArcelorMittal led the third round of increases since late June, signaling $630 /s.ton and $800 /s.ton for HR and CR coil prices, respectively. Other mills have again opted for a $40 /s.ton price increase. These higher asking prices came after HR coil rose by a total of $48 /s.ton over the past three weeks. We expect our transaction-based price assessment will continue to rise, yet $630 /s.ton looks quite rich to us based on current demand, inventory levels, rate of incoming orders at service centers, as well as the availability of prompt supply from North American producers. Furthermore, and possibly most important, contract buyers will use their discounted monthly price to go after business.

On the West Coast, California Steel Industries and USS-POSCO Industries followed the Midwest mills by announcing $40 /s.ton price increases on Tuesday. This came after CSI closed its order book for all items, except for HR coil and P&O, and UPI closed its order book for September. Buyers said they did not know yet what their new offer prices would be following the price increases.

Europe

Sheet prices are all down w/w in Europe this week other than German HR coil prices, which are unchanged at €478/t. Market activity is in a seasonally low period for summer but that isn’t stopping prices from falling. During July so far HR coil prices have lost €10/t in Germany and €12/t in Italy.

China

Chinese sheet prices were mixed over the past week. While downstream sheet products, such as CR coil and HDG sheet, remained steady w/w, the HR coil price went down by RMB60 /t. This was mainly due to bearish sentiment brought by the recent news regarding Vale’s partial return of its dry processing operations at the Vargem Grande complex. Although only 5 Mt/y of additional supply is said to be resumed in 2019, iron ore futures dipped by 2.7 percent on Wednesday and thus dragged down HR coil futures by 1.5 percent on the same day. Nevertheless, domestic fundamentals remained sluggish. While the demand side hardly saw any improvement, sheet inventories continued to increase by 1.4 percent w/w. But sheet producers are trying to maintain prices by managing production levels given deteriorating margins, so we would expect limited price decline for sheet prices in the short term, despite fluctuation in HR coil, which will keep reflecting unstable sentiment.

Asia

The imported price for HR coil in Asia increased during the week as most sellers lifted their offers after Formosa Ha Tinh announced their price. According to market sources, the mill lifted their prices by $25 /t from the previous month, i.e. rerolling HR coil for September shipment was offered at $536 /t CFR Vietnam and commercial grade HR coil is offered at $526 /t CFR Vietnam.

For SAE1006 grade, the most competitive offers were at $517-520 /t CFR Vietnam from Indian mills while Chinese and Brazilian mills were looking at $520-525 /t CFR Vietnam. Buying indication was around $515 /t CFR Vietnam, but a trader suggested buyers might soon increase their bid, especially for September shipment.

For SS400, offers for Chinese-origin materials were at $520-530 /t CFR Vietnam, however buying interest remained almost mute.

CRU assessed HR coil prices at $517 /t, CFR Far East Asia, $4 /t up w/w. CR coil prices were assessed at $550 /t CFR Far East Asia, unchanged w/w, while HDG prices were assessed at $595 /t CFR Far East Asia, also flat w/w.