Analysis

June 3, 2019

May Auto Sales Better Than Expected

Written by Sandy Williams

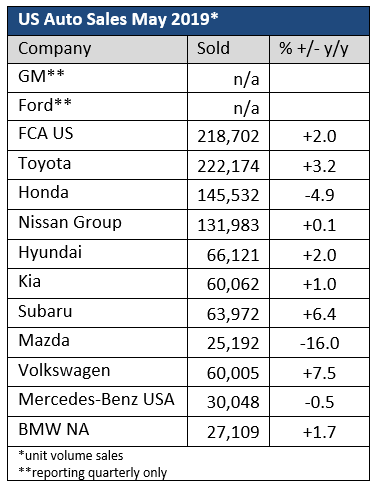

May turned out to be a good month for several automakers. Fiat Chrysler, Toyota and Nissan all reported year-over-year gains. Fiat Chrysler posted a 2 percent gain in May, its first monthly increase since January, while Toyota jumped 3.2 percent and Nissan 0.1 percent.

Overall sales totaled 1.587 million, a year-over-year decline of 0.3 percent, according to Automotive News. The seasonally adjusted annual rate of sales for May was 17.4 million, beating forecasts of 16.9 million.

“Volatility is a new ingredient in the market and it’s likely to be like this for the rest of the year,” said Charlie Chesbrough, an economist for Cox Automotive. “It’s hard to know if May’s results are an indicator of a robust summer ahead or more volatility ultimately leading into a downward trend for the year.”

New Headache for the Industry

The auto industry thought potential Section 232 tariffs on autos was their immediate concern, but now proposed tariffs on Mexico bring new worries. The tariffs would affect billions of dollars of auto and auto parts imports. Nearly $60 billion in auto parts were imported from Mexico in 2018 and about 2.5 million Mexican-made vehicles.

A short-term tariff of 5 percent can be weathered by the industry, says Jeff Schuster, LMC Automotive’s president for global forecasting, but an increase to 25 percent would be substantial.

In an analysis by Deutche Bank, a 25 percent tariff would cost General Motors $6.3 billion, FCA $4.8 billion and Ford $3.3 billion.

“That means lower margins and less investment and R&D spending,” said Kristin Dziczek, vice president of industry, labor and economics at the Center for Automotive Research. Dziczek said if the USMCA fails to pass and the president withdraws from NAFTA, there will be no incentive for businesses to move back to the U.S. when they can move to other low-cost countries.