Prices

July 9, 2019

CRU: Iron Ore Prices Fall in Highly Volatile Market

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

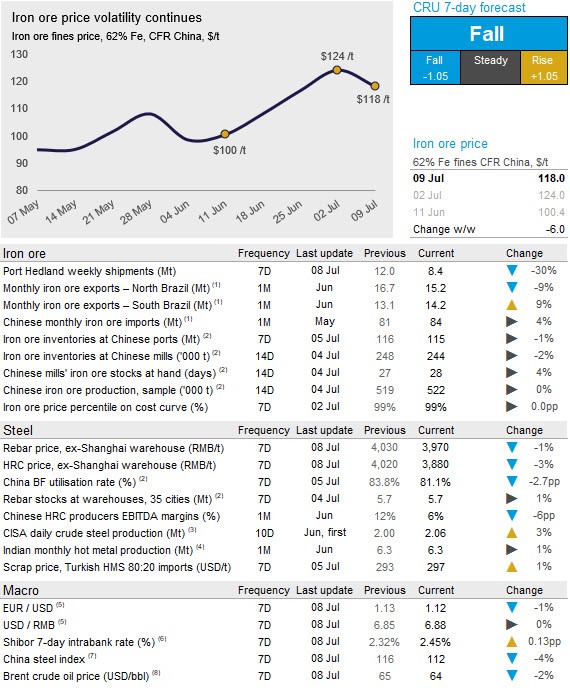

The high volatility in the iron ore market continues. After peaking on June 2, iron ore prices fell sharply at the end of last week before rebounding on Monday and Tuesday. On July 9, CRU has assessed the 62% Fe iron ore price at $118 /t, down $6.00 w/w.

As expected, seaborne supply has dropped in July as we are now entering the Australian maintenance period. Both BHP and FMG are in the first month of their financial year and are expected to carry out heavy maintenance after running their systems hard in June. Roy Hill will carry out its shiploader maintenance later on this month. Based on our shipment tracker, we are expecting Port Hedland’s June shipments to come in at a new all-time high. In Brazil, shipments were unchanged m/m, with continued recovery of supply from Minas Gerais.

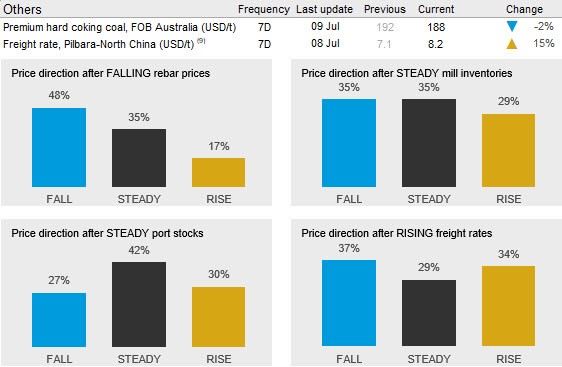

Stronger Brazilian shipments are seen as the main reason for the rising freight rates. After having collapsed following the Vale accident, freight rates have recovered and are currently trading at a new 2019 high.

In China, steel mills continue to struggle with profitability and CRU’s contacts have mentioned that we could soon see production cuts if margins do not improve in the next few months.

Current market indicators are mixed, but we see limited upside to prices and therefore expect continued price falls in the coming week.