Government/Policy

July 9, 2019

Commerce Issues CVDs on Fabricated Structural Steel from Mexico

Written by Sandy Williams

A new tariff on fabricated structural steel from Mexico adds another complication to U.S./Mexico relations, but is not expected to threaten ratification of the USMCA.

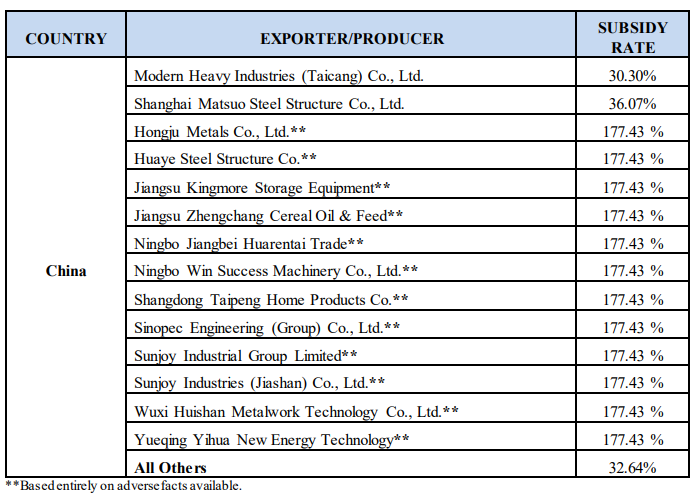

The U.S. Department of Commerce issued a preliminary ruling in a countervailing investigation that U.S. producers are being harmed by imports of fabricated structural steel from Mexico and China. Canada was also included in the investigation, but received a negative preliminary determination from Commerce.

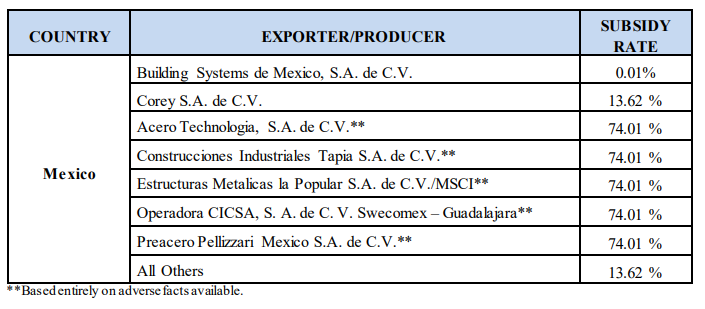

Commerce assigned preliminary subsidy rates to Mexican producers ranging from 0.01 to 74.01 percent. The investigation was prompted by a petition filed in February by the American Institute of Steel Construction.

Mexico’s deputy foreign minister Jesus Seade said on Tuesday that the CVD determination “does not put in danger the ratification of the North American trade deal USMCA.”

Seade noted that the U.S. subsides are against certain private companies in Mexico and not the “wider steel industry.”

“U.S. tariffs on Mexican structural steel is a ‘new problem’ and Mexico will have to be very active supporting its steelmakers,” he added.

The Section 232 tariffs on steel and aluminum products from Mexico were lifted in May clearing the way for USMCA ratification. Last month, Mexico narrowly escaped general tariffs of 25 percent on its exports to the U.S. after acceding to demands by the Trump administration to step up efforts to slow immigration across the U.S./Mexico border.

The final determinations by the Department of Commerce and the U.S. International Trade Commission in the CVD investigation are due Nov. 18, 2019, and Jan. 2, 2020, respectively. Issuance of orders, if the decisions are affirmative, will be Jan. 9, 2020. In the meantime, Customs and Border Protection will collect cash deposits from imports of fabricated structural steel from Mexico and China.