Prices

July 25, 2019

Hot Rolled Futures: Price Increases at Play?

Written by Jack Marshall

The following article on the hot rolled coil (HRC) steel and financial futures markets was written by Jack Marshall of Crunch Risk LLC. Here is how Jack saw trading over the past week:

Steel

Latest HR indexes have physical trading higher at around $555/ST to $560/ST, which appears to reflect the first of the three mill minimum price announcements for the month of July. Meanwhile, the HR forward curve prices have shifted higher for spot month plus one through the end of the Q1’20. However, forward prices beyond that are little changed from July 1. On average, Aug’19 through Dec’19 HR forward prices are only up about $20/ST with the biggest increase in the nearby months. The Q1’20 HR prices are up about $12/ST from the beginning of the month.

The mill price increase announcement initially pushed forward prices higher, but they have been sold back off on concerns that capacity still outstrips demand. The sense has been that the capacity reductions might take a bit longer to impact the market prices, especially after sizable HR spot purchases at the beginning of the month, which were driven by a bottoming price market. There is some concern that the large sales this month will impact demand for future sales.

Below is a graph showing the history of the CME Group hot rolled futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here. If you need assistance with either logging in or navigating the website, please contact us at info@SteelMarketUpdate.com.

Scrap

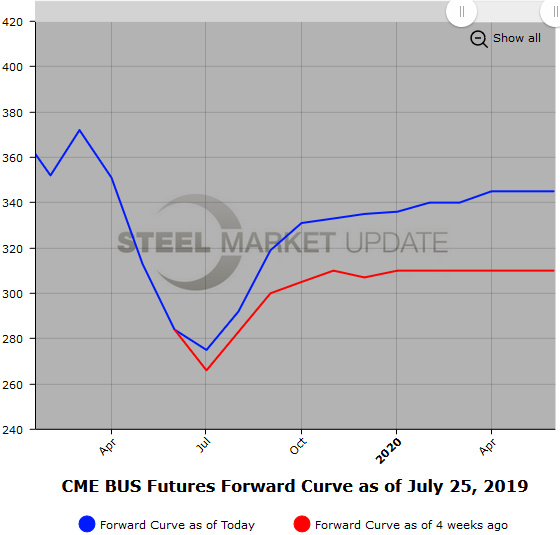

Early discussions on Aug’19 BUS have the price rising about $20/ST putting it in the mid $290s/GT. BUS Futures activity has been light so far this month. Since the beginning of July, BUS futures from Oct’19 through Jun’20 BUS have risen about $30/GT in light trading. With the front month basically at $285/295 per GT and the 1H’20 offered at $345/GT the market has a bit of contango reflected. However, some talk that demand might not be a robust as prices would indicate has kept participants on the sidelines. Lots of scheduled maintenance and summer furloughs could be cited for some of this view. The question is, with the reduced HR production forecast, how much of an impact will that have on demand?

Below is another graph showing the history of the CME Group busheling scrap futures forward curve. You will need to view the graph on our website to use its interactive features; you can do so by clicking here.

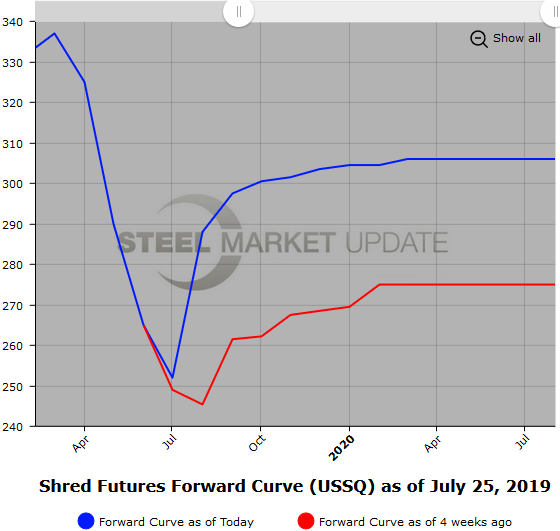

We have started tracking USSQ shredded scrap futures, shown below. Once we have built a sizable database, we will add this data to our website.