Prices

March 16, 2019

LME Zinc Stock Squeeze Belies Balanced Markets

Written by John Packard

By CRU Group’s Zinc Analysis Team

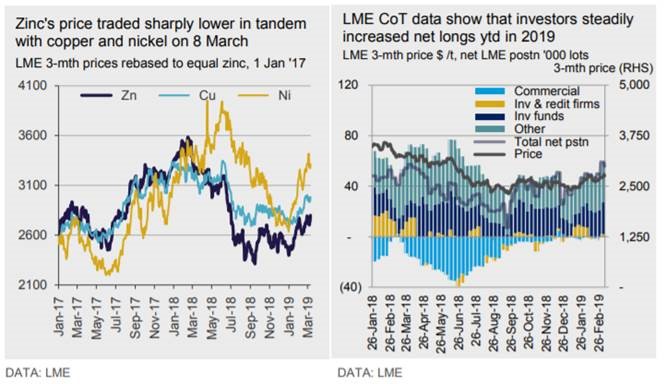

Zinc’s price on the LME tracked copper and nickel sharply lower on March 8 as data showed a steep fall in overall Chinese exports in February. Even though January and February data from China can be misleading due to the New Year holiday, the contraction in export volumes rattled commodities markets. Zinc’s cash price settled almost $80/t lower on the day, at $2,706/t. However, the slump was short-lived as competing bull narratives returned to the fore. A pledge from China’s central bank to increase lending and ever decreasing LME stocks contributed to a switch in sentiment, with zinc’s cash price being bid up to the mid $2,800s at the start of this week, its highest level since July 2018.

So, while LME stocks continue to fall, perhaps to the lowest level they can be (consensus estimates among market participants is that this could be 20,000-30,000t), zinc’s price is likely to remain supported. However, with the surge in TCs reflecting improved concentrate availability and signs of weak end-use demand in China and Europe, we believe that zinc’s price upside is relatively limited.

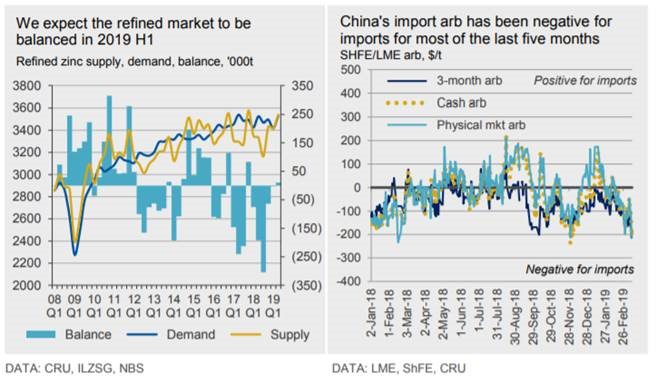

The LME’s commitments of traders’ data show that investors have steadily increased their non-risk-reducing (which we take to mean speculative) net long so far this year and, despite the recent slight pull back last week, the total speculative net long is now 56,000 lots (1.4Mt), up from 34,000 lots (850,000t) at the start of the year. The biggest year-to-date change has been in the investment fund category, whose net long has increased by 14,000 lots (350,000t) since the start of 2019, although the biggest change since early 2018 is in the commercial category, which has switched from a sizeable 35,000 lot (875,000t) net short in June last year to a marginal net long this year. We estimate that weak demand will help to bring the refined market to balance in 2019 Q1. We estimate that a 3.8 percent year-on-year increase in ex-China smelter output in 2019 Q1 has lifted production to 1.96Mt, against a 1 percent increase in refined demand. We expect Chinese imports to fall to more normal levels on a firmly closed arbitrage window, bringing the ex-China market to balance. In China, we have both smelter output and demand falling year-on-year, by 0.5 percent and 1.5 percent, respectively, and this, coupled with our expectation of lower net imports, brings the Chinese market to balance in the first quarter, too. In 2019 Q2, we expect the overall market to remain in balance, with a possible uptick in net imports into China (as post New Year demand begins to pick up) to result in a modest deficit in the world ex-China and a modest surplus in China.