Prices

July 25, 2019

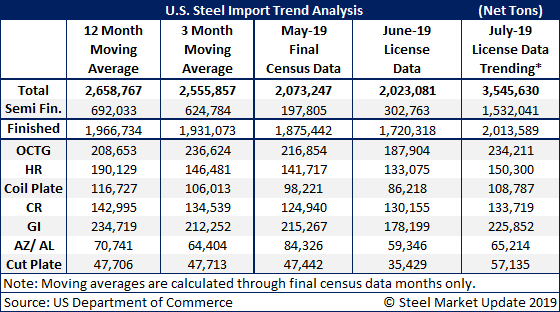

July Imports Will be Higher Due to Slabs

Written by John Packard

The U.S. Department of Commerce released foreign steel import preliminary Census data for June and license data for July. June imports totaled 2,023,081 net tons with 1,720,318 of those tons being finished steels (as opposed to semi-finished, which is slabs/billets). The July license data has total finished imports trending toward a 2 million net ton month. Total imports for July are trending toward a 3.5 million net ton month due to the 1.5 million tons of projected slab imports.

As mentioned in previous reports, slab imports are quite high due to the quarterly and annual quotas on Brazil. There are already 1,332,734 net tons of Brazilian slab licenses requested for July. This means there will be little to no slabs coming in from Brazil in August or September and the quota remaining for the balance of the year will be minimal. So, we should see greatly reduced imports of slabs through the balance of the year (review May and June), unless we see an uptick in Canadian and Mexican slab exports.

We aren’t seeing any uptick in flat rolled imports and our expectation is for lower flat rolled through the balance of the year, as well.

Lower slab imports and finished steel imports will help support domestic pricing.