Market Segment

July 23, 2019

CRU: Why China is Using Less Scrap in its Blast Furnaces

Written by Tim Triplett

By CRU Analyst Jordan Permain

Ironmakers are continuously seeking ways to increase production efficiency and reduce costs but, particularly when profitability is good, productivity is a focus area. To achieve this, ironmakers can increase their usage of metallics in the blast furnace (BF), and benefits include not only increased productivity but also a lower coke requirement, as the iron in metallics is already “reduced.” This article explores the fundamental impacts and limitations of charging metallics into the BF and why Chinese ironmakers have decreased the rate of scrap charging in the past year.

Higher Scrap Use Increases Productivity and Lowers Costs

The usage of scrap in integrated carbon steelmaking has traditionally been limited to that charged into the basic oxygen furnace (BOF) before the hot metal is added. Other than serving as a necessary coolant during steelmaking, the respective prices of hot metal and scrap, the latter related to availability, largely determined how much scrap would be added. However, scrap and other metallics can also be charged directly into the BF along with other burden materials by loading scrap into the top of the BF via the same conveyors that are used to charge iron ore (n.b. as sinter, lump or pellet) and coke, and this can provide benefits for ironmakers as outlined below.

Higher BF Productivity: BF productivity increases when more scrap is used. Since scrap contains ~95 percent Fe that is already fully reduced, energy is only required for heating and melting purposes. This lowers coke consumption as the energy previously required from the coke for reduction of the iron ore is no longer required and energy is only required for melting. A productivity increase is achieved because less coke is required in the BF, which frees up space for more ore to be charged, and because lower slag rates can be achieved. Productivity gains from charging more scrap will be sought by steelmakers with latent BOF capacity during periods of high margins or when capacity is restricted for environmental reasons, as seen in China in recent years.

Impact on Ironmaking Costs: It may be that, from an operating cost perspective, costs are not lowered significantly as a lower ore and coke requirement is likely to be offset by the higher scrap costs. However, a higher productivity should allow fixed costs to be diluted across higher volumes. Where scrap charging into the BF is more routine (e.g. in the USA where scrap is plentiful, cost effective and correct qualities are available), this will allow upstream facilities to be downsized relative to total steel make and this will provide a cost saving as the on-going costs of maintaining the asset base should be lower.

Scrap Usage in the BF has Limitations and Disadvantages

Charging scrap into the BF is not without technical limitations and logistical and operational disadvantages. The most critical risk for ironmakers to consider is that the chemical and physical properties of scrap could disrupt the stability of the BF. Logistically, the storage of scrap would require additional space at the steel site and the scrap may damage the charge conveyor belts.

Scrap can be Charged at a Maximum Rate of ~10 Percent of the Fe Burden: A BF requires ~960 kg of Fe burden to produce 1 tonne of hot metal (i.e. 960 kg/thm) and, due to the respective Fe contents of sinter, lump and pellet, this typically requires a total of ~1.6 t of iron ore burden to be charged.

It is also of critical importance to operate BFs in a stable manner. For smooth operation, it is essential that temperature and gas flow in the BF remain constant. But charging scrap can have a cooling effect in the BF due to the lower usage of coke, and the physical manner in which scrap is charged into the BF is also important to ensure operational stability. That is, charging scrap in the center of the BF can reduce the gas permeability. Therefore, scrap is normally charged towards the wall of the BF to mitigate this effect.

Our research shows that scrap can be charged up to a maximum of ~10 percent of the Fe burden without disrupting operational stability, equivalent to ~100 kg/thm. At this level of scrap charging, the coke rate will decrease up to a maximum of ~10 percent, productivity will increase up to a maximum of ~13 percent and slag generation will fall up to a maximum of ~8 percent.

Chinese Ironmakers have Reduced Scrap Usage in BFs

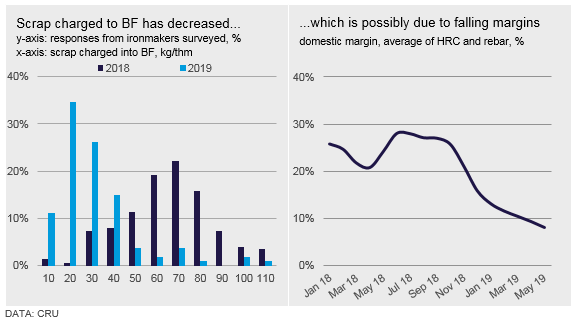

CRU has conducted significant primary research and understands that steel mills in China have decreased their usage of scrap in the BF in the past year. Our data from 2018 indicates an average scrap rate in the BF of ~68 kg/thm, but in 2019 this decreased to ~28 kg/thm.

Some ironmakers have reported that they were charging the maximum ~10 percent of the Fe burden as scrap, whereas others said that they did not use any scrap due to the adverse cooling effect in the BF. A scrap size of ~10 mm, which is a relatively small size, was said to be favored to prevent damage to conveyors, but scrap up to ~100 mm was manageable. We also found that ironmakers with smaller BFs (i.e. <1,000 m3 in size) were, on average, charging higher amounts of scrap than larger BFs, which likely related to more conservative operating practices in larger BFs.

Our analysis of the Chinese steel industry suggests that ironmakers may have decreased the amount of scrap charged into the BF due to lower margins. When we surveyed ironmakers in May 2018, average industry margins (n.b, the average of HRC and rebar) were ~28 percent, but this had decreased to ~8 percent in May 2019 when our most recent data was collected. In the months preceding May 2018, strict capacity restrictions were in place as part of WHS 2017/2018, which pushed up margins. To capitalize on this, Chinese ironmakers were incentivized to increase productivity at operating BFs by charging more scrap. Conversely, when restrictions were loosened in WHS 2018/2019, falling steel margins led mills to reduce overall scrap usage as the push for additional productivity was not required. One ironmaker remarked that they stopped charging scrap into the BF in early-2019 due to lower margins that arose as a result of oversupply and weak demand.

Scrap Charging in BFs is Beneficial But Depends on Technical and Economic Factors

From our research, we conclude that ironmakers can benefit from productivity gains from charging scrap into BFs, but technical limitations, logistical difficulties and economic conditions must be considered. In the past year, Chinese ironmakers have decreased the rate at which they are charging scrap in BFs due to falling margins.

More information on supply, demand, production costs, trade and price forecasts in global coke and scrap markets can be found in CRU’s Metallurgical Coke Market Outlook and Metallics Market Outlook.