Prices

April 30, 2019

SMU Analysis: Regional Cold Rolled Coil Imports

Written by Peter Wright

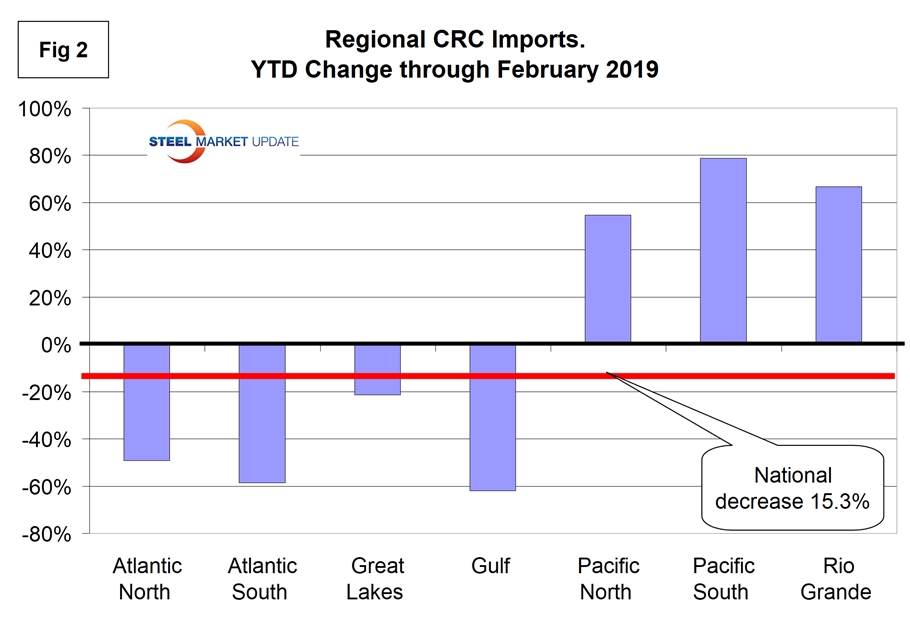

Cold rolled imports from Mexico through Laredo have surged in 2019 making this the highest volume region of entry year-to-date. For the nation as a whole, cold rolled imports year-to-date were down by 15.3 percent, but the Pacific South, (Los Angeles and San Diego) was up by 78.8 percent, according to Steel Market Update’s latest analysis of government data.

![]()

SMU now offers a comprehensive series of import reports ranging from the first look at license data to the very detailed look at volume by district of entry and source nation. The report you are reading now is designed to plug the gap between these two. Our intention is to report regional imports for two of six flat rolled products each month. This month, (April), we are reporting on hot and cold rolled sheet through February. Next month, we will report on coiled and cut-to-length plate, and in June we will report on coated products.

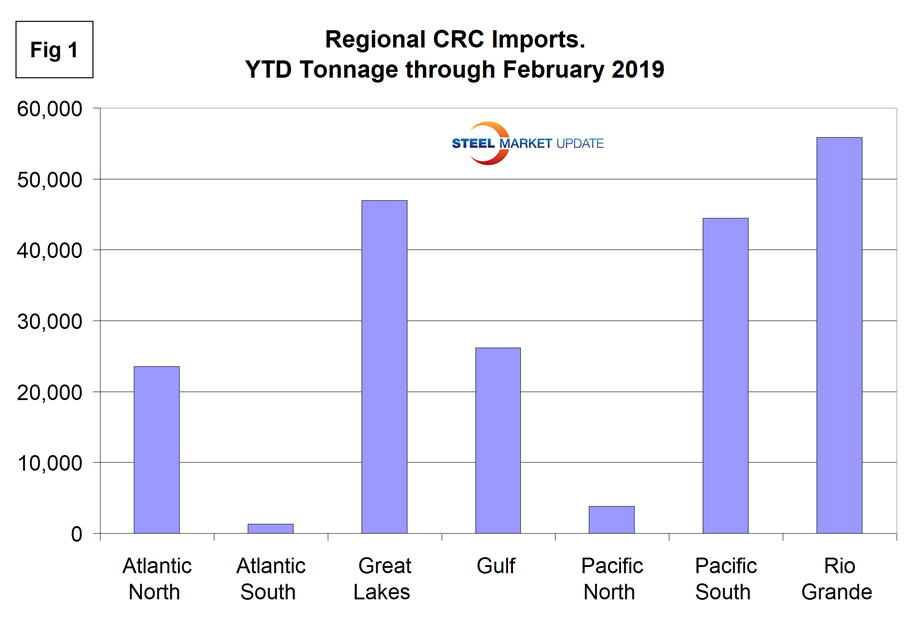

National level import reports do a good job of measuring the overall market pressure caused by the imports of individual products. The downside is that there are huge regional differences. Figure 1 shows the year-to-date tonnage into each region and the dominance of the Rio Grande, the Great Lakes and the Pacific South.

Figure 2 shows the year-to-date change for each of seven regions and the change at the national level. Volume declined this year through February in all regions except the North and South Pacific Coast and the Rio Grande Valley.

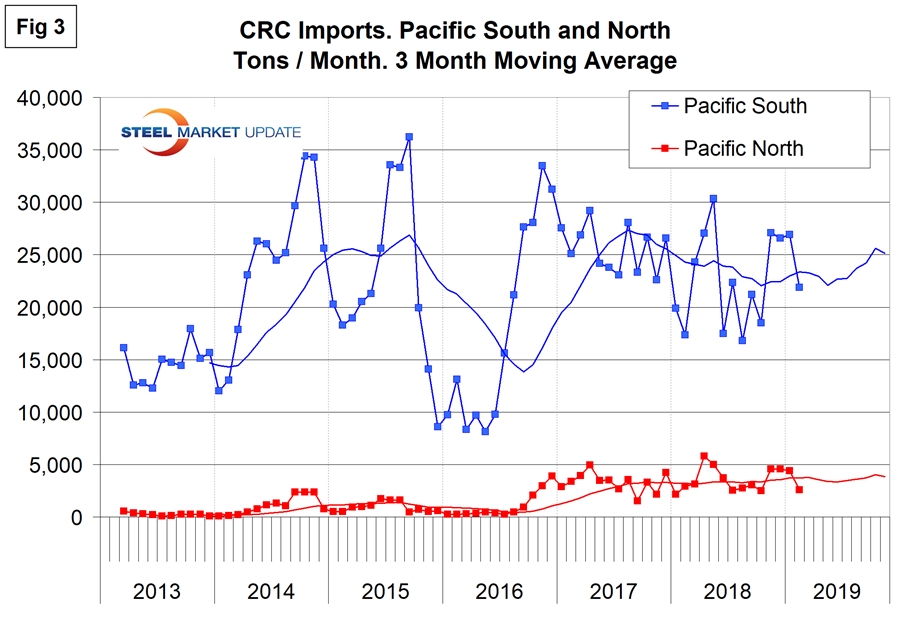

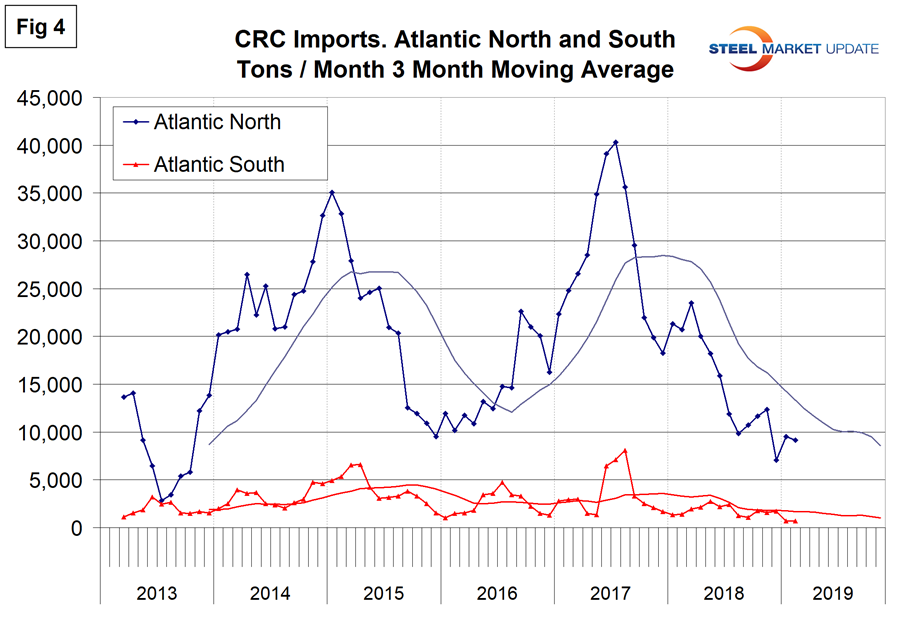

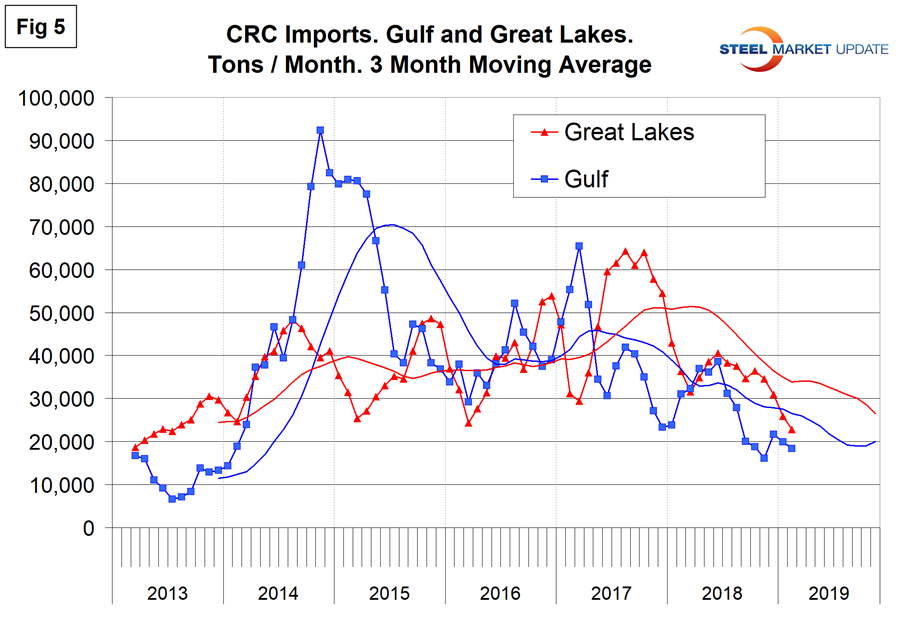

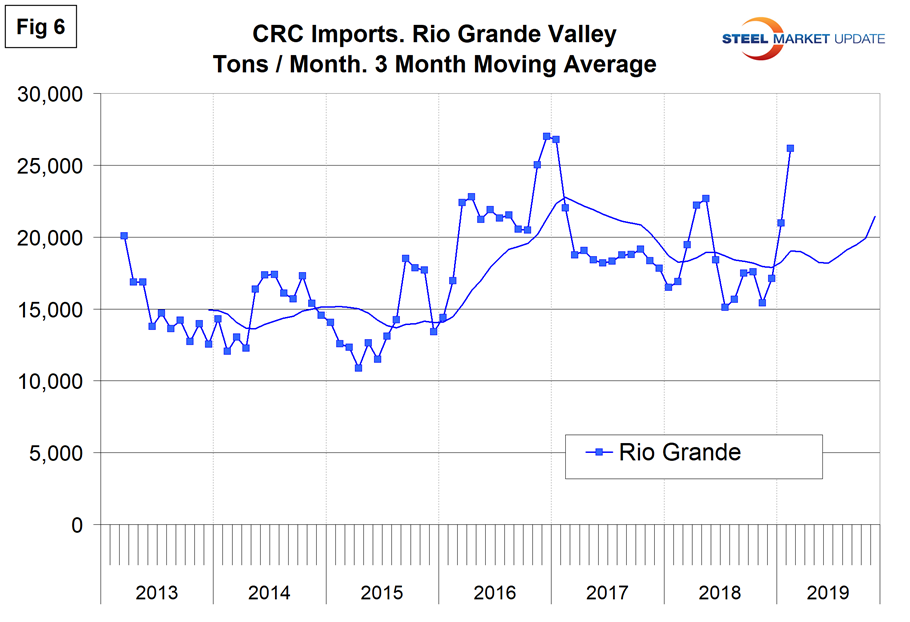

Figures 3, 4, 5 and 6 show the history of CRC coil imports by region since March 2013 on a three-month moving average basis.

Imports into the Pacific South have been drifting down erratically for over two years, though this is still the third highest region of entry. Volume into the Pacific North has been minimal during the time of this study.

Imports into the North Atlantic spiked in 2017 when a large volume arrived in Philadelphia from Russia. Since then volume into this region has been drifting down. The South Atlantic region receives little volume.

Imports into the Great Lakes and Gulf have both been drifting down since 2017. The Great Lakes is still the second highest region of entry. Volume into the Gulf has declined by 61.9 percent year-over-year through February.

Tonnage out of Mexico, almost all through Laredo, has surged in 2019 making this the highest volume region of entry year-to-date. Year-over-year, volume over the river through February was up by 66.8 percent.

This data comes from the USITC, which has still not recovered from the government shutdown. February data should have been released by April 8 but was not released until April 22. Hopefully they will be caught up next month and premium subscribers will have access to detailed reports by district and source nation on our web site.

Regions are compiled from the following districts:

Atlantic North: Baltimore, Boston, New York, Ogdensburg, Philadelphia, Portland ME, St. Albans and Washington, DC.

Atlantic South: Charleston, Charlotte, Miami, Norfolk and Savannah.

Great Lakes: Buffalo, Chicago, Cleveland, Detroit, Duluth, Great Falls, Milwaukee, Minneapolis and Pembina.

Gulf: Houston, New Orleans, Mobile, San Juan, St. Louis and Tampa.

Pacific North: Anchorage, Columbia Snake, San Francisco and Seattle.

Pacific South: Los Angeles and San Diego.

Rio Grande Valley: Laredo and El Paso.