Overseas

May 30, 2019

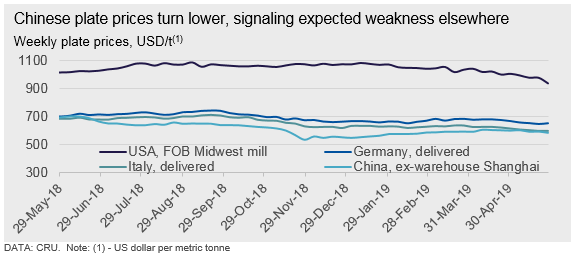

CRU: Chinese Prices Decline as Recent Run Comes to an End

Written by Tim Triplett

By CRU Principal Analyst Josh Spoores

In the U.S. Midwest market, sheet prices have continued to decline on increased domestic, and now North American, supply. In addition to rising supply, falling scrap costs have also allowed EAF-based mills to remain competitive at these lower prices. It has now been one week since Canada and Mexico could export steel to the U.S. without the S232 tariff. This has worked to increase competition to place steel. Yet, consequently, buyers remain hesitant of initiating orders as they wait for lower prices. Plate prices in the U.S. have resumed their downward trend after steadying for a week. Prices here fell by $37 /s.ton as service centers continue to refrain from buying in order to work down inventory in this falling price environment. We continue to expect scrap prices to fall slightly further in June, which may add to this decline in plate prices.

Sheet product demand weakness in the European market is still evident. German HR coil prices fell for the fifth consecutive week. Low demand coupled with high inventories among stockholders in Germany is seen as the largest obstacle to price upside in the near-term. That said, slightly higher prices for Italian HR coil continue to hint towards a turning point, as Italy is considered the prime mover in Europe for price. The discount for Italian HR coil compared to German HR coil now stands at €21 /t, the lowest HRC price difference between the two countries in over a year, according to CRU data. Plate prices in Italy fell further this week, down by €2/t, but prices in Germany were up by €3/t, returning to the level of two weeks ago. The German plate premium over HR coil is now at €101 /t. This is now the largest spread since April 2016, and it comes after a fall in German HR coil prices this week. The Italian premium of plate over HR coil is at €71/t. Based on recent activity in the European market such as production curtailments and steadying prices in Italy, we continue to look for a possible near-term bottom, particularly for sheet.

Chinese steel prices broadly decreased by RMB 10-90/t w/w over the past week. Due to continuous rainy days in South China, spot transactions slowed as construction activities were negatively affected. This was also reflected by the weak performance of recent cement prices. Moreover, bearish traders were keen to destock as they were afraid of further decline. Given the margin was further squeezed by rising iron ore and coke prices, some sheet producers have scheduled maintenance in the next few weeks. Looking forward, although downward pressure from high production persists, a large fall is not possible due to cost support. Plate prices in China fell by RMB 70/t w/w. Output rose by 2 percent w/w together with growing inventory at steel mills that pressed down the prices. Traders were active to de-stock over the past seven days as their inventory decreased by 2.6 percent w/w. With the decline of future prices on Wednesday, spot prices were negatively affected as sentiment was dampened.