Prices

March 28, 2019

Ferrous Scrap Prices Poised for Another Drop in May

Written by Tim Triplett

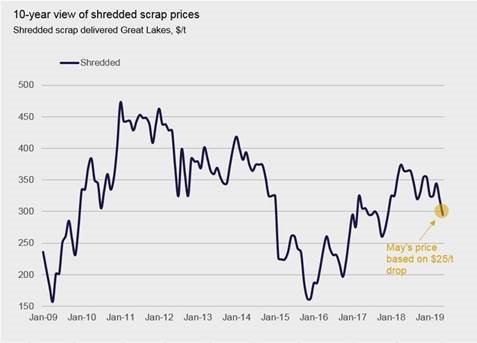

Ferrous scrap prices are poised to drop substantially in May, anywhere from $20 to $50 per gross ton, predict Steel Market Update sources, adding to the downward price momentum on finished steel. Scrap prices moved down or sideways in three of the first four months of the year.

CRU North America steel analyst Ryan McKinley said sentiment is souring and some observers believe U.S. scrap prices could decline by as much as $40-50 next month for the following reasons:

Weather—The U.S. has had a relatively warm start to spring and this has increased flows into scrap yards. The material that was buried by snow is now accessible to scrap collectors, and scale prices have been high enough to spur both demolition and independent peddlers to bring scrap into dealers’ yards.

Demand—While steel mill capacity utilization in the U.S. remains high, there isn’t much in the way of upward momentum. A few mills took unplanned outages in April, and a some will still be offline when the scrap market trades either this week or next. McKinley fully expects some mills to cancel outstanding orders by the end of this week.

Inventory levels—Dealers were unable to place all of their material in April so there is scrap overhanging the market right now. Mills also did not work through all of their inventories and will reduce their buys as a result.

Export Market—The export market has softened a bit with Turkish rebar sellers now cut out of both the U.S. and EU markets. The most recent deals have been done at $5-10 lower than earlier in April. If fewer deals are booked, scrap can move from the East Coast to inland mills, which further exacerbates the oversupply situation domestically.

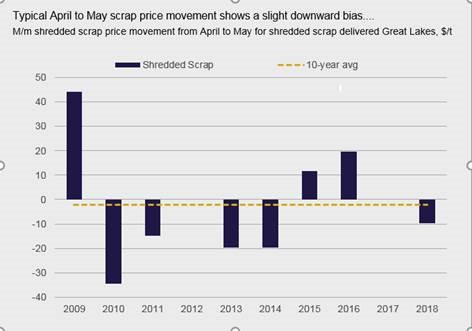

CRU’s charts below show the trends for scrap.

May is usually a month where the supply of obsolescent scrap is plentiful due to “spring cleanup,” which was delayed this year by the long winter in the north. Combined with lackluster demand from the U.S. mills, this is creating a glut of shredded. Industrial scrap is also in good supply due to increased manufacturing. Thus, scrap prices are likely to drop by at least $20-30/GT across the board, reported another scrap executive. At down $30, that would make the shred/bush/HMS prices in Detroit around $295/320/265 per gross ton, he said.

Export has been on a steady decline losing $16/GT in April—not enough for exporters to ship domestic but enough where eastern shredders are looking domestically for homes, added a dealer in the Northeast. “However, it’s the lack of demand that is the biggest factor going into May. Specifically, the lack of demand in key regions populated by independent mills that typically initiate pricing nationally.”

The Ohio Valley is currently buying about 50 percent of its normal monthly tons because of a combination of planned/unplanned outages and holes in steel order books. This is causing sellers to capitulate at down pricing in order to find the few available homes for their scrap. This also allows larger scrap consumers outside the region to wait out the market knowing there is excess scrap available, he explained. “It will be interesting to see if the mills view May as a buying opportunity to replenish stocks as many on both sides of the table view the coming market as at or close to the bottom.”

Pig iron pricing is holding its own, said one executive. “The lowest booking I have heard of was a cargo of Russian material at $365/MT CFR NOLA—down just $5/GT from a month ago. Iron ore is over $90/MT, and Ukrainian and Russian producers are allotting more of their liquid pig iron generation to steel products, resulting in less merchant pig iron on the market. U.S. mills want to buy at $350/MT or below, but it does not look like they can at this point.”

Commented another dealer out East: “The general sentiment for May ferrous scrap is that the market will trade down $20-$30, and perhaps a bit more on prime. But I don’t think the price drop will be long lived. On the other side of the coin, export demand and pricing are steady to slightly lower. At current export price levels, if the U.S. domestic market falls $20, exporters have little to no incentive to sell scrap to domestic mills. Perhaps more importantly, scrap inflows are trending well below typical seasonal levels for nearly all scrap yards, including the exporters. So, I would guess we see a bottom in May with a modest pickup in June or July, with steady price levels from there through the summer.”