Prices

May 28, 2019

CRU: Iron Ore Price Surge Continues

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

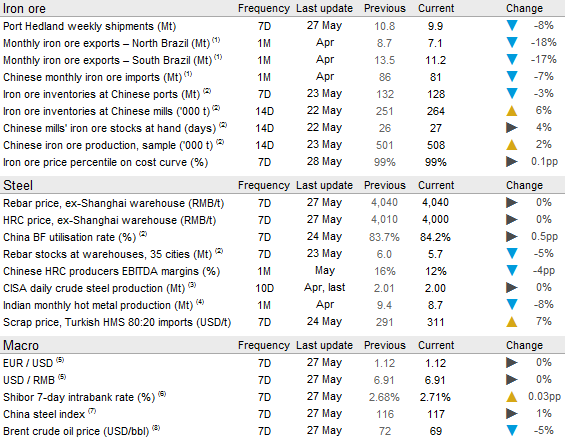

Iron ore prices continued to climb in the past week with a sharp price jump on Monday lifting prices to $108.0 /t on Tuesday, May 28. This translates to a $6.5 /t increase w/w.

Seaborne supply outside of Minas Gerais is recovering. Supply from Port Hedland, although falling w/w, is still at a high level and registered 9.9 Mt in the past week. FMG’s shipments have been particularly strong. The company shipped at an annualized rate of 164 Mt/y in April and 173 Mt/y thus far in May. BHP has also performed well and shipped at 283 Mt/y for the two months combined. In Vale’s Northern System, shipments have recovered after the heavy rain in March and April. Recent trade data shows that shipments in the second half of May have been at the highest level this year. In addition, Rio Tinto is now shipping at full capacity from both its Cape Lambert and Dampier ports.

With strong seaborne supply in northern Brazil and Western Australia, there is still a great deal of uncertainty around production in Minas Gerais, southern Brazil. In Vale’s Minas Centrais complex, the Brucutu mine is still not allowed to use wet beneficiation, which is restricting its output to 5-10 Mt/y. The ramp-up is facing delays caused by difficulties to carry out third party safety inspections. Also in the Minas Centrais complex, Vale’s Gongo Soco mine, which has been idled for three years, is facing the risk of a mine wall collapsing. The seismic movements from such a collapse could result in the nearby tailings dam breaching, which would have serious consequences for Vale’s future iron ore operations. However, the mine wall was expected to collapse during the weekend, which did not happen, and recent reports suggest the risk of a collapse rather than a gradual breakdown of the wall has reduced.

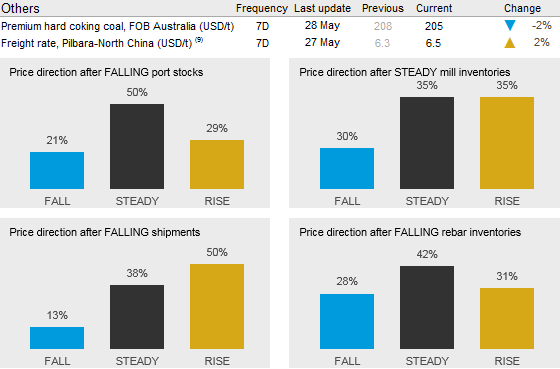

On the demand side, Chinese appetite for iron ore continues to be strong due to recent elevated production levels and low inventories. Port stocks have continued to decline while we are now seeing a slight increase in inventories at mills. Steel prices remain high, but we are expecting the market to weaken somewhat due to seasonally weaker construction activities caused by heavier rain in southern China.

Our sources suggest the recent price hike is speculation-driven. With more arrivals of cargoes to China expected, slightly more comfortable mill inventory levels and seasonal weakness to steel demand, we expect iron ore prices to correct in the coming week.