Market Data

April 23, 2019

Chinese Industrial Production Surges in March

Written by Tim Triplett

The official economic statistics out of China show a surge in industrial production in March and a steady growth in fixed asset investment.

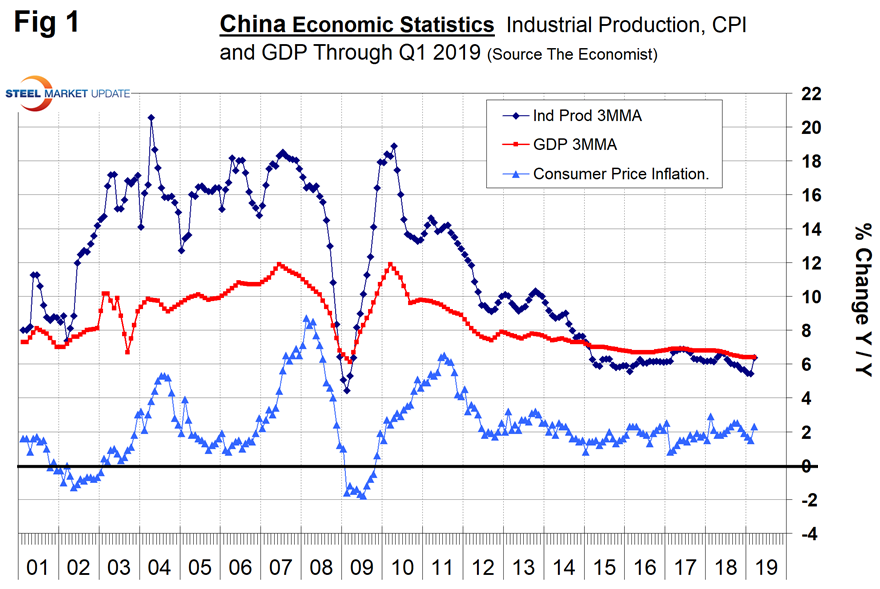

Once each quarter, Steel Market Update publishes the official statistics for Chinese GDP, industrial production, consumer price inflation and fixed asset investment. We don’t know the accuracy of these numbers but we include them in our reports because of the importance of China in the global steel scene. China’s economic statistics are never revised, which makes analysts suspicious considering the U.S. routinely makes revisions back decades. Figure 1 shows published data released this week for the first quarter of 2019. The GDP and industrial production portions of this graph are three-month moving averages.

China’s GDP grew at a rate of 6.4 percent in the first quarter of 2019, down from 6.7 in the first quarter of 2018. Growth has gradually slowed from 7.0 percent in the first and second quarters of 2015.

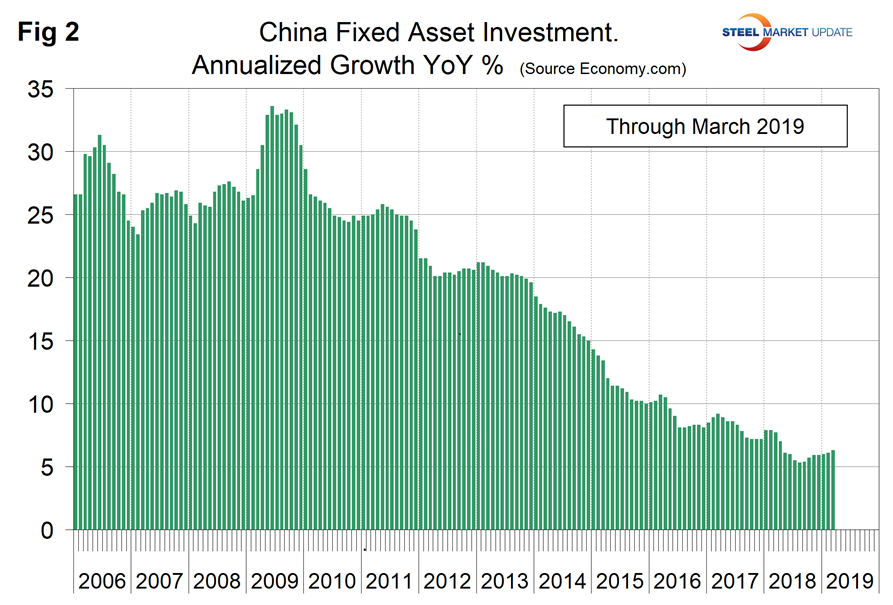

Economy.com reported: “The Chinese economy expanded 6.4% y/y in the March quarter, the same pace as in the prior quarter. This was faster than our expectations and consensus forecasts, adding further evidence that Beijing’s easing measures are working to stabilize economic growth. Measures have included reserve requirement ratio cuts, higher tax reimbursement rates for exporters dealing with U.S. tariffs, tax cuts, and a push to increase bank lending and public works. Notably, fixed asset investment growth, led by infrastructure investment, has picked up since August last year. All told, following today’s result, we are likely to nudge up our GDP growth forecast to 6.4% for 2019, up from the current forecast of 6.3%.”

The growth of industrial production slowed from 7.0 percent in April 2018 to 5.3 percent in February 2019, then shot up to 8.5 percent in March 2019. The three- month moving average (3MMA) slowed from 6.40 percent in April 2018 to 5.43 percent in February 2019 before increasing to 6.37 percent in March. On April 17, Moody’s reported: “China’s industrial production growth quickened to 8.5% y/y in March from 5.3% y/y in January-February. The result beat expectations, with strong growths in both the manufacturing and mining sectors. Auto production also stabilized, recording the first positive y/y growth since October. Industrial production has been affected by softer conditions in domestic and offshore demand, largely due to the U.S.-China trade war, though the March result was better than most expected and offers a positive sign for the future. However, we still expect further moderation of growth in industrial production in 2019.”

Figure 2 shows the growth of fixed asset investment year/year. In March, FAI grew at 6.3 percent, up from 5.3 percent in August last year. Based on the rule of 72, a 6.3 percent growth rate results in a doubling of investment in 11.4 years. The improvement in the latest reading was driven by a double-digit increase in road and railway transportation investment, which in turn will result in higher domestic steel consumption.

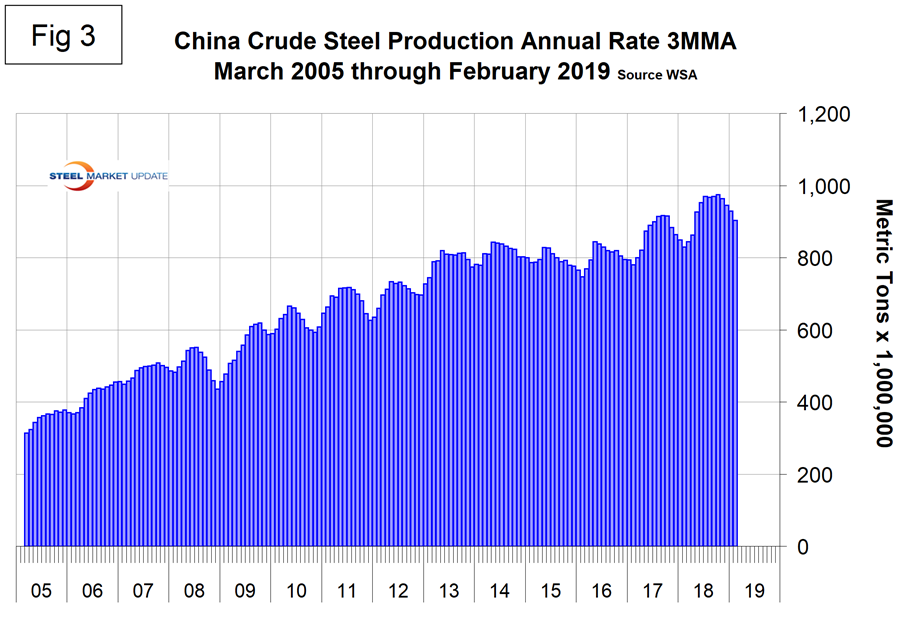

Figure 3 shows the 3MMA of China’s crude steel production through February when it accounted for 51.7 percent of global production. The WSA is forecasting a deceleration in China’s steel production growth in 2019.

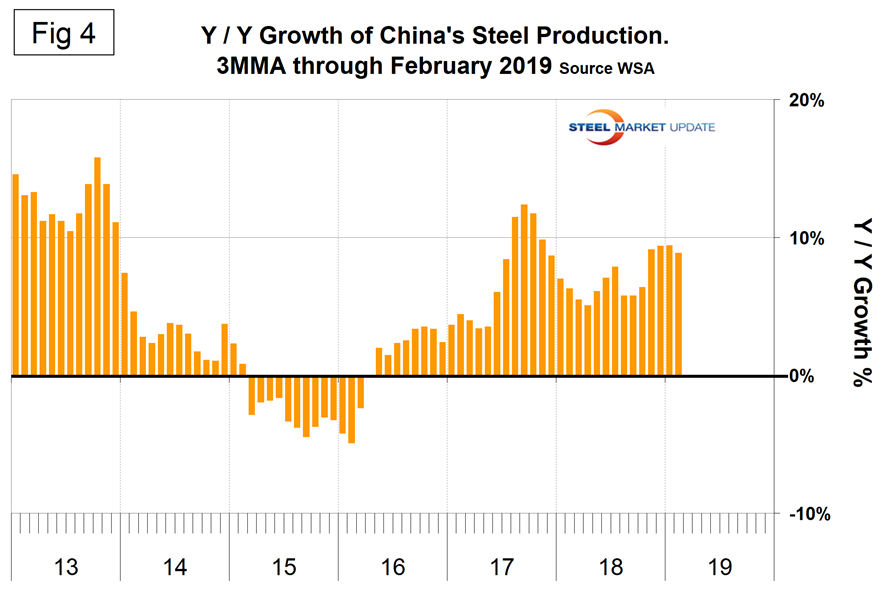

Figure 4 shows the year-over-year growth of China’s steel production. China’s production returned to positive growth each month since April 2016 and accelerated each month October 2018 through February 2019. The rest of the world had negative growth in January and February 2019.

SMU Comment. It seems that China is taking the trade talks seriously, but the downside is that this is not a zero sum game. If China increases imports from the U.S. it will reduce them from other nations with resulting unintended consequences. It occurs to us that this latest batch of economic data might be part of the negotiation game.