Market Segment

June 11, 2019

HARDI: Weak Prices Undercut Strong Demand

Written by Tim Triplett

Suppliers of steel products to the HVAC industry find themselves stuck in a good news/bad news market. Demand remains good as the construction season ramps up, but pricing on galvanized steel continues to weaken. “Demand in the Southeast is still very good, even though there has been a painful devaluation of our inventory,” said one member of the Heating, Air-conditioning and Refrigeration Distributors International (HARDI), during the trade group’s monthly conference call earlier today.

Galvanized ste![]() el prices have fallen by about $4.50/cwt in the past eight weeks. Steel Market Update estimates the current market price is running close to $35/cwt, or $700 per ton. “Prices just seem to be in a freefall. We are in pricing territory we have not seen since the fall of 2016,” said one executive on the call.

el prices have fallen by about $4.50/cwt in the past eight weeks. Steel Market Update estimates the current market price is running close to $35/cwt, or $700 per ton. “Prices just seem to be in a freefall. We are in pricing territory we have not seen since the fall of 2016,” said one executive on the call.

President Trump’s decision to lift the Section 232 tariffs on Canada and Mexico may be contributing to the softening of prices in the U.S., although galvanized steel imports overall actually declined in May to approximately 208,000 tons from 237,000 tons in April when the tariffs in North America were still in place.

“Nearly 95 percent of the service centers surveyed by Steel Market Update report that prices on galvanized steel are negotiable with the mills. So, my expectation is that prices will continue to drop for a while,” reported John Packard, president and publisher of Steel Market Update, on the call.

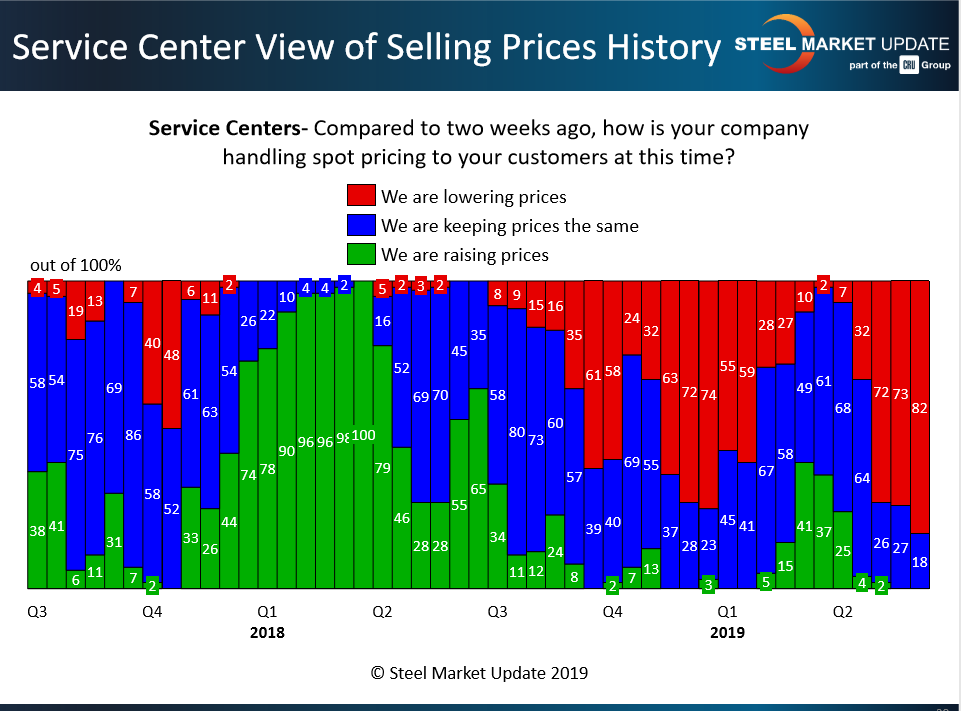

He pointed to one statistic that suggests prices may be nearing a bottom. SMU data shows that 82 percent of service centers are now lowering prices to their customers. Historically, when 75 percent admit they are discounting to move material, the market reaches a point of “capitulation” in which distributors give up trying to make sales at the expense of their inventories and instead begin to support higher prices.

Another poll of the HARDI members on the call indicated that nearly all expect galvanized prices to decline another $1-2/cwt over the next 30 days.

“The price is tanking a lot farther and a lot faster than we expected it to go,” said one distributor who is hoping for a strong selling season in construction this summer. “Like everyone else, we’re really watching our inventory closely.”

Added another: “Demand is still good for us, although the rhetoric is increasingly pessimistic. Maybe our industry is lagging and we will start to see it later this year.”

Steel Market Update participates in a monthly steel conference call hosted by HARDI. The call is dedicated to a better understanding of the galvanized steel market. The participants are HARDI member companies who are wholesalers, service centers and manufacturing companies that either buy or sell galvanized sheet products used in the HVAC industry.