Market Segment

May 9, 2019

AISTech 2019: Mill Execs Optimistic about "Golden Era" for Steel

Written by Sandy Williams

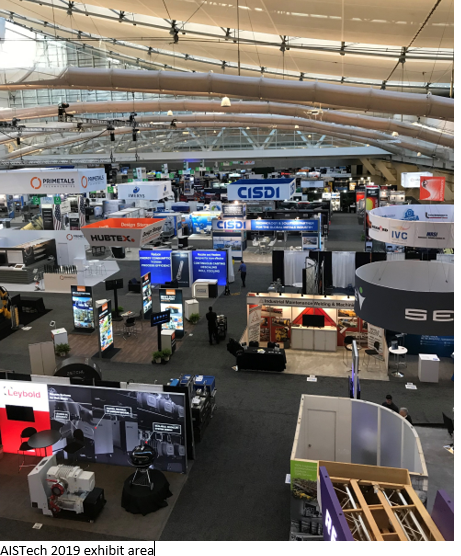

AISTech 2019, presented by the Association for Iron & Steel Technology, boasted more than 8,000 attendees this year. The four-day conference May 6-9 in Pittsburgh included more than 550 technical presentations and nearly 550 domestic and international exhibiting companies. The exhibit floor was a dizzying display of the latest innovations from software and robotics to cranes and steel mill planning. Student exhibits, technical presentations and panel discussions highlighted new equipment and processes that will drive the industry’s future.

The current “golden era” for steel will continue for the “foreseeable future,” said U.S. Steel CEO David Burritt. Although the Trump administration deserves credit for its strong stance on trade and advocacy for the steel industry, there was strong bi-partisan support for tougher measures on unfairly traded imports and excess steel capacity in China long before the Section 232 tariffs. That support is expected to continue whether or not the current administration is re-elected, Burritt said.

SMA President Philip Bell noted that in addition to new trade measures, tax relief, regulatory reform and confidence in the economy have spurred new investment. Between 2007 and 2017, Nucor invested $9 billion into upgrading its operations, said David Sumoski, Nucor Executive Vice President, Merchant and Rebar.

The U.S. is not the only country strengthening trade measures, noted CMC CEO Barbara Smith. The European Union has similar safeguards in place to project their domestic steel industry and have extended those measures until 2021. “At Commercial Metals, our philosophy is we have to be successful in any economic scenario,” she said.

Burritt added that trade measures need to be put in place everywhere in the world. Countries need to work together to fight excess capacity in China. “Put the pain where the problem is,” said Burritt.

The U.S Steel CEO added that “quotas at appropriate levels” would be fine for Canada and Mexico and the USMCA, noting that U.S. border allies have not always been proficient at preventing circumvented products from entering the U.S.

The executives agree that innovation and technology utilization is critical for the success of the steel industry. Nucor hosts high school students to show that it is “not your grandfather’s steel industry,” but is instead one that values STEM skills like science and math that will enable employees to work with today’s high-tech systems. It is important to show students that the industry offers real jobs with decision making, accountability and the freedom to do things that may not be available in other careers, said Sumoski.

{loadposition reserved_message}

“You never hear someone accuse the U.S. Steel industry of not paying living wages,” said Bell. He added that the new capacity and modernization projects are happening within a large geographic footprint.

New steel mills have a multiple effect, creating jobs at the mills, businesses downstream and in communities, said Smith.

The executives were asked to comment on the industry slowdown in 2019. Although the economy is good, Sumoski said, there have been some headwinds this year, such as inclement weather and a slowing auto sector. He noted that 21 of the 24 markets that Nucor participates in are going strong. “Customers are telling us it could be a record year.”

Smith noted that announcement of the Section 232 tariffs last year incited panic buying among customers with some stocking more inventory than needed to hedge against shortages. CMC customers are now seeing opportunities going forward. CMC currently has its largest backlog of orders since the Great Recession, said Smith.