Market Segment

July 25, 2019

Reliance Optimistic About Demand

Written by Sandy Williams

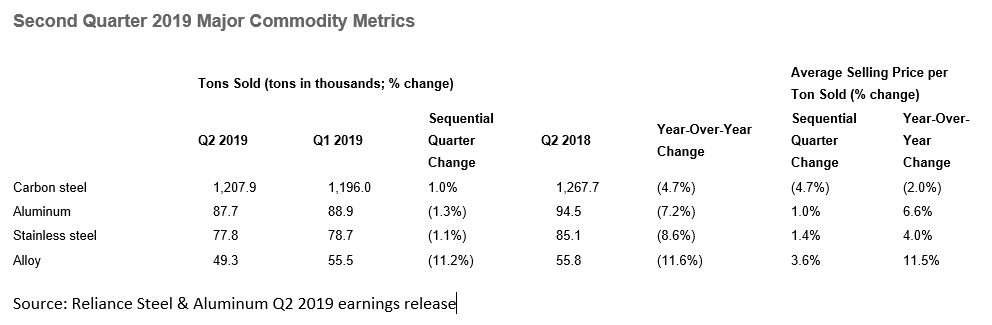

Reliance Steel & Aluminum reported net sales of $2.8 billion for the second quarter of 2019, a decrease of 2.5 percent from the first quarter. Net income totaled $183.1 million, down from $190.1 million in the prior quarter, while shipments totaled 1.5 million tons, up slightly (0.4 percent) from Q1.

“We had a solid second quarter characterized by relatively steady demand conditions in most of the key end markets we serve,” said Jim Hoffman, president and CEO of Reliance.

Average selling price per ton sold fell 2.8 percent to $1,904 per ton and was lower than the company’s anticipated flat to 1 percent decline.

Three HRC price increases have been announced in the past month that Reliance says it supports even though flat-rolled is only 7 percent of its business.

“As soon as the prices are announced, we do our best to get those prices out, and when they’re going down, we like to see what’s going to happen,” said CEO Jim Hoffman.

Looking forward, Reliance expects that end demand in the third quarter will remain relatively steady, subject to normal seasonal patterns, which include a decline in shipping volume due to customer shutdowns and vacation schedules.

Tons sold are expected to decline 4-6 percent in the third quarter compared to the second quarter. Metals pricing is expected to remain consistent with current levels. “However, because metal prices, especially for carbon steel, declined throughout the second quarter of 2019,” said Reliance, “the company expects its average selling price per ton sold for the third quarter will be down 1.5 percent to 2.5 percent compared to the second quarter of 2019.”

“We want to be clear that we think end demand will continue at reasonable rates for us,” said CFO Karla Lewis. “There is no change in our outlook for that. The downward guide is our normal seasonality.”

Hoffman is encouraged by the recent fabricated steel trade case. The subsidization and transshipment of fabricated steels into the U.S. is cheating, he said. The next phases of the investigation will determine how much damage has been caused by the steel imports and what duties will be levied.

“There is enough information around for fabricators in the U.S. to determine it is just not worth it,” said Hoffman. “We have seen some business earmarked for [foreign steel] come back into the United States. You can’t fight a battle with one arm behind your back.”

On the energy sector, Hoffman said that well drilling is likely to decline but the tanks, pipelines and other products that go into OCTG still need a lot of metal. Although energy is not a huge part of Reliance’s business and is smaller than it used to be, “we still like it,” said Hoffman.