Market Segment

April 25, 2019

NLMK USA Shipments Increase in Q1

Written by Sandy Williams

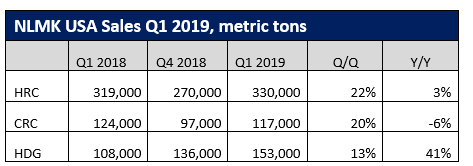

NLMK USA shipments increased 19 percent to 600,000 metric tons from the fourth quarter of 2018 to the first quarter of 2019. Higher shipments resulted in $530 million in revenue—a 4.0 percent increase despite steel prices slipping 12 percent quarter-over-quarter.

NLMK USA hot rolled coil shipments totaled 330,000 metric tons and high value added products 270,000 MT. The division saw higher demand for rolled products from service centers, pipe producers, machinery and construction industries.

Slab shipments from NLMK’s Russian flat products division to NLMK USA fell 24 percent to 141,000 MT from the fourth quarter of 2018. The U.S. government has denied NLMK USA exemption from Section 232 tariffs for imports of steel slab from its parent company.

NLMK USA includes NLMK Indiana, NLMK Pennsylvania and Sharon Coating.

NLMK Group Results

NLMK Group reported a 5.0 percent sequential decline in revenue to $2.87 billion due to lower steel prices. Sales were almost flat compared to the fourth quarter.

Group shipments totaled 3.4 million MT. More than half (56 percent) of NLMK’s steel products were sold in the Group’s home markets of Russia, the EU and the United States. Steel output fell 4 percent to 4.18 million MTs in the first quarter due to overhauls of blast furnace operations and seasonal slowing. Steel capacity utilization, excluding production capacities under maintenance, was at 96 percent.

“In Q1 2019 there was a multidirectional trend in steel consumption in our key markets: in Russia and the U.S. demand grew quarter-over-quarter, while in the EU there was a slowdown in activity among steel product consumers,” commented NLMK Group CFO Shamil Kurmashov.

NLMK Group expects Group steel output to decline 6-8 percent in the second quarter due to blast furnace maintenance at Lipetsk.