Market Data

July 14, 2019

SMU Adjusts Price Momentum Indicator to Higher

Written by John Packard

Steel Market Update has moved our Price Momentum Indicator on flat rolled products from Neutral to Higher. We continue to reference plate Price Momentum at Lower. This move is being made after the domestic steel mills, led by Nucor, announced two rounds of $40 per ton price increases over the past two weeks.

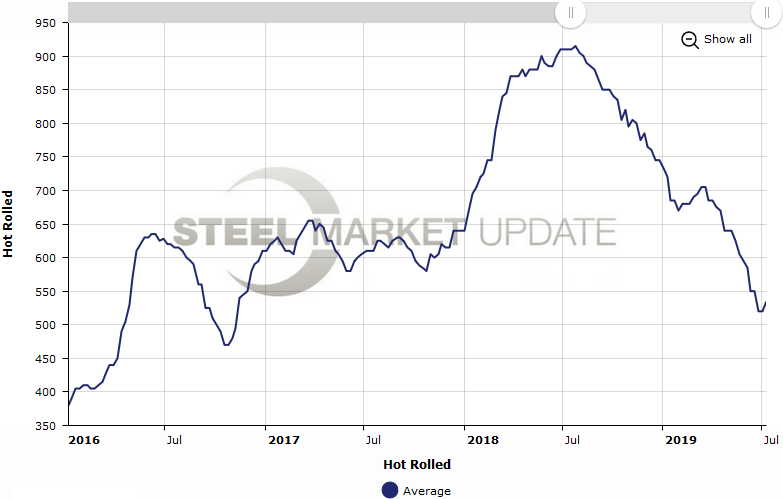

![]() SMU is making this change at this time as we are beginning to see our spot price index gradually moving higher. Benchmark hot rolled has increased $15 per ton since the first announcement was made. We have seen lead times starting to extend. Steel buyers are reporting mills, such as Steel Dynamics, reporting lead times one to three weeks longer than what they were quoting a few weeks ago. Mill salespeople are doing a better job of holding the line on pricing, especially on coated products.

SMU is making this change at this time as we are beginning to see our spot price index gradually moving higher. Benchmark hot rolled has increased $15 per ton since the first announcement was made. We have seen lead times starting to extend. Steel buyers are reporting mills, such as Steel Dynamics, reporting lead times one to three weeks longer than what they were quoting a few weeks ago. Mill salespeople are doing a better job of holding the line on pricing, especially on coated products.

There is a healthy amount of skepticism in the market, which some executives feel is a bullish sign for steel prices. If lead times stay extended and mills hold the line, steel buyers will have no choice but to book at the new numbers in the coming weeks and months. SMU feels upward pressure will also come from a lack of imported flat rolled as we move into the late third and fourth quarters of 2019.

Even at the new base prices being referenced by the domestic steel mills, their pricing is still lower than most foreign offers available right now. The $60 to $100 discount on foreign to domestic is not there, making the risk of buying foreign untenable for most steel buyers (exception for those located close to ports and away from domestic steel producers).

One year ago, benchmark hot rolled coil spot pricing peaked at $910 per ton. Since that time pricing has been in a freefall except for a small dead cat bounce earlier this year when the mills last announced increases. Hot rolled coil spot pricing bottomed (assuming this is not another dead cat bounce) at $520 per ton at the end of June/first week of July. The SMU HRC index is now referencing the hot rolled average as being $535 per ton.

Whether this round of increases will clearly “stick” or will become another dead cat bounce will depend on these factors:

- The mills’ ability to keep their order books full and their lead times extended from where they were a few weeks ago.

- The mills holding the line on pricing which, over time, will force service centers to raise spot prices to their customers as higher priced steel begins to flow into their warehouses.

- Service center support of the increases by not dumping cheap inventory in the markets at discounted pricing.

- Service center inventories are low enough that they have no choice but to rebuild at the higher pricing.

- Foreign steel imports decline in September through the end of the year.

- The mills do not increase supply.

- Demand remains steady or increases from here.

Steel Market Update will continue to monitor momentum and will advise of any changes we see coming on the horizon.