Prices

April 16, 2019

CRU: Scrap Price Falls Aided by Improved Supply

Written by Tim Triplett

By CRU Analyst Michelle Liu

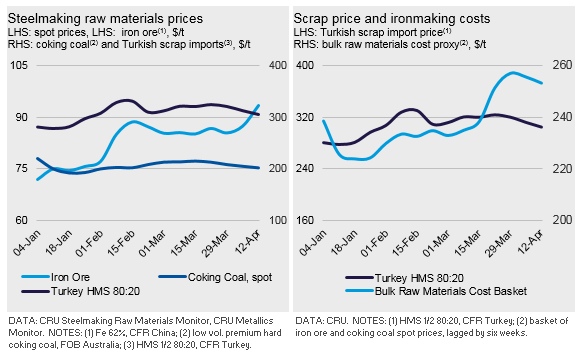

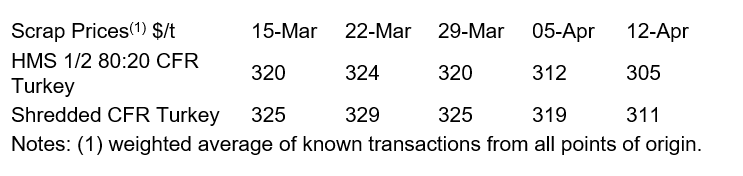

Turkish prices have continued to fall, down $7 /t w/w for the week ending Friday, April 12, to $305 /t CFR for HMS 80:20. Warmer weather has increased supply in the U.S. and Europe, placing downward pressure on scrap prices there. This was compounded by reduced scrap demand on both sides of the Atlantic due to mill maintenance outages in the U.S. and softer steel demand in Europe. We heard four Turkish scrap deals being concluded last week totaling around 120 kt.

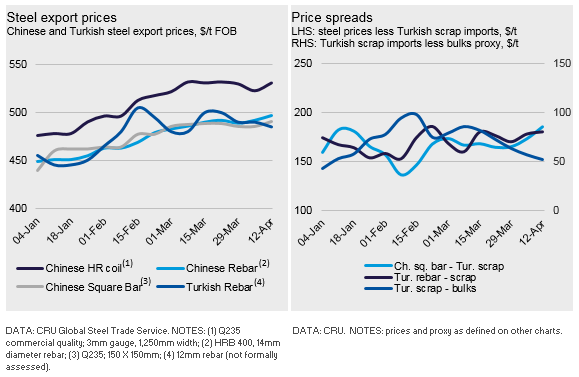

Turkish steel demand in both domestic and export markets was disappointing. Confidence in the Turkish economy from international investors remains low, meaning capital available to support domestic steel demand has not improved. In export markets, rebar prices were down $5 /t w/w. Turkish mills are not competitive in EU steel markets, being full exposed to a 25 percent safeguard tariff on rebar and wire rod, and are having to search for alternative buyers. Turkish mills must wait until July 1 before a new round of EU quotas open.

Rangebound Prices to Continue

Despite the price for iron ore increasing last week due to supply disruptions, we do not expect Turkish scrap prices to strengthen significantly over the coming month as scrap supply improves in the Northern Hemisphere. Scrap supply will increase with warmer spring weather and reduced snow cover. Global steel margins are at the lowest they have been in the past two years, meaning steelmakers are less willing to pay for higher scrap prices, despite iron ore prices rising. That said, we do not expect substantial falls from current levels as this would slow inflows in the U.S. and Europe, unless there is a sharp fall in steel prices.