Market Data

April 12, 2019

CRU & CME Discuss Hot-Rolled Coil Price Volatility: Buckle Up

Written by Tim Triplett

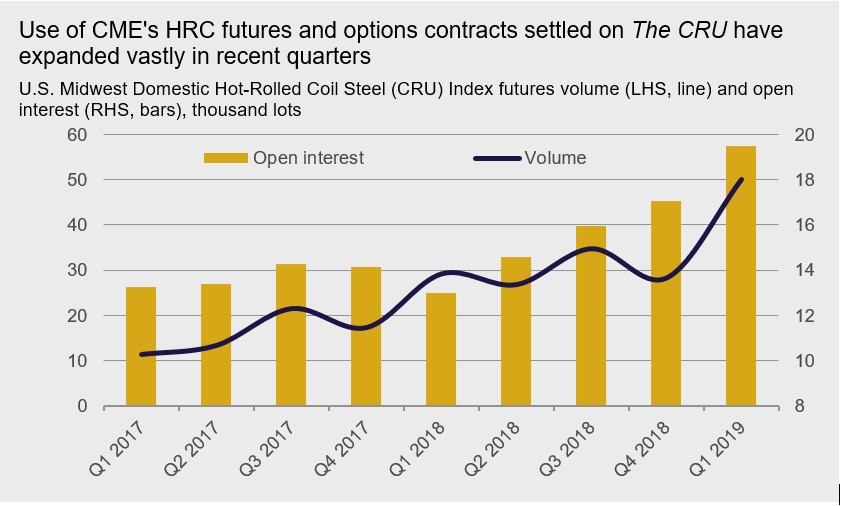

US Midwest HRC price volatility has increased markedly in recent months as government policy and inelasticity of domestic supply have led to large variations in physical market price. Concurrently, volume and open interest on the CME’s HRC futures and options contracts, settled on CRU’s US Midwest HRC price (“The CRU”) has surged as physical market participants look to manage price risk.

This futures contract has enabled users of the CRU to effectively hedge with minimal basis risk, taking advantage of a contract that has grown consistently with increasing liquidity while settling their physical contracts on the index of choice in the market.

In partnership between CRU and CME, you are invited to attend an upcoming webinar, discussing both the HRC physical and paper markets. The webinar will be approximately 45 minutes and will include Q&A with the presenters. Questions may be submitted during the webinar and upon registration. On the agenda:

- Causes of US Midwest HR coil price volatility;

- Understanding future market fundamentals and prices;

- Managing price risk now.

Presenters will include Chris Houlden (CRU), Josh Spoores (CRU), and Sean Kessler (CME).