Market Segment

April 30, 2019

SSAB Americas Posts Record Profit in Q1 2019

Written by Sandy Williams

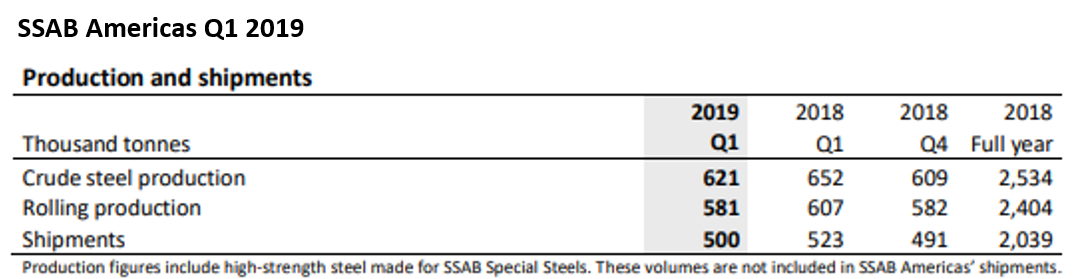

SSAB Americas was a strong contributor for SSAB’s global steel business in the first quarter of 2019. The Americas segment turned in a solid performance with an EBITDA margin of 23 percent and record profit of $129 million due to higher steel prices. Sales increased 45 percent from the first quarter of 2018 to $3.363 billion, the company reported.

Shipments were slightly lower in the quarter due to severe weather impacts for the Montpelier, Iowa, facility. A week of winter storms and minus 50 degree windchills in January caused shipping disruptions to truck and rail. Steel service centers were somewhat cautious with buying patterns in the first quarter, said SSAB executives.

Looking ahead, overall demand is good in the United States, with some weakening in automotive. SSAB also noted positive demand in wind energy and high activity in the U.S. oil and gas sector going into the second quarter.

SSAB Americas expects its shipments to be similar in the second quarter, though it anticipates lower steel prices.

On the topic of new capacity in the U.S., CEO Martin Lindqvist said the U.S. plate market is structurally undersupplied, so it relies on imports. “Import is typically between 20 percent and 30 percent every year, so there is room for more capacity,” he said. “But the big capacity being built, or at least announced so far, is within strip. And we are not producing strip in the U.S. But of course, it will over time change the market dynamics a bit. But we also see over time growth in plate. So, we think there is room for more plate capacity in North America.”

SSAB Americas’ steel mills are located in Mobile, Ala., and Montpelier, Iowa, and have a combined annual production capacity of 2.4 million metric tons, producing heavy plate and coil. Both mills utilize a scrap-based, electric arc furnace (EAF) method to produce steel. The mills are strategically located to cover the industrial heartland in North America, with access to the strategic port systems, intercoastal waterways and major railways, which provide logistical advantages.