Market Data

July 14, 2019

SMU Steel Buyers Sentiment Index: Attitudes at a Tipping Point?

Written by Tim Triplett

Industry optimism, as measured by Steel Market Update’s Steel Buyers Sentiment Index, continues to waver in the face of uncertain demand in some sectors and steel prices that are at an important tipping point. The mills have announced price increases totaling $80 per ton in the past two weeks. If they succeed in reversing the year-long downtrend in steel prices, industry sentiment may well follow suit.

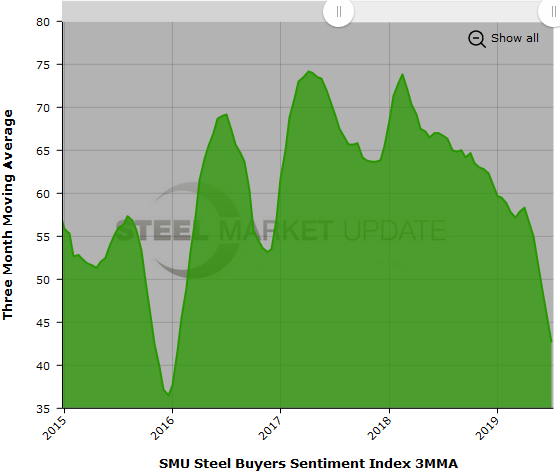

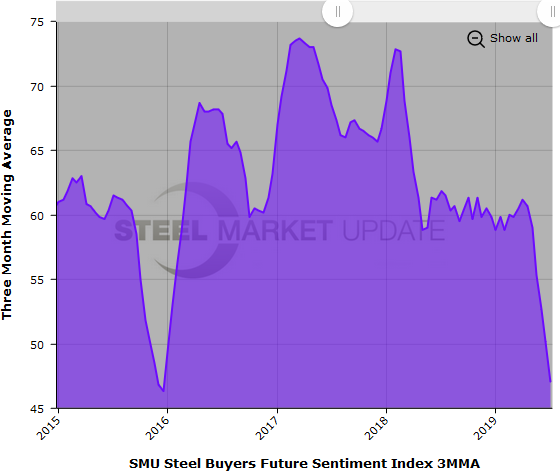

The goal of SMU’s index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

Current Sentiment measured as a single data point registered +41 in the latest data, down another point in the past two weeks. Current Sentiment has been on the decline since peaking at +78 in January 2018.

Measured as a 3MMA, Current Sentiment averaged 42.67, down from 46.00 two weeks ago. The last time the Current 3MMA was this low was January 2016. The 3MMA for Current Sentiment peaked at 74.17 in April 2017.

Future Sentiment

Respondents were asked to assess their chances for success in three to six months. Measured as a single data point, Future Sentiment registered +46, unchanged from mid-June. Future Sentiment peaked at +77 in February 2017.

Measured as a 3MMA, the Future Sentiment Index averaged 47.00, down 3 points from 50.17 in SMU’s last data set, and down nearly 15 points from this time last year. Future 3MMA peaked at 73.67 in March 2017.

Note that any figure above zero falls on the optimistic half of SMU’s scale. Therefore, industry sentiment remains positive on a historical basis, though much less so than last year.

What Our Respondents Had to Say

“Demand has been okay, but not great.”

“Demand is good, but margins are really being pressured by customer negotiations.”

“I’m just a little concerned with maintaining demand.”

“The push for price increases is not getting support.”

“Steel pricing is the factor with demand slowing. If both continue, then our ability to be successful will be difficult.”

“I don’t see the market situation changing in a direction to improve the risk of imports.”

“I see nothing in the near future to make me optimistic.”

“It’s so unpredictable 3-6 months out anymore that throwing a dart blindfolded seems more accurate these days.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 40 percent were manufacturers and 46 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.