Prices

March 12, 2019

CRU: Iron Ore Falls on Weak Chinese Demand

Written by Tim Triplett

By CRU Senior Analyst Erik Hedborg

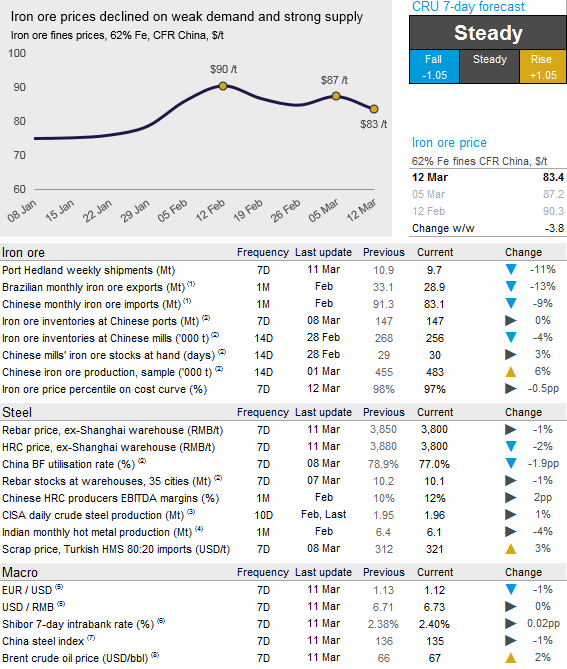

In the past week, iron ore prices continued to decline as demand in China remained weak. Steel prices continued to fall and buying activities have yet to pick up after the 13th National People’s Congress (NPC) began its annual two-week meeting on March 5. On Tuesday, March 12, CRU has assessed the 62% Fe fines price at $83.40 /t, down $3.80 /t w/w.

There has been a mixed bag in terms of seaborne supply in the past weeks. While Brazilian iron ore supply only saw a modest decline in February as Vale was running down inventories at its ports and mines, supply from Rio Tinto’s two ports have been exceptionally strong. Rio Tinto’s Robe Valley material is still being shipped at a reduced rate, but the company has managed to increase supply of its Pilbara Blend material. Meanwhile, supply from Port Hedland continues to be volatile. FMG’s shipments vary significantly from week to week and most recent data displays an 11 percent drop from Port Hedland w/w.

On Monday evening, the local authorities in Brazil suspended loading at Vale’s Guaiba port as the company has “failed to comply with environmental regulation.” The Guaiba terminal ships around 40 Mt/y of iron ore and is Vale’s third largest port complex behind Sao Luis (~200 Mt/y) and Tubarão (~100 Mt/y). There is no timeline on the suspension, but a previous closure was ordered on Jan. 31 and lasted for ~24 hours. However, CRU expects the current suspension to be more significant and port operations to be shut for at least a few days.

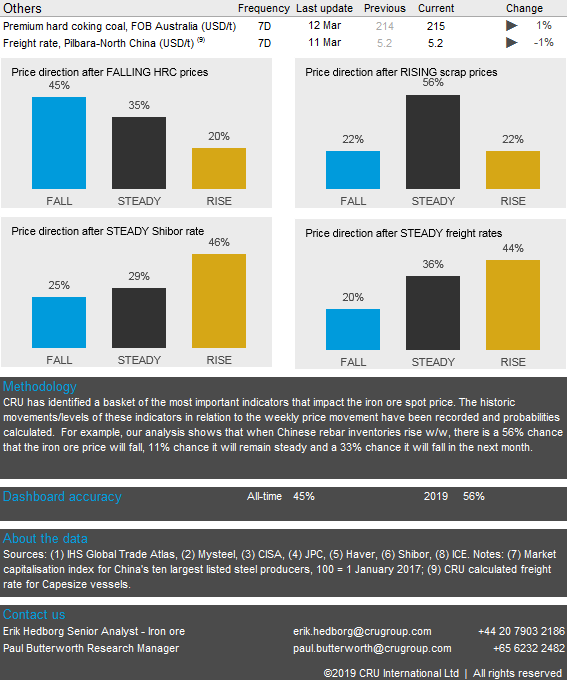

The market is still hampered by weak demand, but we expect improvements in the coming week as Chinese buying will pick up after the NPC. However, seaborne supply has remained strong and inventories at ports and mills remain high, which will limit the upside to iron ore prices. We are expecting prices to remain steady in the coming week.