Prices

July 25, 2019

Hot Rolled Futures: Sentiment Shift!

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

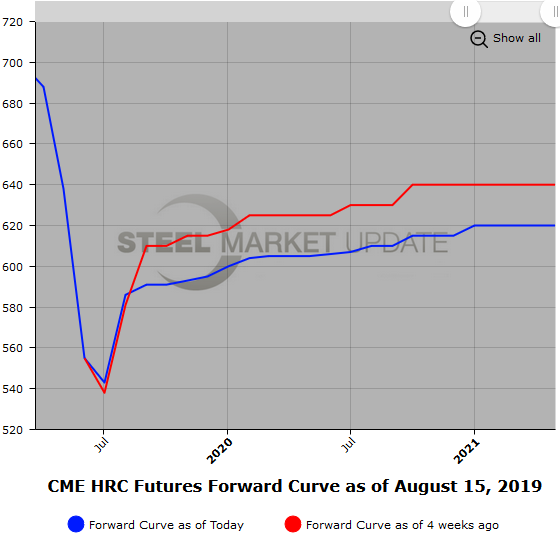

Lighter volume summer market conditions prevail in the HR futures market. After six consecutive price increases, in the HR index that the CME uses to settle HR futures, the market got a surprise drop, which has led to a market sentiment shift. Participants continue to struggle with forecasting as uncertainty in the global trade markets and the financial markets remains very opaque. There’s concern that recent HR price volatility will restrict some business going into the final leg of the year as recent sharp moves in HR prices restrict business operations.

August opened with nearby month bid interest in HR futures, which gave sellers some liquidity. That has now shifted as plentiful offers have provided buyers an opportunity.

As of last night, the HR futures curve had shifted lower by an average of $15/ST for the first 12 months since Aug. 1. The nearby futures months prices have declined about $20/ST and the last six months have declined by about $10/ST. The Q4’19 HR vs. Q1’20 HR calendar spread has widened from roughly a $2.5/ST contango to about $8.5, and the Q1’20 HR vs Q2’20 HR calendar spread has widened by about $6/ST as the near end dips have been more pronounced.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

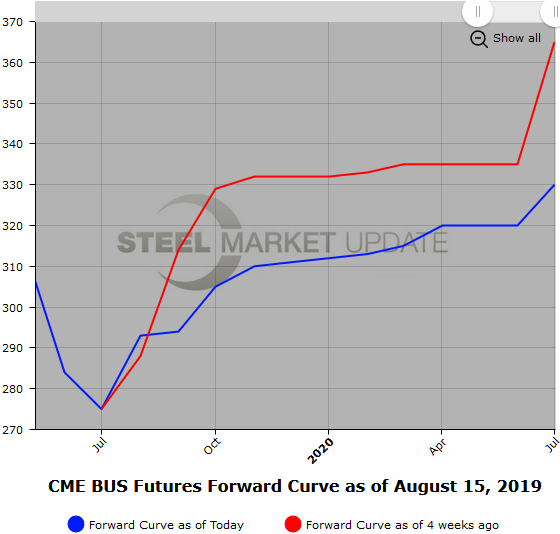

Scrap

The BUS futures have also been trading in lighter volumes in August with the prices along the curve declining about $15/GT since the beginning of the month. This is in sharp contrast to the move in spot, which was up over $20/GT for August ($297.25). The Sep’19 BUS future traded early this week at $305/GT and is offered at $305/GT, on the follow, still a slight premium to the August settle. We are seeing some narrowing of the price between the near date forwards and the mid to farther out months. However, volumes have been light, so these levels need to be tested with some larger trades.

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

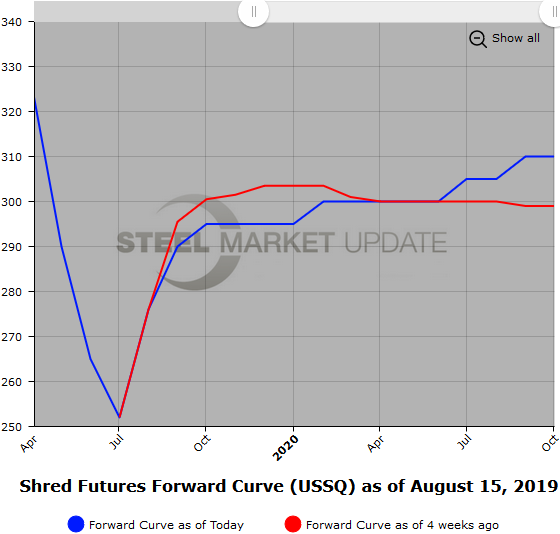

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.