Plate

June 18, 2019

Steel Import Market Share for Sheet, Plate, Long Products

Written by Peter Wright

This report examines the import share of sheet, plate, long and tubular products and 16 subcategories.

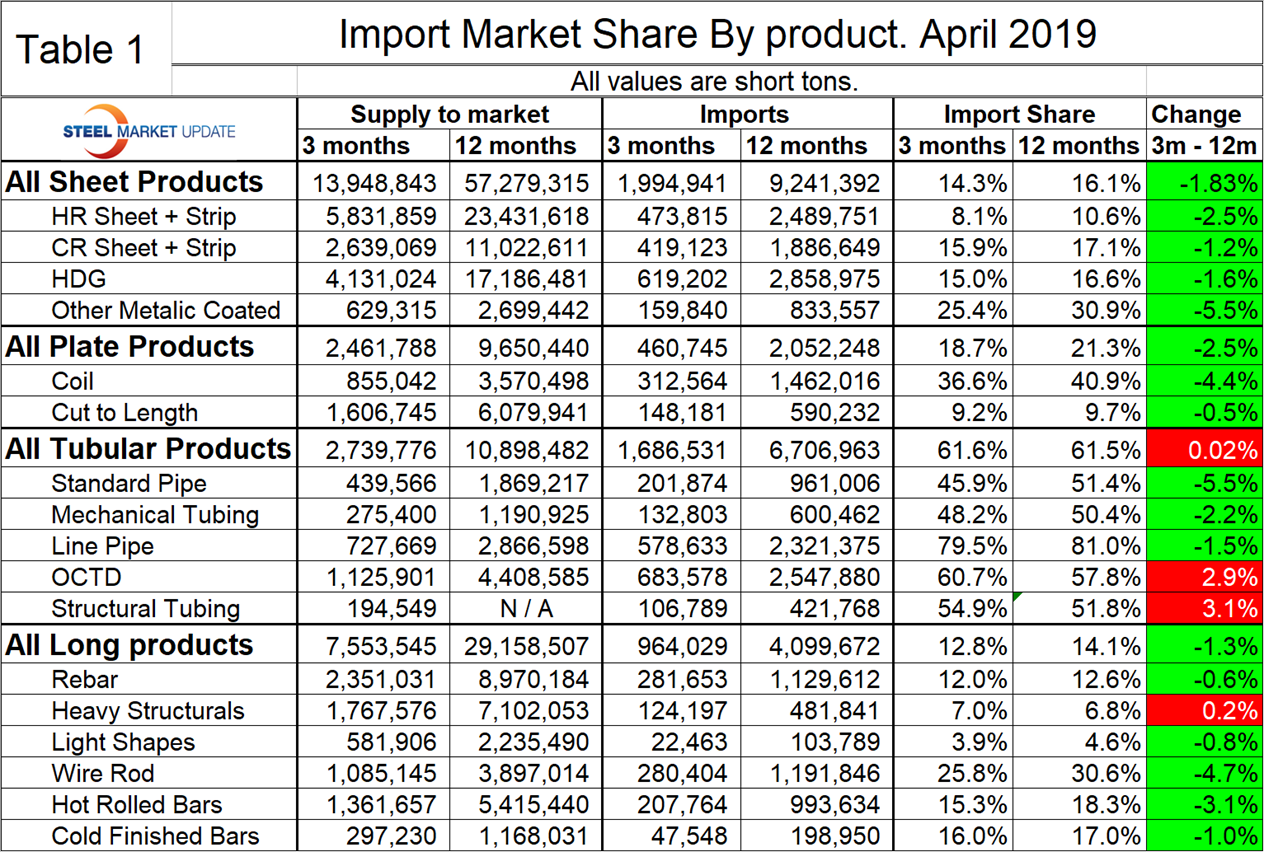

Table 1 shows total supply to the market in three months through April and in 12 months through April for the four product groups and the 16 subcategories. Supply to the market is the total of domestic mill shipments to domestic locations plus imports. It shows imports on the same three- and 12-month basis and then calculates import market share for the two time periods for 16 products. Finally, it subtracts the 12-month share from the three-month share and color codes the result green or red. If the result of the subtraction is positive, it means that import share is increasing and the code is red. The big picture is that import market share declined in three months compared to 12 months for total sheet, plate and long products and was almost unchanged for tubular products.

There is a huge difference in import market share between products with each of the tubular products and coiled plate being the worst cases.

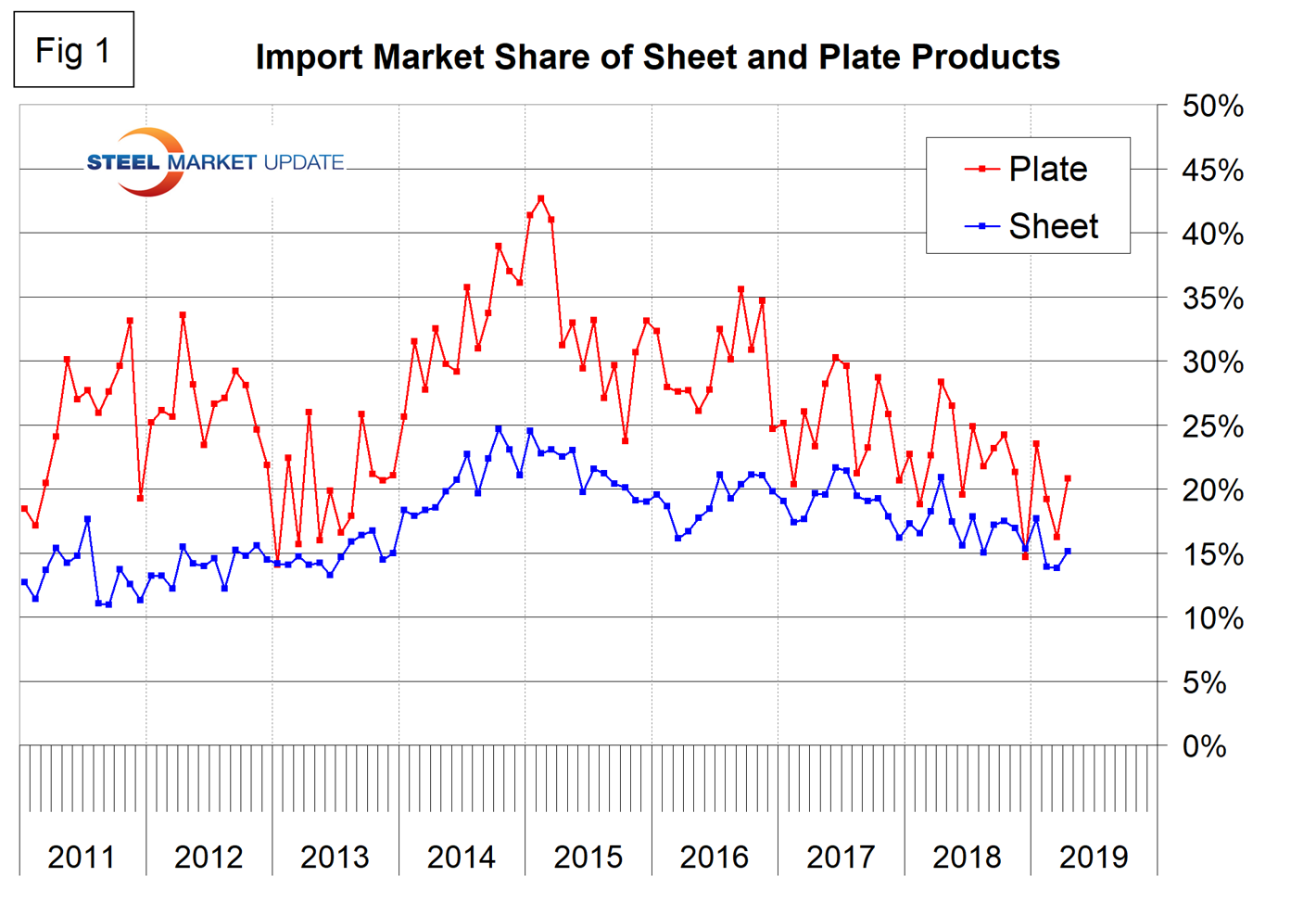

Figure 1 shows the historical import market share of plate and all sheet products. The import share of plate has been decreasing erratically for four years. There has been a downward drift of sheet product import share for the last two years.

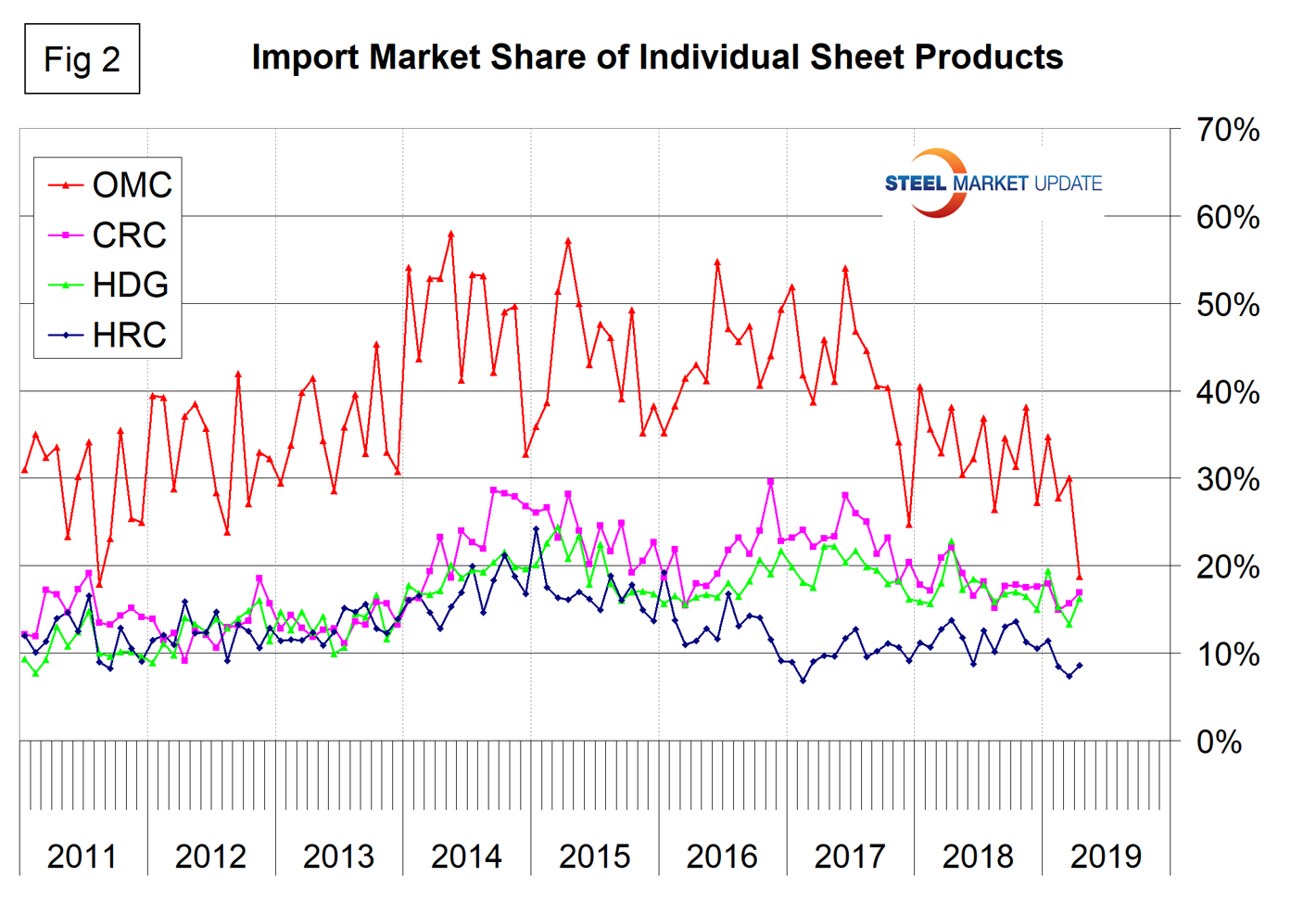

Figure 2 shows the import market share of the four major sheet products. Prior to April 2019, other metallic coated (mainly Galvalume) had by far the highest import market share. The April result, which may turn out to be an anomaly, brought OMC into line with the other sheet products. For the last three years, hot rolled coil has had the lowest import market share of the major sheet products.

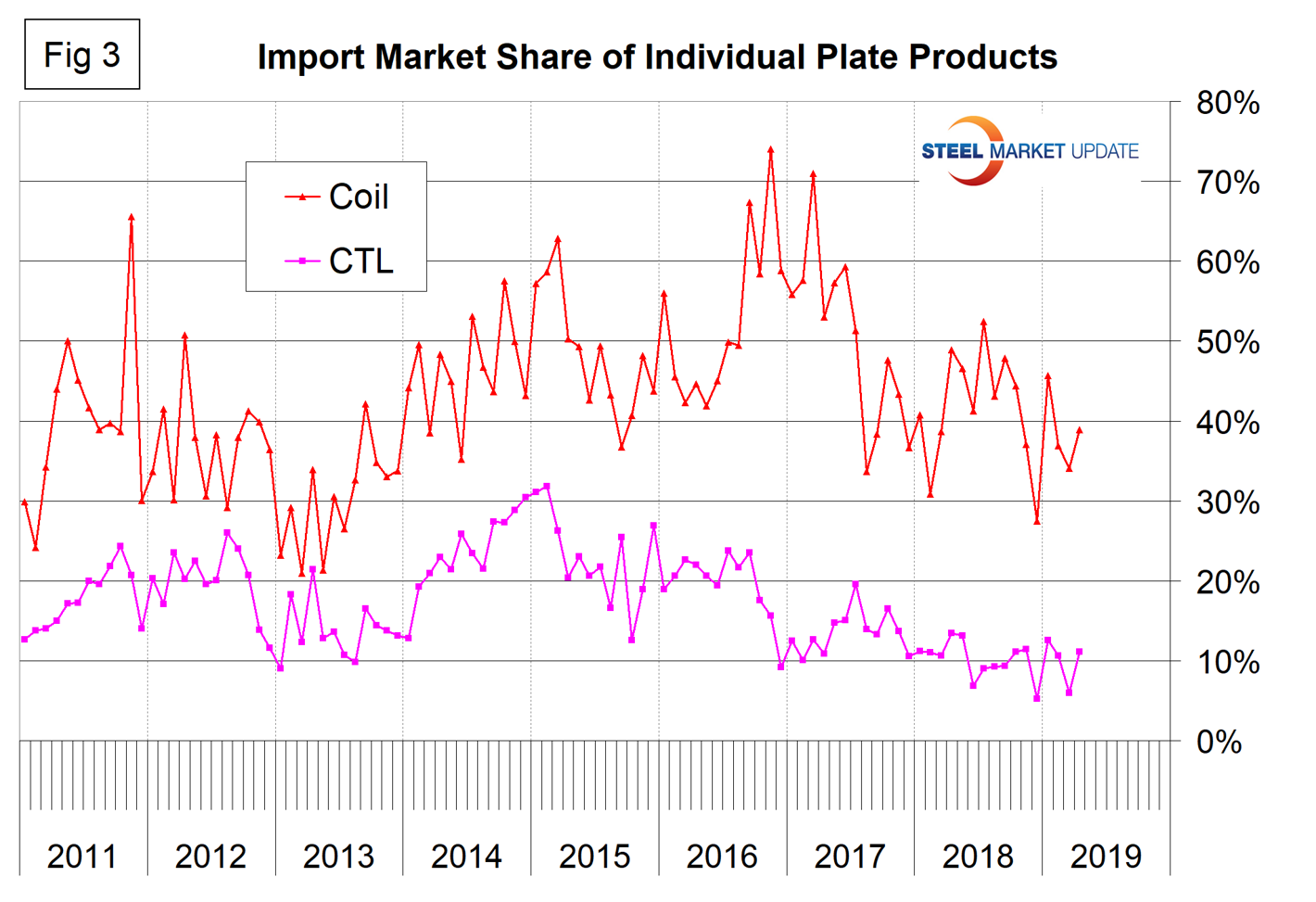

Figure 3 breaks out coiled and CTL plate from the flat rolled total and shows that coil imports currently have over four times the market share of CTL imports.

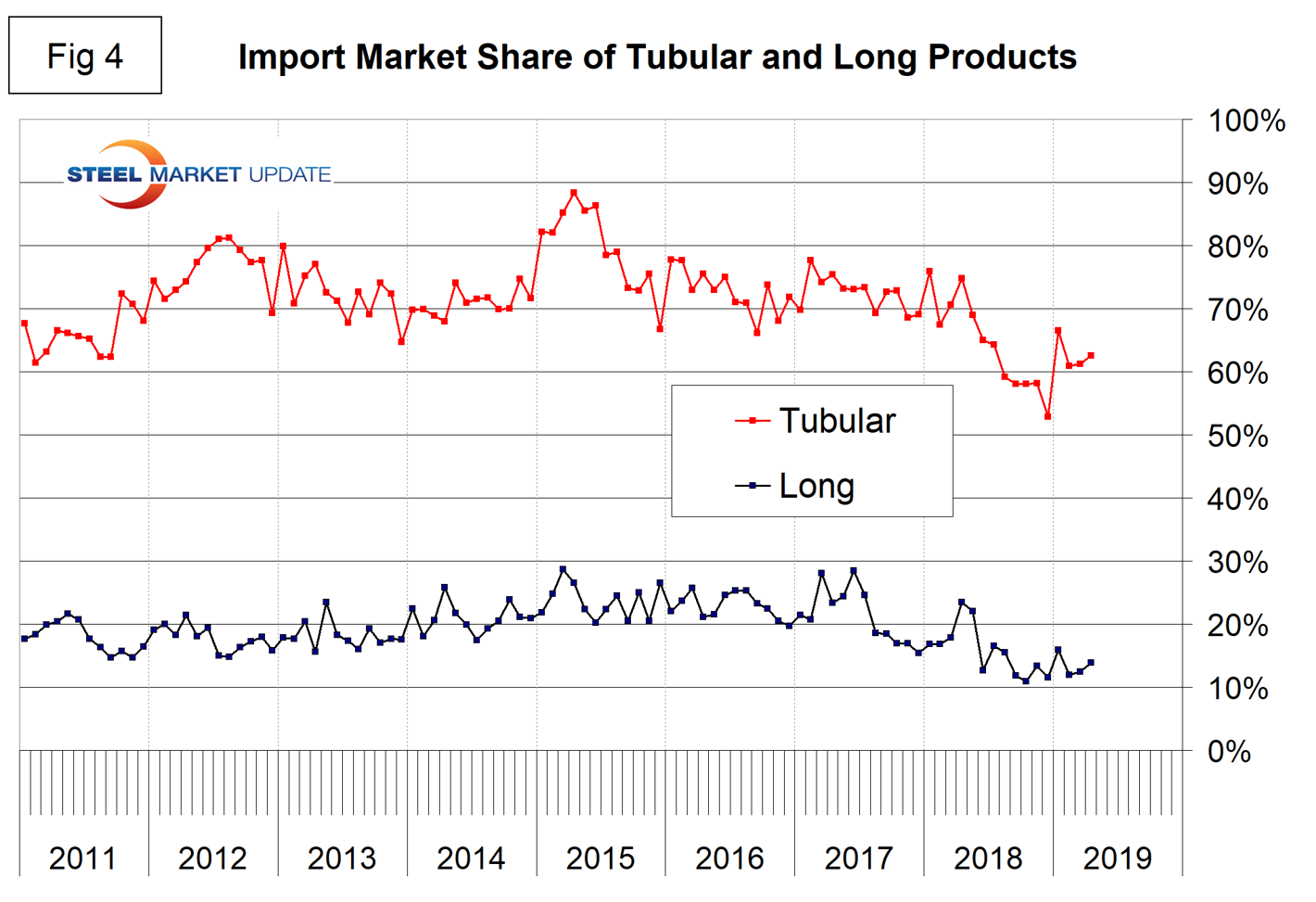

Figure 4 describes the total import share of tubular goods and long products. It is evident as we work the numbers that data for the domestic production of tubulars is much less reliable than for other products. Domestic shipments are definitely understated for some products and we suspect for all. This is probably because of a more fragmented supply chain and the independent tubers not reporting to the extent that the steel mills do for other products. This has the result of increasing the apparent import market share. In the 11 months prior to and including April, the import market share of long products has been historically low.

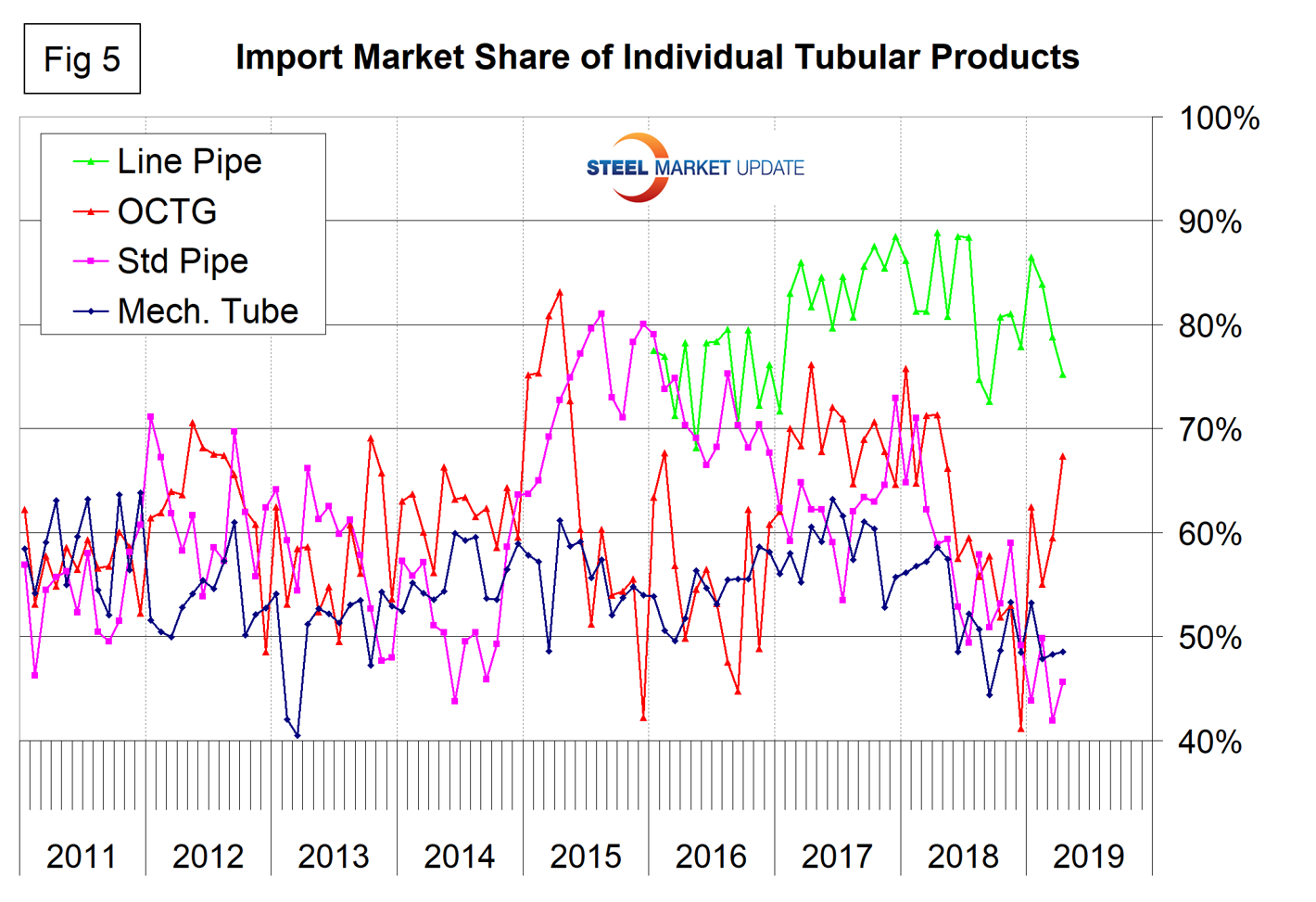

Figure 5 shows the import market share of the individual tubular products. Based on the available information, all are very high compared to other steel product groups, and line pipe is the highest.

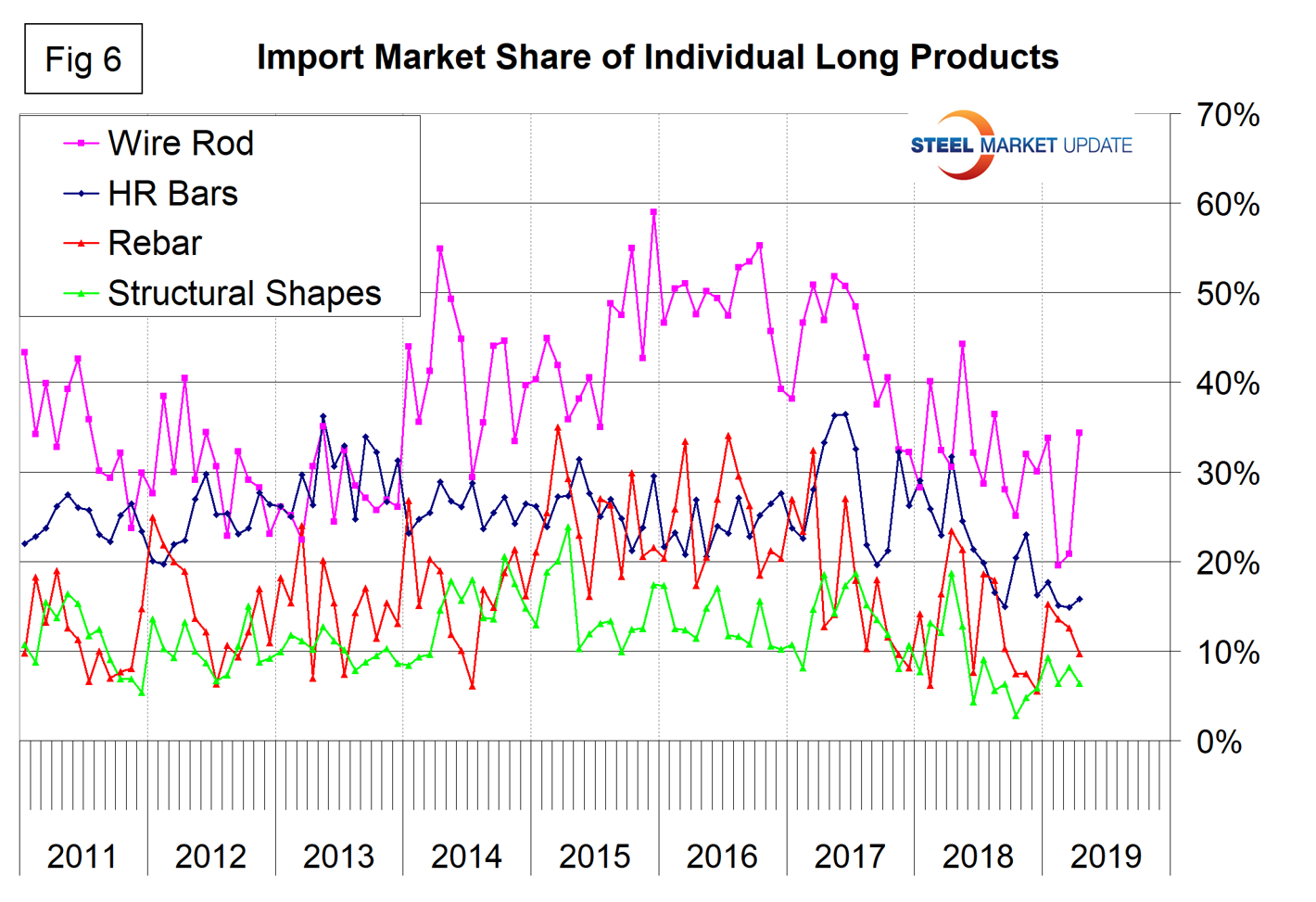

Figure 6 shows the detail for the four major sectors of the long products group. The most significant reduction is for wire rod, which in the years 2014 through most of 2017 had a significantly higher import market share than the other long products. In 2018 through March 2019 the gap narrowed. The import share of hot rolled bars has declined by 50 percent in the 18 months including April 2019. Rebar has been drifting down erratically for two years. The import market share of structural shapes is currently historically low.

SMU Comment: It’s not obvious that the Section 232 legislation has had the effect of reducing the import market share of any of the 16 products considered in this report. It is truer to say that trends established before March 2018 have continued through April 2019.