Market Segment

July 16, 2019

NLMK Trading Update Shows Drop in Sales for U.S. Segment

Written by Sandy Williams

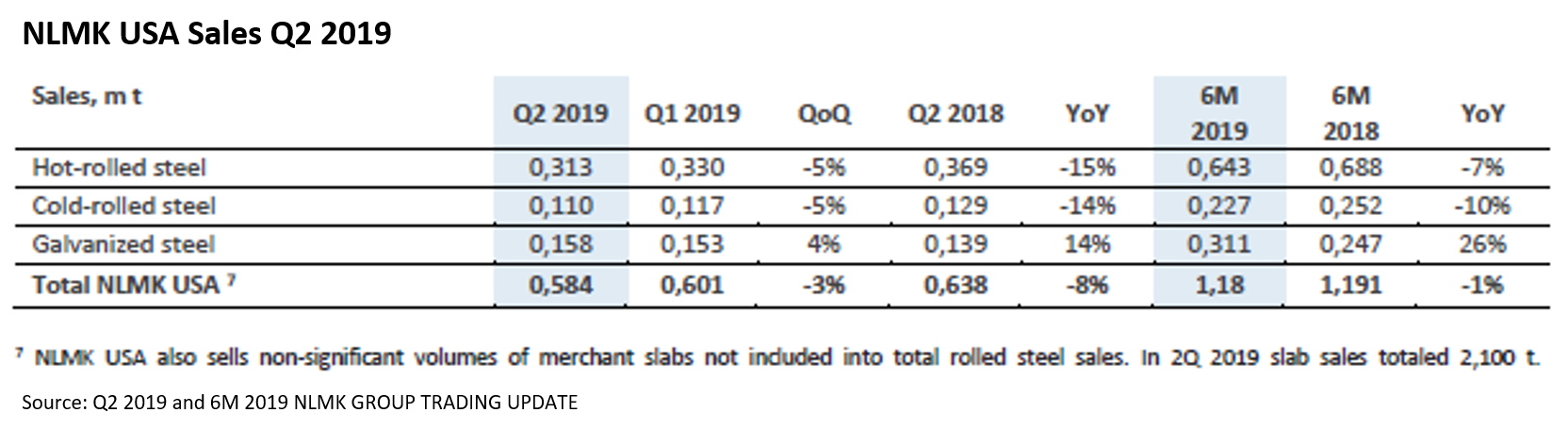

NLMK USA’s second-quarter sales dropped 3 percent from the previous quarter to 580,000 metric tons due to lower shipments in anticipation of further deterioration of steel prices. Flat steel prices in the U.S. went down by 6-11 percent from first to second quarter and 23-30 percent on a year-over-year basis. Pricing was impacted by steel oversupply and exacerbated by the lifting of Section 232 tariffs on steel products from Canada and Mexico, said NLMK.

NLMK noted a 10 percent quarter-over-quarter decline in U.S. scrap prices driven by lower rolled steel prices.

Group Results

Steel output for NLMK Group declined 5 percent in the second quarter due to a planned maintenance outage at the NLMK Lipetsk blast furnace and BOF operations. Overall sales were down 7 percent q/q due to reduced output and sales of commercial slabs and billets. Sales in Russia increased 11 percent due to seasonal demand for long and flat products. Export sales fell 40 percent q/q and 26 percent y/y due to lower slab shipments from Lipetsk.

Average coal prices were flat in the quarter while average iron ore prices grew 23 percent q/q due to uncertainty concerning Brazilian suppliers and higher Chinese demand. Scrap prices in Russia dropped 8 percent due to seasonal supply growth. Seasonal demand elevated steel prices for uncoated flat products 6.8 percent in the second quarter and rebar prices jumped 11 percent.