Market Data

July 12, 2019

Shipments and Supply of Steel Products Through May

Written by Peter Wright

Demand for long products is very strong, driven by the construction industry. Demand for sheet products is declining. This analysis by Steel Market Update is based on steel mill shipment data from the American Iron and Steel Institute (AISI) and imports/export data from the U.S. Department of Commerce (DoC).

The analysis summarizes total steel supply by product from 2003 through May 2019 and year-on-year changes. The supply data is a proxy for market demand, which does not take into consideration inventory changes in the supply chain. Our analysis compares domestic mill shipments with total supply to the market. It quantifies market direction by product and enables a side-by-side comparison of the degree to which imports have absorbed demand.

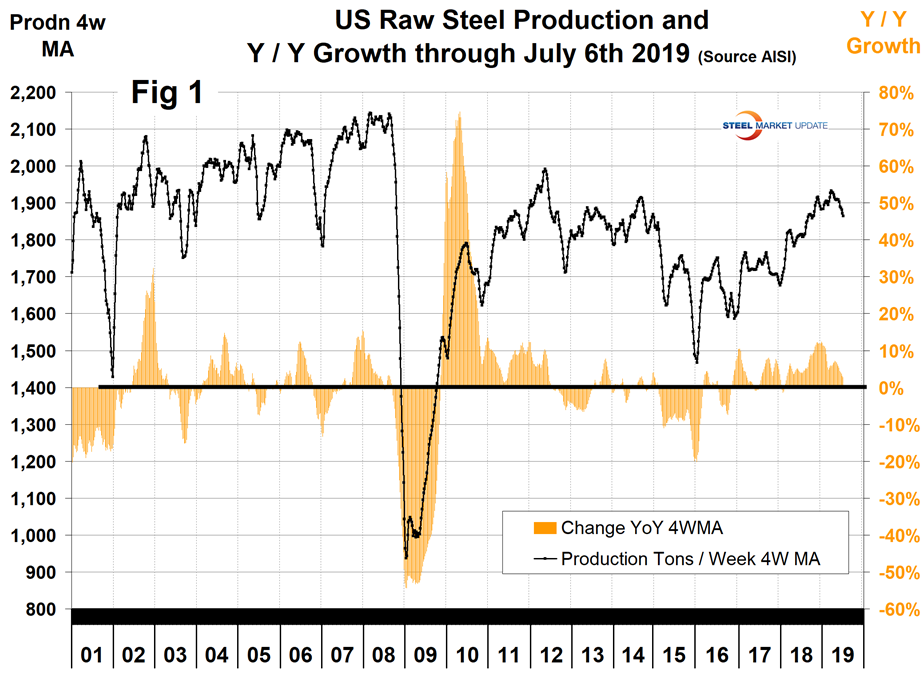

Figure 1 shows that the robust growth of U.S. raw steel production that occurred last year has slowed in 2019, but is still positive 2.7 percent year over year through July 6. This is a four-week moving average and is based on weekly data from the AISI.

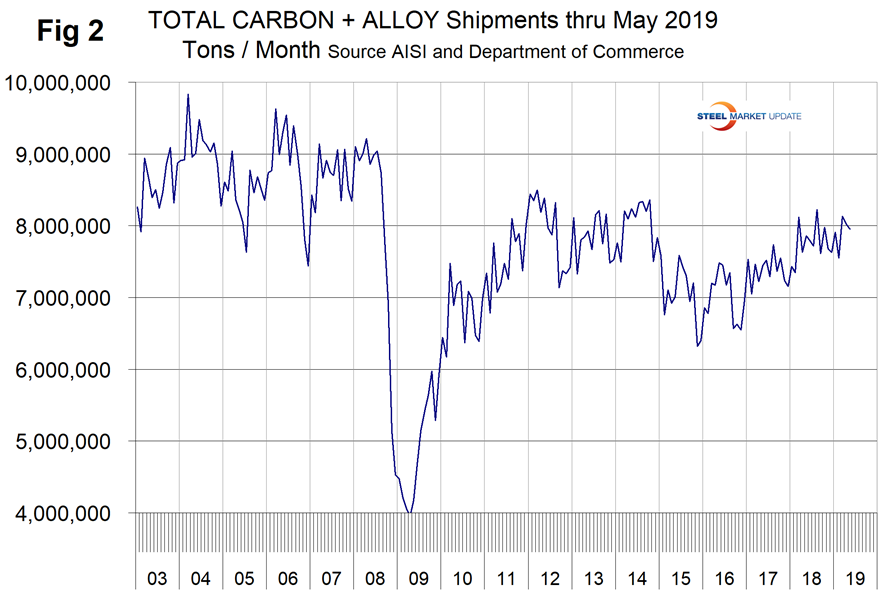

The shipments and supply report that you are reading now is based on monthly shipments by product as reported by the AISI plus import and export data from the Department of Commerce. Figure 2 shows the monthly shipment data for all rolled steel products. In the long run, the trajectories of growth in Figures 1 and 2 are basically the same.

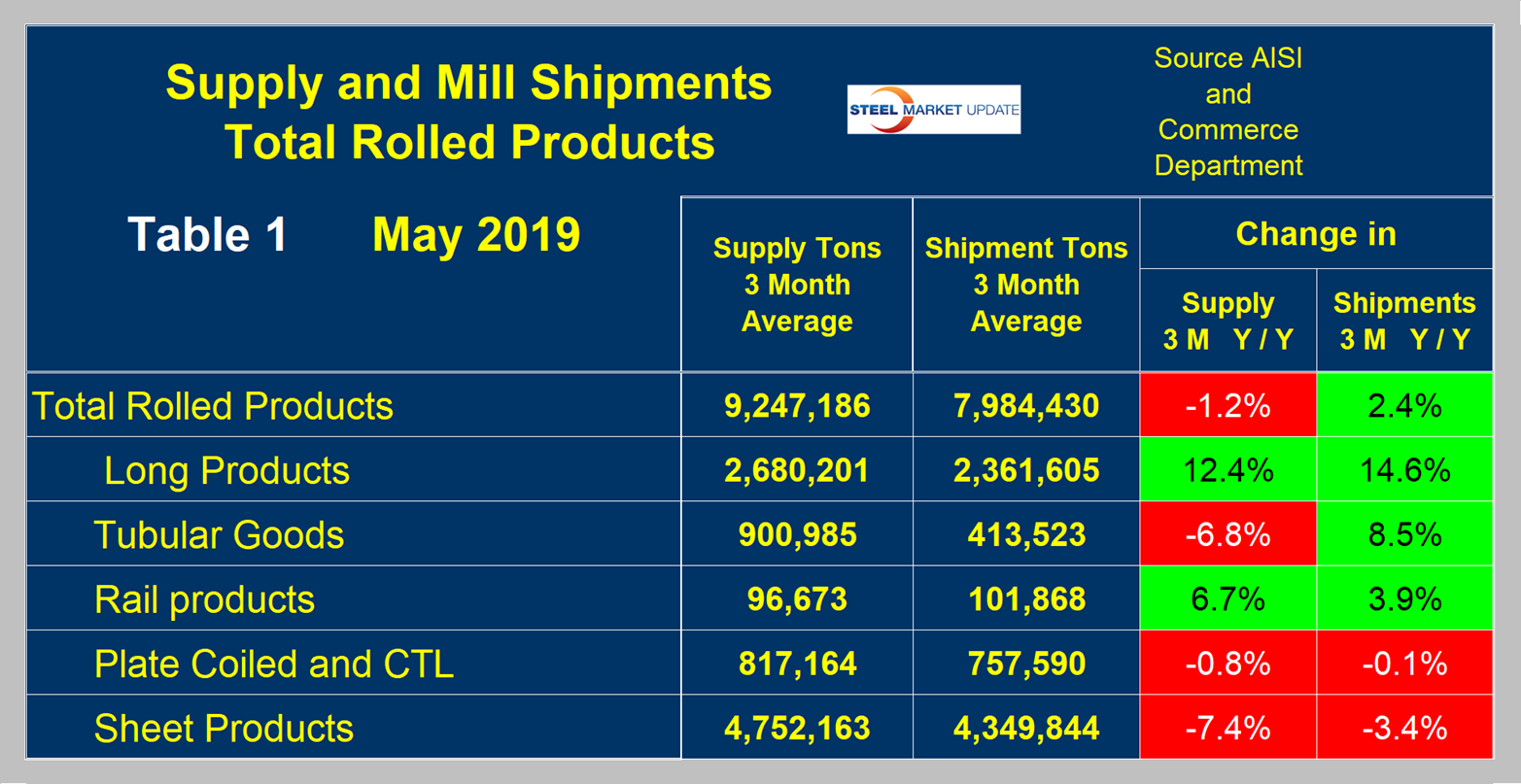

First, though, we will look at the shipment and supply situation for all product groups to see how much difference there is between them. Table 1 is this compilation. Total supply (proxy for market demand) as a three-month moving average (3MMA) was down by 1.2 percent year over year and mill shipments were up by 2.4 percent, meaning that imports took a smaller slice of the pie in the three months through May year over year. There is a big difference between products. Sheet products had a year-over-year decline in both shipments and supply. Long products had double-digit growth in both shipments and supply, and tubular goods was mixed with supply down and shipments up. The domestic plate market had a small decline in both supply and mill shipments.

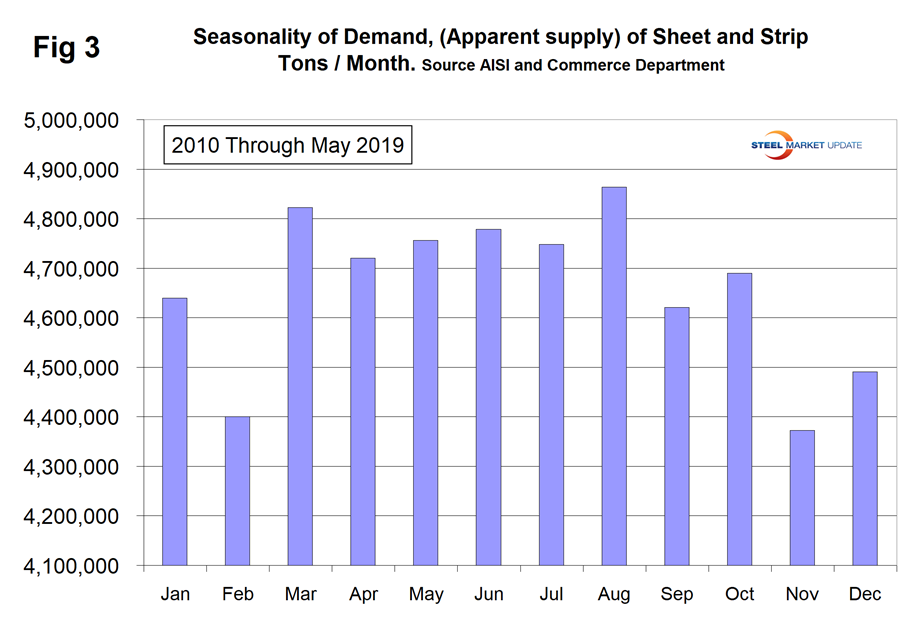

Now let’s look at sheet products in detail. One consideration is that demand in May on a 10-year historical average has been up by 0.8 percent from April. This year May was down by 2.7 percent, therefore weaker than normal. Figure 3 shows the seasonality that has existed since January 2010.

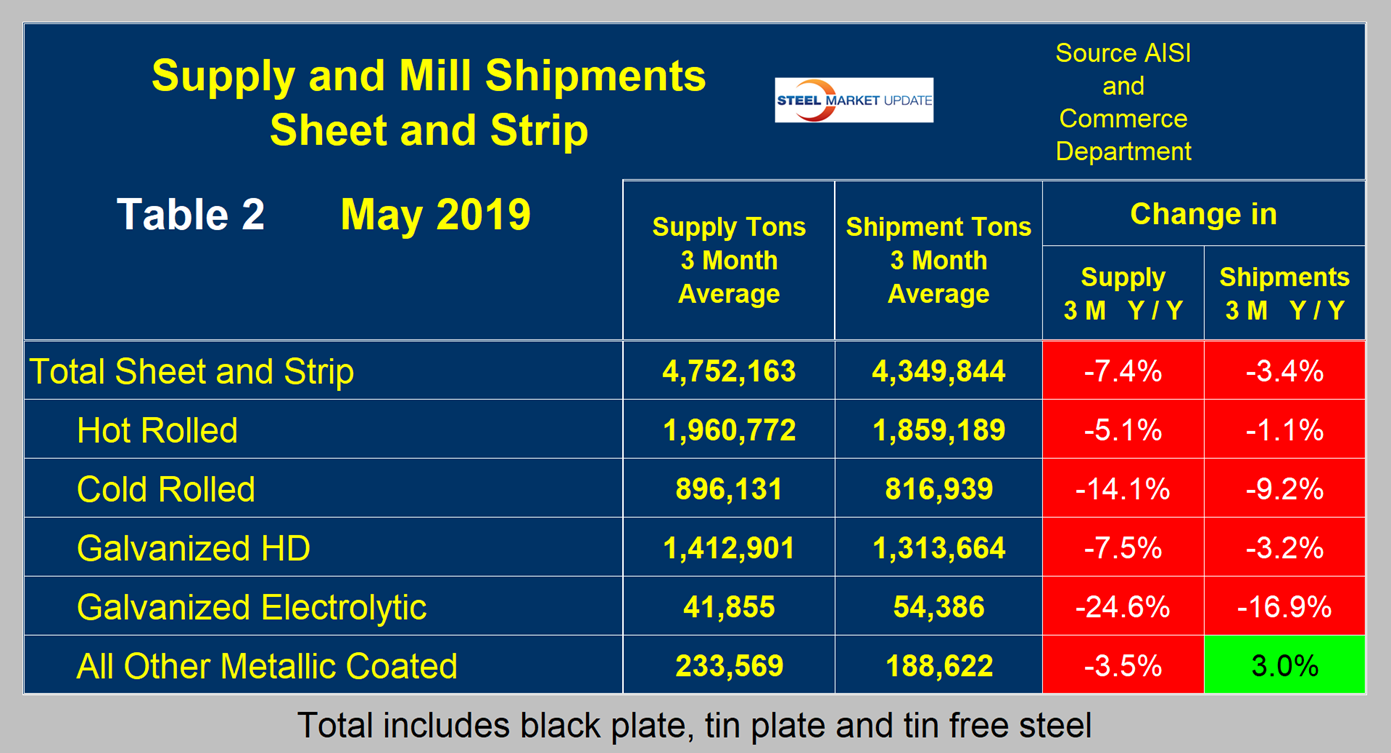

Table 2 describes both apparent supply and mill shipments of sheet products (shipments includes exports) side by side as three-month averages through May with year-over-year growth rates for each. Comparing the year-over-year time periods, total supply of sheet products to the market decreased by 7.4 percent and mill shipments decreased by 3.4 percent. Table 2 breaks down the total into product detail and shows that supply was down for all five sheet products considered in this report. Cold rolled and electrogalvanized were particularly week. Domestic mill shipments were down year over year for all products except other metallic coated, which is mainly Galvalume. Apparent supply is defined as domestic mill shipments to domestic locations plus imports. In the three months through May 2019, the average monthly supply of sheet and strip was 4.752 million tons. There is no seasonal manipulation of any of these numbers. By definition, year-over-year comparisons have seasonality removed. Table 2 shows the change in supply by product on this basis through May.

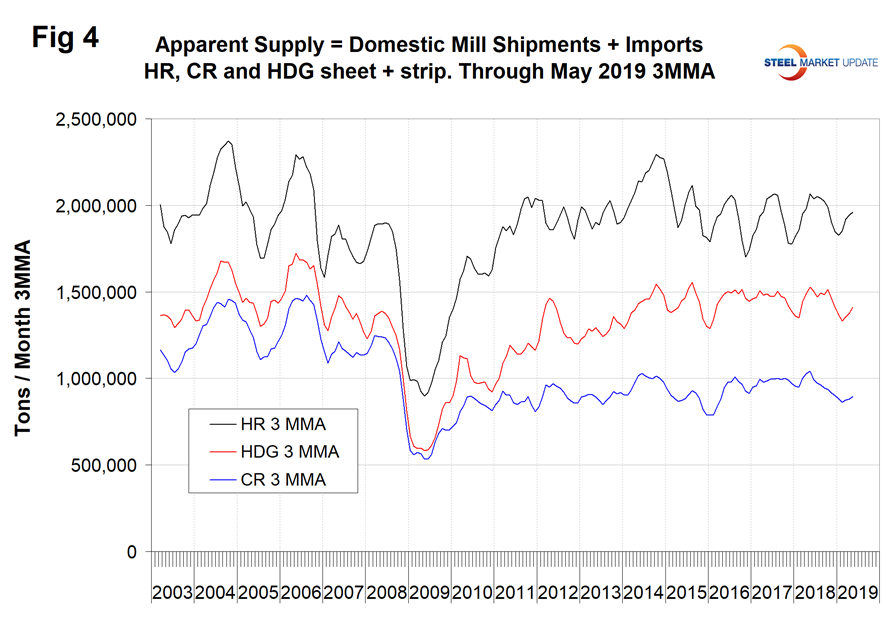

Figure 4 shows the long-term supply picture for the three major sheet and strip products, HRC, CRC and HDG, since January 2003 as three-month moving averages.

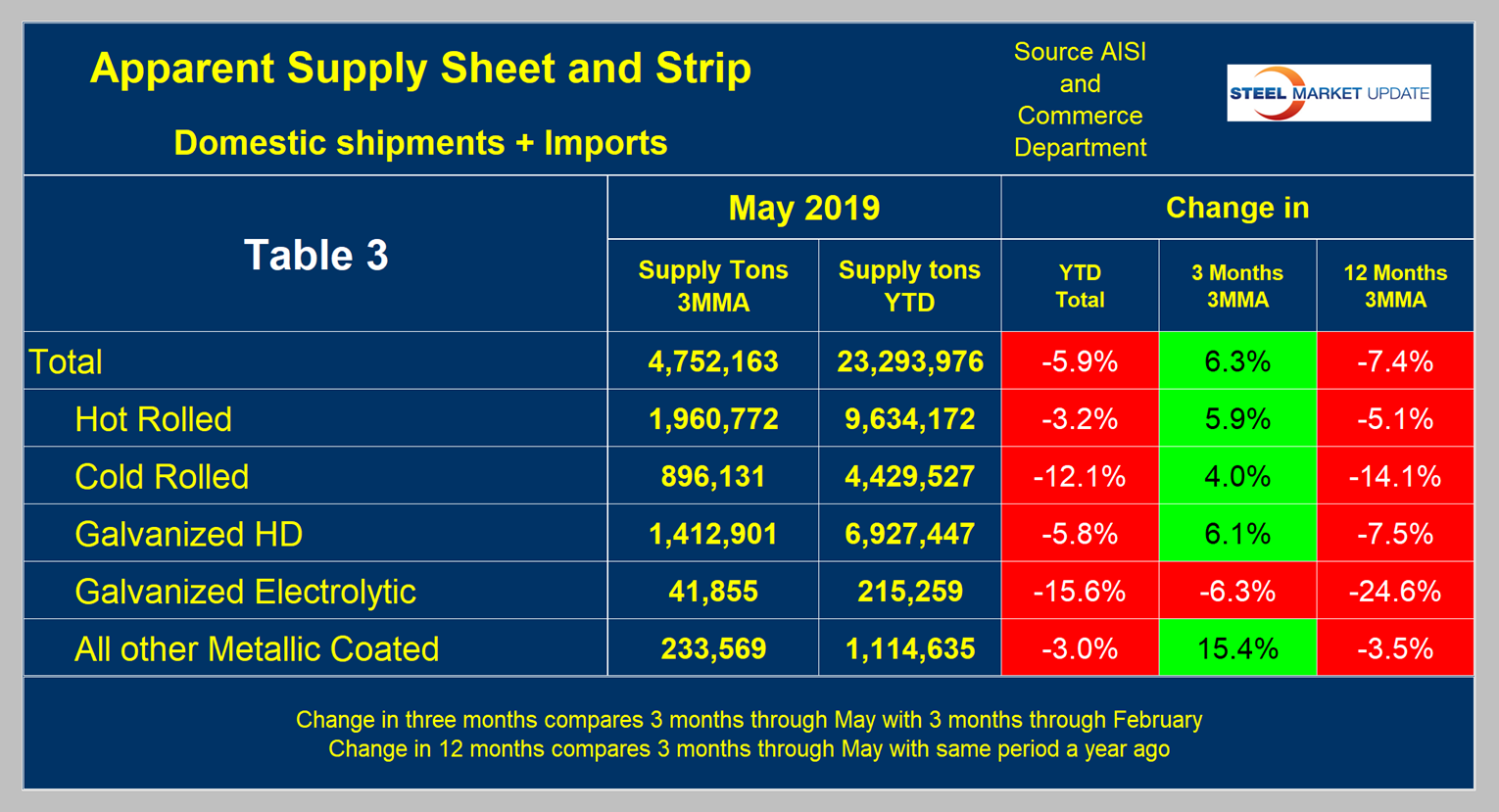

Table 3 shows that total supply of sheet and strip products including hot rolled, cold rolled and all coated products decreased by 5.9 percent year-to-date and increased by 6.3 percent comparing three months through May with three months through February. This latter increase is a seasonal effect as shown in Figure 3.

SMU Comment: There has been a reversal of fortunes in demand for long products and sheet products since the beginning of last year. Longs are experiencing very strong demand and mill shipments, driven by the booming construction industry. Sheet product demand is being adversely affected by the weakness of manufacturing industries. Since last November, the long product mills have had higher capacity utilization than the flat rolled mills for the first time since October 2012.