Product

May 9, 2019

New Flat Rolled Capacity: Oversupply or Overdue?

Written by Paul Lowrey

By Paul Lowrey

Editor’s note: Paul Lowrey is an industry consultant and president of Steel Research Associates, LLC. He will be a featured speaker at the upcoming Steel Market Update Steel Summit Aug. 26-28 in Atlanta. Click here for more information and to register for the summit.

Recent announcements of new flat rolled capacity have caused some to speculate there will be an oversupply in coming years. Solid fundamental analysis shows this is not the case. After years of uncertainty and net capacity reduction, domestic producers are responding to an improving supply/demand picture and a better business and manufacturing environment. They are investing in the future with new technology, expanding product offerings and geographically positioning plants closer to regional demand centers.

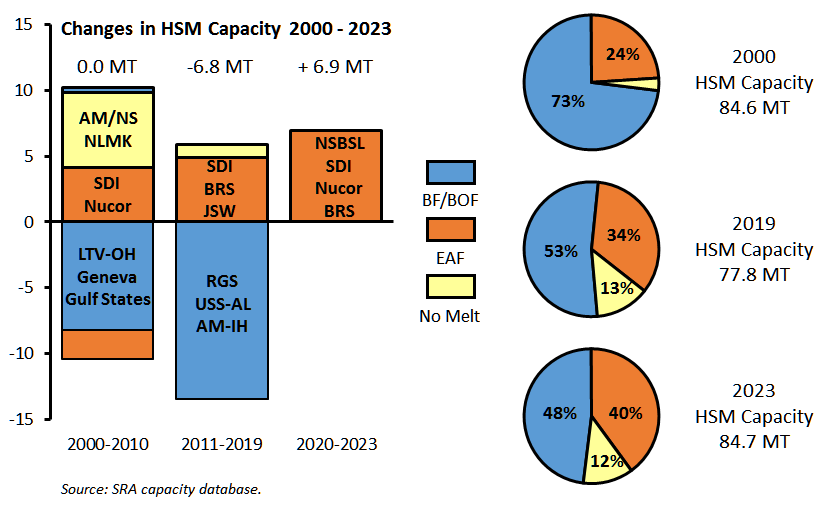

Let’s take a look at the new capacity from a historical perspective. The chart below shows the changes in domestic hot strip mill capacity from the year 2000 through 2023 when the new capacity will be fully operational. As you can see, aggregate HSM capacity was reduced by nearly 7 million tons (MT) from the year 2000 to present, including the recent restart of the JSW mill in Mingo Junction. The new additions (assuming all of it will be built) essentially return us to the same capacity as the year 2000—no change in nearly 25 years!

What’s really changing is the technology. The domestic industry is going through another modernization phase. U.S. Steel’s recent announcement regarding the Mon Valley Works, although not incremental new capacity, is yet another example of a significant investment in modernization. In capital intensive industries, modernization tends to come in big chunks in a short period of time rather than small increments spread out over a long period of time.

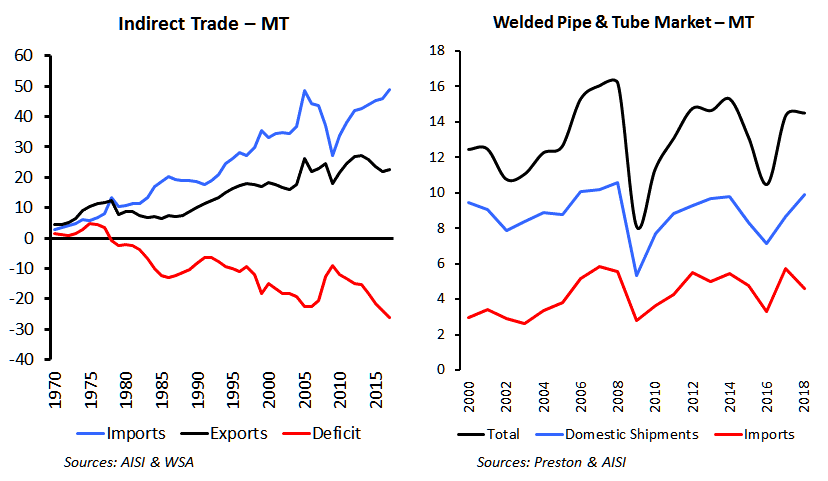

One reason for concern about the new capacity is the current level of steel demand. In 2018, flat rolled steel demand was about 65 million tons, or 15 percent lower than the 75 million ton peak in the mid-2000s. There are two major reasons for this decline. First, construction activity (residential and non-residential) has still not fully recovered since the financial crisis. Second, steel demand continues to be eroded by the growth in indirect steel trade (imported finished products containing steel).

So, how is hot strip mill utilization going to change in a reduced demand environment? I used a set of conservative assumptions to forecast supply and demand for the next five years. They include 1 percent annual growth in demand, 17.5 percent import supply (current level), and no domestic hot strip mill closures. As shown in the chart below, HSM utilization only drops marginally as the new capacity is phased in. The utilization is based on the hot band equivalent of domestic producer flat rolled shipments vs. HSM capacity and should not be confused with the AISI raw steel number.

Based on the current economic environment and trade policies, I think it would be appropriate to envision higher demand growth, lower import supply, or both. It doesn’t take a lot. Underlying demand growth of 1.5 percent per year and a reduction of import supply to 15 percent (still high by historical standards) absorbs all the new capacity and keeps the HSM utilization rate in the mid 80’s.

Another significant issue to consider is the impact of indirect steel trade. In 2017 (last year of indirect trade figures), the U.S. imported 78.5 MT of steel including 29.6 MT of steel mill products (flat and long) and 48.9 MT of indirect steel in the form of autos, appliances, machinery and equipment, etc. That’s the equivalent of 40 steel mills producing 2 million tons each! Imports of steel mill products include welded pipe and tube, which are separate from flat rolled steel imports. In 2018, we imported 5 MT of equivalent hot band in the form of welded pipe and tube. Long-term trends in indirect steel trade and welded pipe and tube imports are shown below.

It is worth noting the AD/CVD trade cases are growing in downstream products containing steel. Here’s a partial list of cases in progress:

- Fabricated structural steel from China, Canada and Mexico

- Steel nails from China

- Steel propane cylinders from China and Thailand

- Steel racks from China

- Steel wheels from China

- Utility scale wind towers from China and Vietnam

- Vertical metal file cabinets from China

It’s not just about trade protection. Lower taxes, reduced regulations and lower energy costs are all benefitting domestic manufacturing. It’s entirely reasonable to expect the return of some of the lost manufacturing. Coupled with the supply/demand picture described above, the new flat rolled capacity appears to be reasonable and justified.