Prices

March 17, 2019

Market Psychology: Steel Prices Could Go Either Way

Written by Tim Triplett

Are steel prices witnessing a dead cat bounce or the beginning of a bullish reversal? The market appears split on the feline vs. bovine analogy. In other words, there is a huge divergence of thought on what is going to happen to steel prices over the next three or four months.

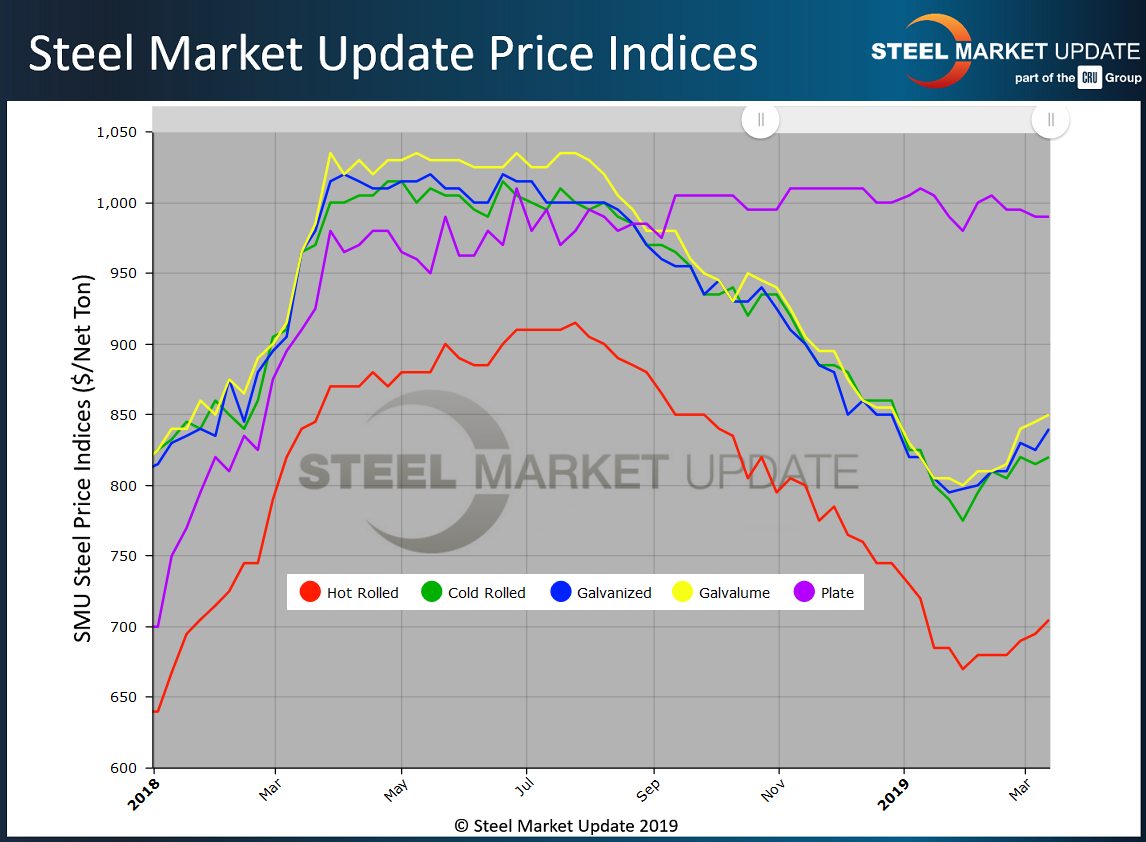

The benchmark price of hot rolled coiled steel peaked at around $915 per ton last summer, according to the Steel Market Update HRC index. HRC then began a steady descent that took it down to $670 per ton by late January—a 27 percent decline. Since then the price has recovered back up over $700. Will this be a soft bounce with no legs (as in a dead cat dropped from some height) or is it the beginning of a bull run?

Some bullish analysts forecast that the price of hot rolled steel could run back up as high as $900 a ton, near the peak of last year. With an assist from the Trump administration’s Section 232 national security tariff, which puts a 25 percent duty on foreign steel, domestic steel mills are operating near full capacity. With less competition from imports, and pent-up demand from the harsh winter, the mills are hoping to collect two $40 per ton price increases announced in January and February, with more likely to follow if those prove successful.

In the dead cat camp are analysts who are concerned about the staying power of Section 232, which is being challenged in Congress, in the courts and in various trade negotiations. It appears increasingly likely that the Trump administration will have to rescind the Section 232 tariffs on steel imports from Canada and Mexico to secure passage of the U.S.-Mexico-Canada trade agreement sometime this year. Opening the U.S. border to steel from the north and south could cause a surge in supply and drive prices back down to $600 per ton, some believe, making the recent uptick in prices just a short-term bounce. That’s the market psychology.

Current Steel Prices

As of March 12, Steel Market Update’s Price Momentum Indicator was set at Higher on flat rolled steel, as lead times have begun to extend and prices have begun to move up following the mills’ two announcements. (All prices below are FOB the mill, east of the Rockies.) The price of hot rolled steel averaged $705 per ton ($35.25/cwt) with lead times of 3-6 weeks. Cold rolled steel was selling at an average price of $820 per ton ($41.00/cwt), with lead times of 5-8 weeks. The benchmark price for galvanized .060-inch G90 coil averaged $918 per ton (45.90/cwt), with a lead time of 5-8 weeks. For Galvalume .0142-inch AZ50, Grade 80, the average price was $1,141 (57.05/cwt) per ton, with a lead time of 6-9 weeks. For steel plate, the SMU average was $990 per ton ($49.50/cwt) FOB delivered to the customer’s facility. SMU’s Price Momentum Indicator on plate was Neutral meaning prices were expected to remain steady over the following 30 to 60 days. This move to Neutral was because SSAB made a $40 price increase announcement a few days prior to this article being written, and it is SMU’s policy not to influence the market when announcements are made. Plate lead times were 6-9 weeks.

Distributors Supporting Mill Increases

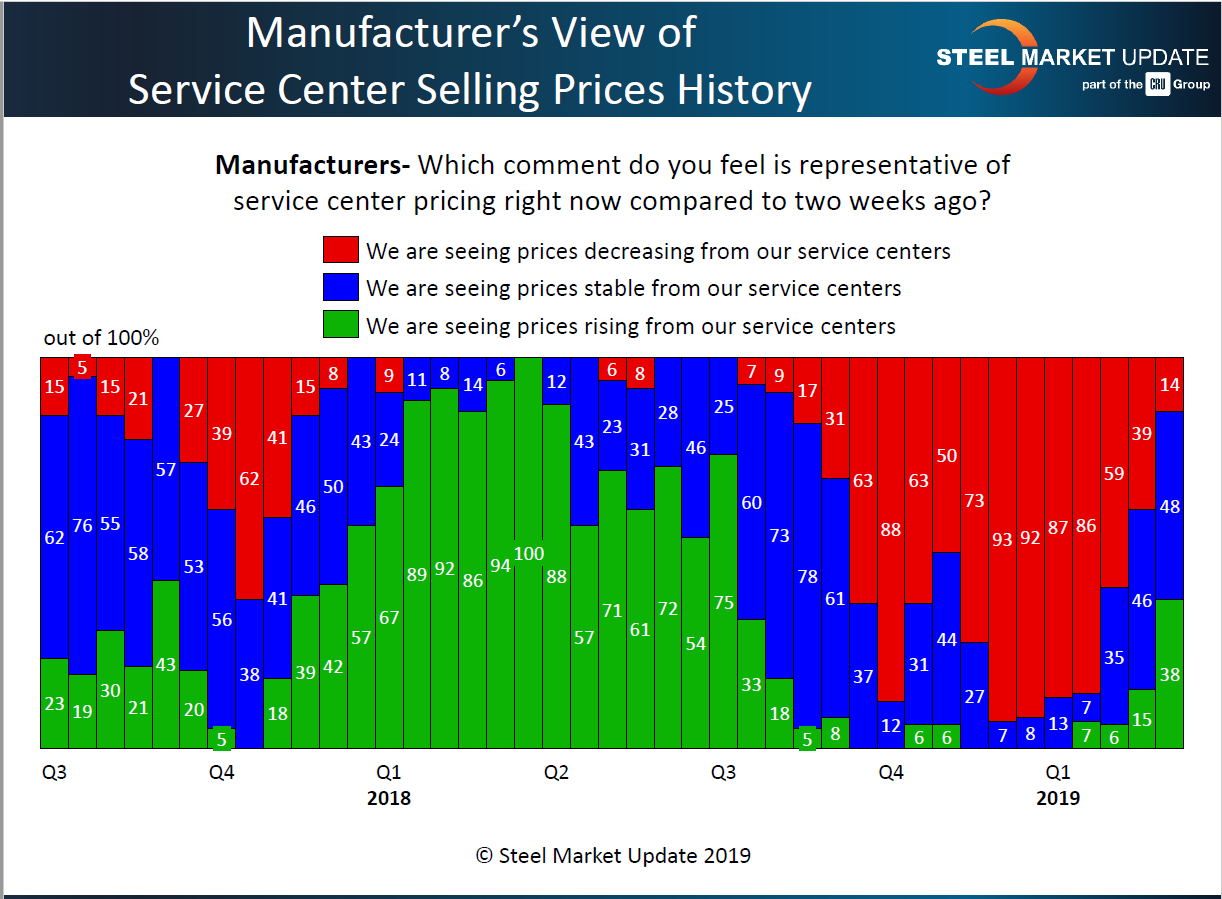

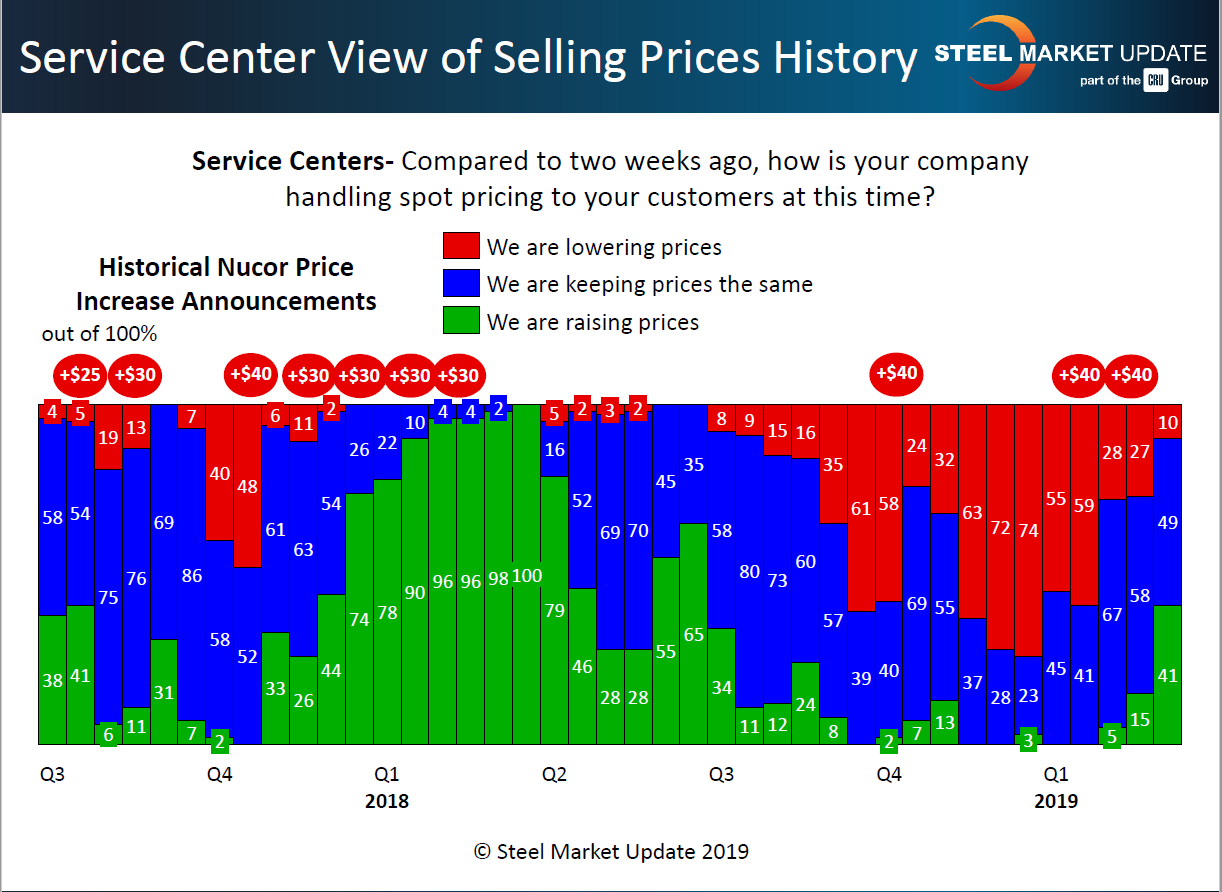

Steel Market Update canvasses the flat rolled and plate steel markets twice a month through the use of a questionnaire to end users, service centers, steel mills and trading companies. One of the key indicators SMU tracks is whether service centers are raising prices or continuing to offer discounts. The latest survey results show that flat rolled service centers are beginning to support the concept of higher steel prices. Distributors are raising spot pricing to their end-user customers and, in the process, are supporting the price increases announced by the domestic mills.

In the first week of March, 38 percent of the manufacturing companies responding to SMU’s questionnaire reported that their service center suppliers were raising spot prices—twice the percentage reported two weeks prior. At the same time, the percentage of manufacturers who reported falling spot prices declined from 39 percent to just 14 percent (see chart below).

Service centers, responding independently from the manufacturing companies, reported similar results. Forty-one percent said they were increasing pricing to their spot customers. Only 10 percent admitted they continued to offer discounts to customers to secure the sale. The graphic below depicts the service center results. The red ovals above the bars show the timing of the Nucor price increase announcements. Since late January, Nucor has announced $80 per ton in sheet increases.

What Steel Executives are Saying

Here’s what steel executives polled by SMU are saying about mill lead times and the current pricing environment. There is no clear consensus:

“We are starting to see mill lead times for HRC moving out to ship dates in the second and third week of April. We have paid about half of the total $80 per ton mill increase. Based on our communications with multiple sources, it appears the market may move mostly sideway. Steel mills are still willing to negotiate.”

“We are not seeing an extension in lead times yet. Some mills are basically sold out for Q2 and others still have April production. It is really kind of a mixed bag.”

“Lead times seem to be all over the place. There’s not the usual mix where integrated mills are notably longer than EAF mills. Bottom line, while lead times are slightly longer than a few weeks ago, there’s not a widespread momentum of extending lead times like we normally see when markets gain pricing strength. I think hot roll prices may get into the low $700s, then hold. There’s a greater chance we’ll see prices ease back again in the late spring and summer to the $670 range.”

“Weather has not had any impact. Demand was very strong to start the year, but now seems to be settling back into the expected range of 0-5 percent growth. There’s more chatter lately about demand concerns popping up in multiple sectors, and automotive in particular is making many folks nervous.”

“Pricing is increasing and will continue to increase for a while. I do not expect all of the $80 per ton increase to stick, but half to three-quarters will. Moderate firming of prices will continue unless the tariffs collapse.”

“Mill lead times are moving out, especially in the South for HR. With import pricing on a par with domestic now, I’m very concerned there will be little to no imports arriving in the summer. With the domestic mills already operating at a high capacity utilization, this could create a short supply issue. We have paid about $40 per ton of the increases, which look to have stabilized the bottom.”

“We have seen the mill lead times start to creep out and we have paid a little more than half of the $80 increase. We have booked a couple offshore orders at numbers not much less than current domestic prices, but we feel confident the current numbers will look great by the time the steel arrives. It’s hard to believe this market will not continue an upward trend, especially if there are not many import tons arriving.”

“I’m not overbuying at current levels, as I think pricing will go up a little over the next month or so. But I don’t believe that will last. I see pricing coming back down from mid second quarter into the third quarter. If and when the tariffs come off of Canada and Mexico, along with some imports coming in May/June/July, and we get some kind of trade agreement with China, we’ll see some softness again.”

“I don’t find it to be the least bit odd that the capacity utilization rate is where it is. The CRU peg cratered for both February and March transactions and I’m sure it brought people off the sidelines to buy on spot, contract or both. If the mills are careful and not greedy about the way they raise prices, they will not kill the market. The challenge in this market appears to be that fundamental demand (domestic or international) is not supporting a longer-term rise in market pricing. We’ll see as April and May are almost here and will quickly tell the rest of this tale.”

Based on executives’ comments and survey results, Steel Market Update believes spot steel prices will continue to gradually rise over the next 30-60 days, at least as long as the tariffs remain in place. If President Trump rescinds Section 232 on some countries, or replaces tariffs with quotas, all bets are off on how the market will react.