Distributors/Service Centers

March 26, 2019

Strong M&A Activity in the Service Center Sector

Written by Tim Triplett

The metals service center industry will see significant ownership turnover and consolidation over the next 10-20 years, but is likely to remain a highly fragmented, family-owned industry, said Dan Sullivan, president of Montrose Advisors, an M&A advisory firm. Speaking at the S&P Global Platts North America Conference March 15 in Chicago, Sullivan said the robust economy, bullish stock market, favorable interest rates, high corporate profits and a positive view of the future are all contributing to “a strong deal psychology” and lots of M&A activity in the service center sector in North America.

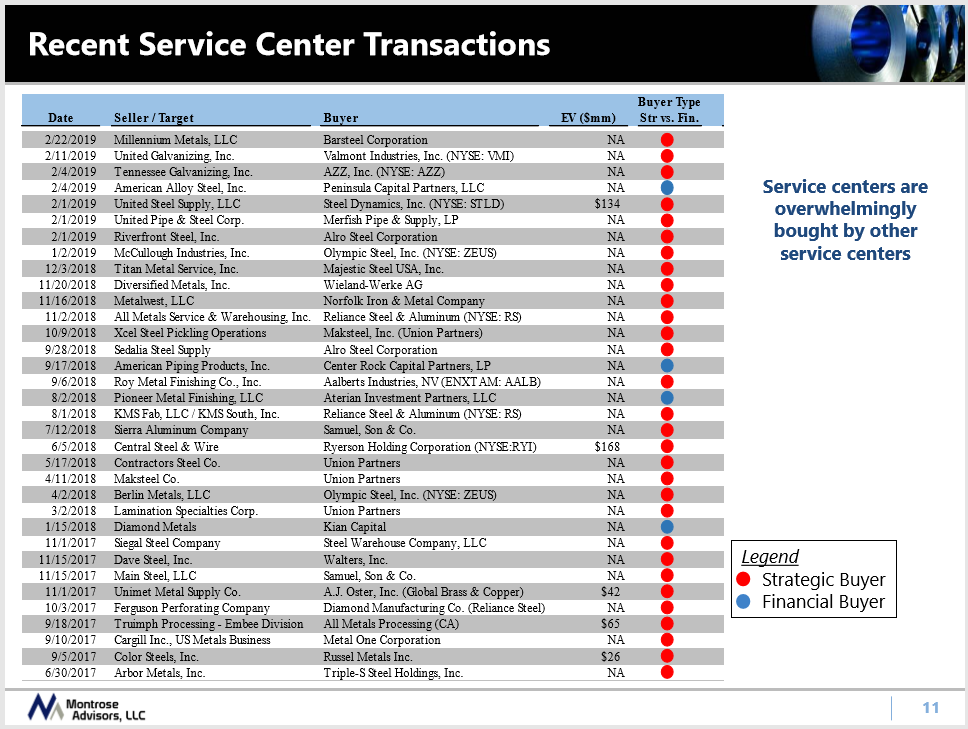

Who is buying service centers? In almost every case, other service centers (with the exception of toll processing businesses), Sullivan said. Recent service center transactions (see chart) show that it’s almost entirely strategic buyers, not financial buyers, who are active in the M&A space.

The service center model is a highly mature business, and the market in the U.S. and Canada is well saturated. “If you are a service center business and you are going to grow, it almost has to be by acquisition. That has to be a core part of your growth strategy,” Sullivan said.

Demographics is perhaps the biggest driver of mid-market M&A. A recent University of Illinois survey of 363 family-owned manufacturing businesses in the Chicago area revealed that 75 percent had owners over 55 years old and within sight of retirement, yet 62 percent had not designated a successor. Often the children of such entrepreneurs aspire to careers outside of manufacturing. Family businesses with no succession strategy are in jeopardy, Sullivan said. “You should be doing more planning on how you are going to get out of your business so you don’t get stuck.”

Not all the trends currently at play are positive for M&A. Some give potential buyers pause. The Trump administration tariffs on steel imports, for one. “Service centers are worried about what might happen with the tariffs. They were a boon in 2018, but their removal is a potential inventory time bomb,” Sullivan said. And if the tariffs are not rescinded, service centers may lose customers to a new wave of offshoring.

The 2020 election adds another layer of uncertainty to the M&A environment. A change of administration could prompt a change in trade and regulatory policy with a direct effect on steel. “That could be white knuckle time for a lot of people in the industry,” Sullivan said.

The gap between what sellers want for their business and what buyers are willing to pay is getting more pronounced in many cases, he noted. Cyclical businesses trade based on multiples of multi-year average EBITDA, not on the company’s best year. “Everyone wants to sell based on a multiple of their 2018 business, but no one wants to pay that.” At the same time, the seller is justified in expecting to recover some of his investment in working capital. “The balancing act between purchase price and working capital, and getting people to be realistic, is the challenge,” Sullivan said.