Prices

April 18, 2019

CRU: Iron Ore Surges While Coking Coal Prices Fall

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

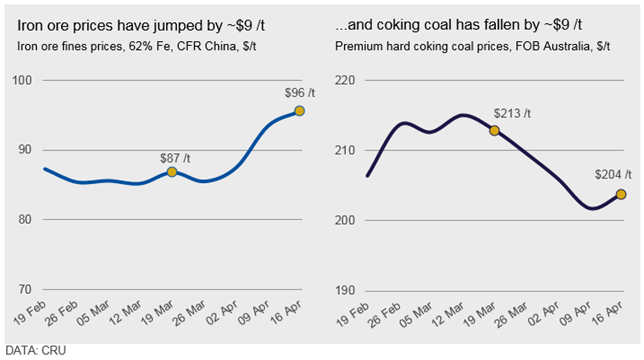

Demand for steelmaking raw materials has improved in April. Chinese steel prices have jumped on rising seasonal demand, particularly from the construction sector. Steel production in the country has also picked up, as indicated by the blast furnace (BF) utilization rate displayed in CRU’s Coking Coal and Iron Ore Dashboards. This has fuelled demand for steelmaking raw materials, but prices for iron ore and coking coal have moved in opposite directions in the past month.

For iron ore, robust Chinese demand has coincided with supply fears following extremely heavy rain in North Brazil and a cyclone in Australia that wiped out over half of the seaborne iron ore market for close to a week. The cyclone also damaged one of Rio Tinto’s two ports, which will hurt the company’s supply for the rest of April and possibly into May. This coincided with low iron ore inventories―Chinese steel mills had previously drawn down their iron ore inventories as margins were weak and were reluctant to buy iron ore at higher prices.

The coking coal story has been different. Mills in China have actually managed to hold comfortable inventory levels in the past month and, once demand improved, there was not the same rush to procure coking coal from the seaborne market as for iron ore. Australian coking coal supply, which was unaffected by cyclones, improved in March while demand in India, another key market, softened.

In the past month, coking coal and iron ore both moved by $9 /t, but in different directions. We expect demand in China to remain strong in the coming month, especially from the construction sector, although a relaxation of production cuts could result in contracting prices and margins.

With the recent news hinting at a restart of Vale’s Brucutu mine and recovering Australian supply, as well as rising Chinese concentrate production and improving supply from North Brazil, we see a downside risk to iron ore prices. For coking coal, we do not expect further price drops, as Chinese supply is steady while Indian demand is expected to rise in the coming month.