Market Data

June 20, 2019

Highlights from the CRU New York Steel Briefing

Written by Tim Triplett

By CRU Prices Analyst Estelle Tran

Hundreds of steel executives from around the world gathered in New York City this week to hold meetings and learn about what will drive the steel markets in the second half of the year. The CRU Steel Briefing on Monday, June 17, provided attendees with our views on sheet prices, trade scenarios, scrap flows and the prospects for an economic recession.

The buzz around the briefing was whether all the steelmaking capacity announced will come online given the recent slump in steel prices and longer-term expectations of compressed mill margins. Between now and 2023, the U.S. market could restart or install 18-20Mt of HR coil capacity, in addition to a slew of investments in long products. A potential result of this additional capacity could be more intraregional competition for scrap, particularly in the Great Lakes region, which will drive up scrap costs, according to CRU Analyst Ryan McKinley. As steel prices return to historical levels that are capped at global prices plus logistics costs to import into the U.S., the increased mill capacity and higher scrap costs will compress domestic mill margins.

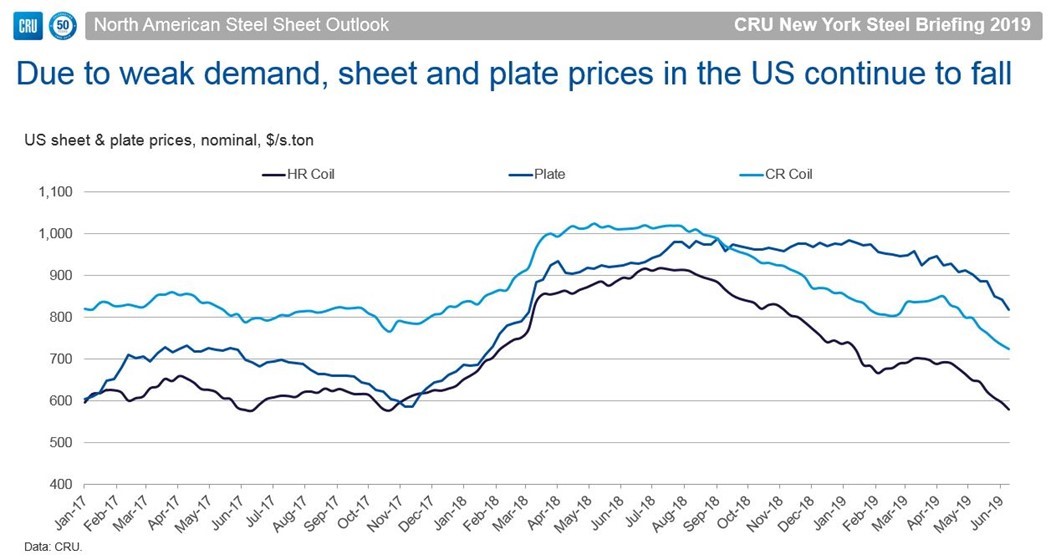

CRU Principal Analyst Josh Spoores gave his sheet market outlook, calling for the market to find a bottom possibly in July. Contract prices based on the CRU Midwest HRC index had already fallen below estimated integrated mills’ cost to produce, he said.

Service center inventories are fairly balanced at 2.5 months of supply for sheet and 2.8 months for plate, according to Steel Market Update inventory data. The data presented showed that inventories may still be high given the lower shipment levels. However, the number of shipping days of supply on order indicated there could be some moderate supply tightness at the end of summer.

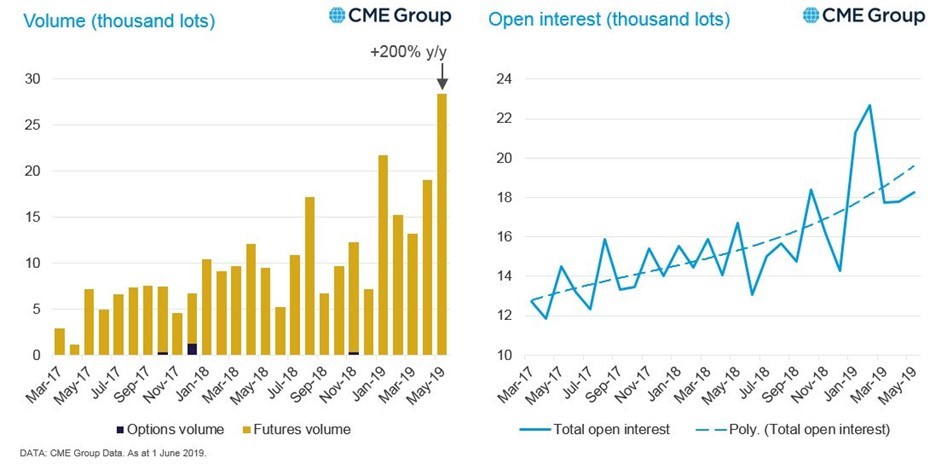

The rapid price declines seen in the first half of this year have pushed more market participants to use risk management tools. In May, open interest on the CME’s U.S. Midwest Domestic Hot-Rolled Coil Steel (CRU) Index futures and options contracts are up with Q1 open interest up 50 percent year on year and volumes traded in May reaching a record of 18,260 lots.

Chris Houlden, CRU Research Manager, Semi-finished and Finished Steel, also highlighted independent research, which found that CRU remains the preferred choice for physical contract settlement, with 88 percent of respondents preferring a transaction-only HR coil price to a daily price. In a survey of 181 market participants, 41 percent of participants said they use only CRU in physical contract settlement; 58 percent use CRU and another PRA and 2 percent said “other.”

Other speakers, including Lewis Leibowitz, trade attorney and owner of The Law Office of Lewis E. Leibowitz, and Steel Market Update President and CEO John Packard, debated whether there would be further adjustments to Section 232 tariffs, following the repeal of tariffs for Canada and Mexico, as well as the imposition of other trade-restricting measures against China and the EU.

CRU Principal Economist Lisa Morrison and Head of Consulting Lynn Lupori joined the Q&A panel to share views on the risk of a recession and likelihood of a major federal infrastructure spending bill. Morrison said people are questioning whether an interest rate cut is warranted given weaker inflation and a moderating U.S. economy. The trade war has put pressure on manufacturing and investments, whereas U.S. consumers see a strong jobs outlook, and services spending is also quite strong, Morrison said.

Near-term steel pricing forecasts do not factor in a possible recession, as CRU does not expect a recession in 2019. Economic data suggests another 9-12 months before a possible recession, so that would not be until mid-2020 at the earliest.