Market Segment

June 22, 2019

CMC Expansions Lead to Improved Results

Written by Sandy Williams

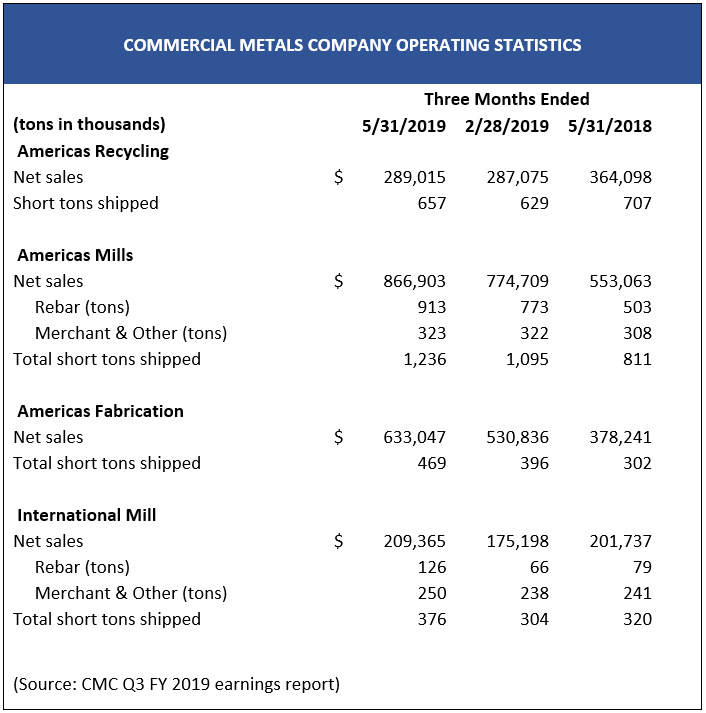

Expansion at Commercial Metals Corp. is paying off with a 33 percent increase in revenue to $1.6 billion in the third quarter of FY 2019. In November, CMC acquired Gerdau’s four rebar mills and 33 fabrication facilities in the U.S., increasing its U.S. mill capacity by 75 percent. Net earnings for CMC totaled $78.6 million.

Recent investments in CMC’s Poland facility have lowered costs and increased value-added capabilities, putting the segment “on pace to produce the second highest financial result in its history.”

A record number of projects for the company’s fabrication business in the third quarter is a good indicator of continued strength in the nonresidential market this year, said Smith.

“The strong results for the quarter reflect the strength of construction activity, as well as solid industrial production levels and the resilient U.S. and Polish economies,” said Smith. “Our recent acquisition, our greenfield Oklahoma facility, and introduction of hot spooled rebar were all meaningful contributors to top- and bottom-line financial results. In addition, the fundamentals of the fabrication segment have improved significantly as we have shipped the majority of the lower priced work in our backlog, which has resulted in a significant improvement in the segment results.”

Smith noted that weather had a big impact on construction in the first and second quarters and continued, to some extent, into the third quarter. CMC is expecting a strong shipping quarter in the fourth.

ArcelorMittal’s decision to idle its Poland assets is not expected to impact business in Europe for CMC, said Smith.

“I think overall that there is excess capacity in Europe and certainly Europe has seen an increase in import penetration,” she said. “So, it was probably a prudent move on their part. But as we reported in our results in Poland, we had a really strong shipping quarter and good backlogs, good economic growth in Poland. And so, other than normal vacation holidays that you tend to see in the month of August, we expect Poland to finish the year strong, as well.”

CMC is monitoring the reduction of tariff duties on steel imports from Turkey carefully, said Smith. “I would remind the callers that there is the 25 percent duty remaining in place as well as any existing CVD or anti-dumping duties. And I know in the case of Habas [Steel], that’s an additional 13 percent of duties on top of the 25 percent. So, we think that continues to be a good deterrent to the dumping we had seen previously and continues to create a more level playing field.”

Recent import offers are in line with U.S pricing, said Smith. “We’re not seeing a big influx of activity at this point in time.

“Our outlook for demand remains very positive driven by the continued strength in nonresidential construction activity levels in our markets,” said Smith. “Leveraging the growth in our business from the acquisition, combined with the continued favorable long steel margin environment and improvement in our fabrication segment, we anticipate a strong finish to our fiscal year. We also anticipate that our business will generate strong cash flows, creating the opportunity to reduce our indebtedness levels,” she added.