Market Segment

March 2, 2019

Section 232 Tariffs Challenge AHMSA

Written by Sandy Williams

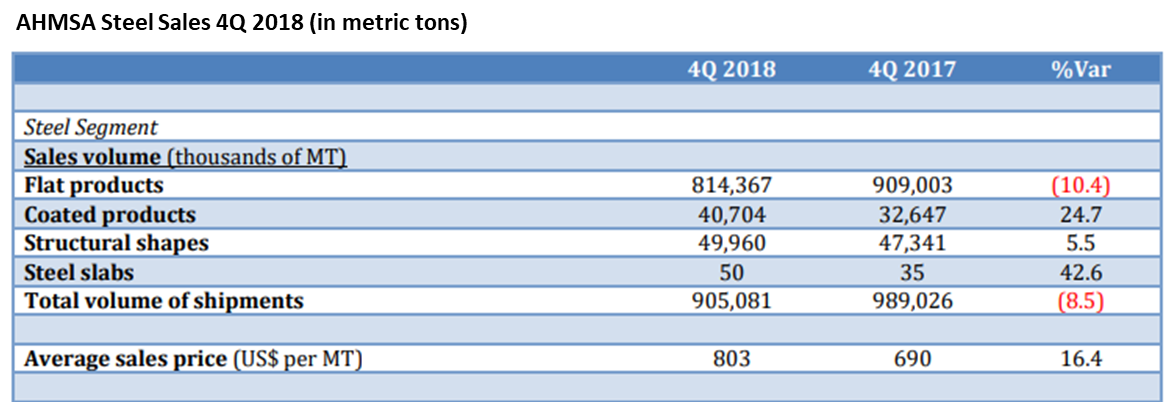

Altos Hornos de Mexico, S.A. (AHMSA), the largest steel producer in Mexico, reported that sales for fourth-quarter 2018 rose 6.5 percent year-over-year to $733.2 million. The improvement was due to stronger product mix and higher steel prices. The average steel sales price was $803 per metric ton.

Adjusted EBITDA was $7.0 million, an 85.2 percent decline from $47 million in the prior fourth quarter. Excluding the effect of the tariffs pertaining to Section 232, EBITDA was $27.2 million, a 24 percent decline year-over-year.

Shipments fell 8.5 percent from Q4 2018 to 905,000 metric tons. U.S. Section 232 steel tariffs had a significant impact on quarterly sales and volumes, said AHMSA Chairman Alonso Ancira Elizondo.

“This year, which should have been one of the best for AHMSA, was strongly affected by the U.S.’s application of Section 232 tariffs to Mexico, which directly and indirectly affected 28 percent of our sales in the last quarter. This event had a strong impact on the volumes and sales prices for the domestic industry as well as for AHMSA,” said Elizondo.

“Despite the challenges discussed above, we had better results than expected during the year, with a significant improvement of 245 percent in operating income mainly due to the increase in international steel prices.”

Elizondo said renewed safeguard duties of 15 percent on steel imports and the potential for complete or partial termination of Section 232 tariffs should result in greater sales volume and lower costs in 2019.

AHMSA is also strengthening its higher value-added steel mix and has reopened the Conchas Sur mine to secure its own supply of metallurgical coal. Repairs are under way on 35 coke ovens at the #1 coking battery, which is expected to increase coke capacity at the plant by approximately 177,000 MT.