Prices

May 1, 2019

Steel Imports Trending Lower for Most Products

Written by John Packard

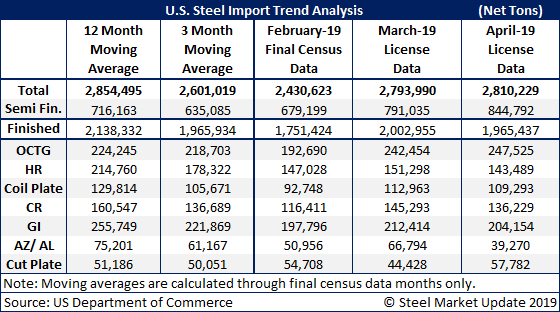

Earlier this week the U.S. Department of Commerce released the latest foreign steel import license data. Based on this data, the trend is for 2.8 million net tons of foreign steel imports to arrive in the United States during the month of April. This is essentially unchanged from March, but higher than the 2.4 million net tons received during the month of February.

As we dig deeper into the data, we are seeing semi-finished steels (mostly slabs), which are used by the domestic steel mills, as the single largest import item. The trend for April is for 845,000 net tons of semi’s to arrive. This takes total finished steels down to about 2 million net tons, or about the same total as we saw in March and 250,000 tons higher than February.

When looking at the long-term trend utilizing the 12-month moving average, we are seeing imports of hot rolled, coiled plate, cold rolled, galvanized and Galvalume all lower. Cut plate and oil country tubular goods (OCTG) were the two items we follow that were slightly higher than the average.