Market Data

June 8, 2019

SMU Market Trends: Demand, Imports in Question

Written by Tim Triplett

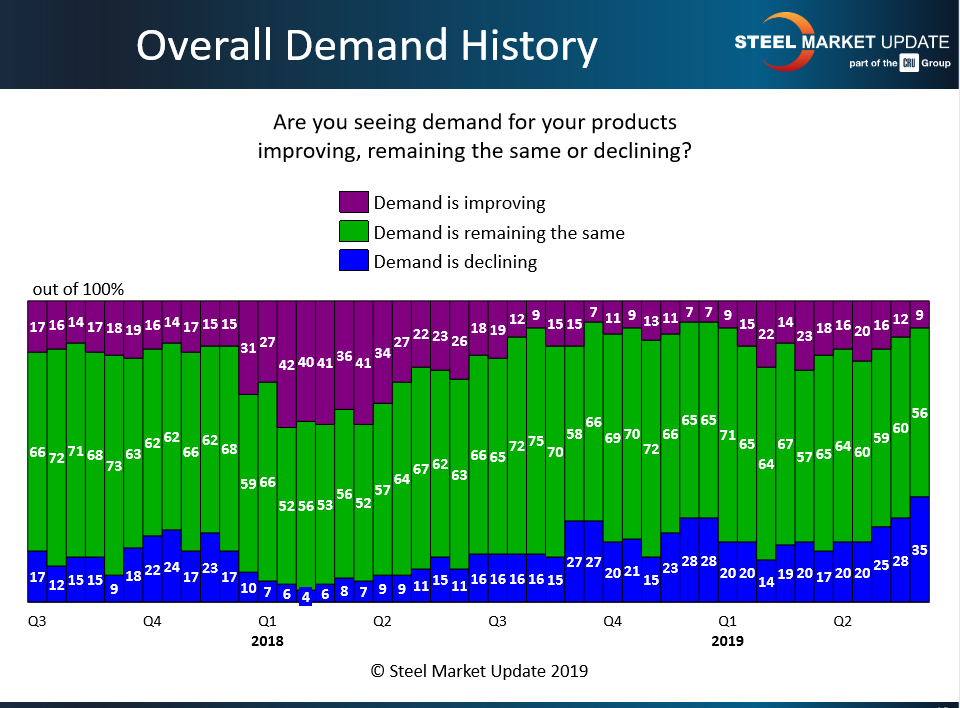

Steel Market Update data supports the widespread view that steel demand is unusually sluggish for this time of year. Nine out of 10 steel buyers responding to Steel Market Update’s market trends questionnaire this past week characterized demand as flat or declining. Only a small single-digit percentage see improving demand.

About 35 percent of the service center and OEM executives polled said they are experiencing declining demand, up from 25 percent a month ago. For the majority (56 percent), demand remains the same.

“We continue to see demand across all business sectors declining,” commented one respondent. “With price reductions and uncertainty, I am seeing less inquiries now as customers try to reduce inventories and dump higher cost steel,” said another executive. “It’s hard to be sure if demand is the same or declining since people are sitting on their hands as they watch the U.S. mills trash the market,” added a disgruntled distributor.

More Imports from Canada, Mexico, Turkey?

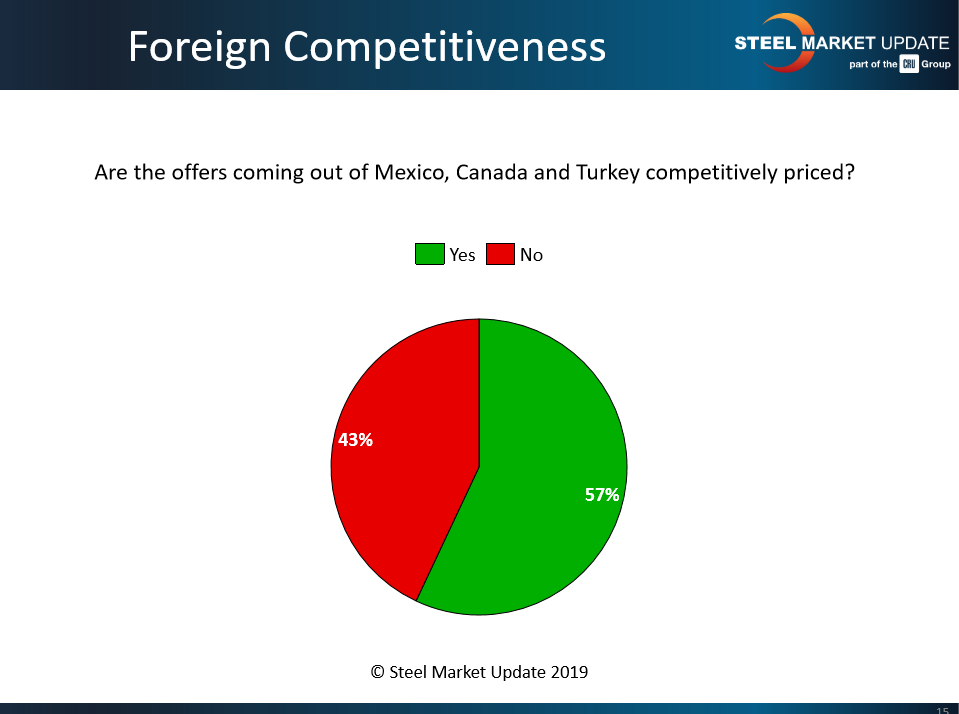

The majority (57 percent) of respondents say they have seen competitively priced offers on steel imports from Canada and Mexico since President Trump rescinded the Section 232 tariffs. Tariffs on Turkey, which were cut in half but still remain at 25 percent, make Turkish steel imports considerably less competitive.

“Turkey is not competitive and they have long lead times versus U.S./Canada/Mexican mills,” said one respondent. “Turkey will struggle for the time being, at least on flat products,” added another.

Offers from mills in Canada have resumed, reported a few respondents. Said one: “Canada continues to sell well beneath the market.”

Forty-three percent of respondents to SMU’s questionnaire said they have not yet seen competitive import offers from the three countries.