Market Data

March 1, 2019

SMU Analysis: Key Market Indicators Strong in March

Written by Peter Wright

Steel Market Update is sharing this Premium content with Executive-level subscribers in this issue. For more information on upgrading to a Premium-level membership, email info@SteelMarketUpdate.com

Key market indicators were strong in March and the trends have improved since January.

This report is designed to provide a big picture summary of data we have covered in detail during the month. In it, we summarize 36 data streams that we believe critically describe the state of the steel market and provide forward guidance to steel executives. The government statistics departments still have a few straggling data streams due to the shutdown, but by mid-April all will be up to date.

See the end of this piece for an explanation of the Key Indicators concept. This will explain the difference between our view of the present situation, which is subjective, and our analysis of trends, which is based on the latest facts available.

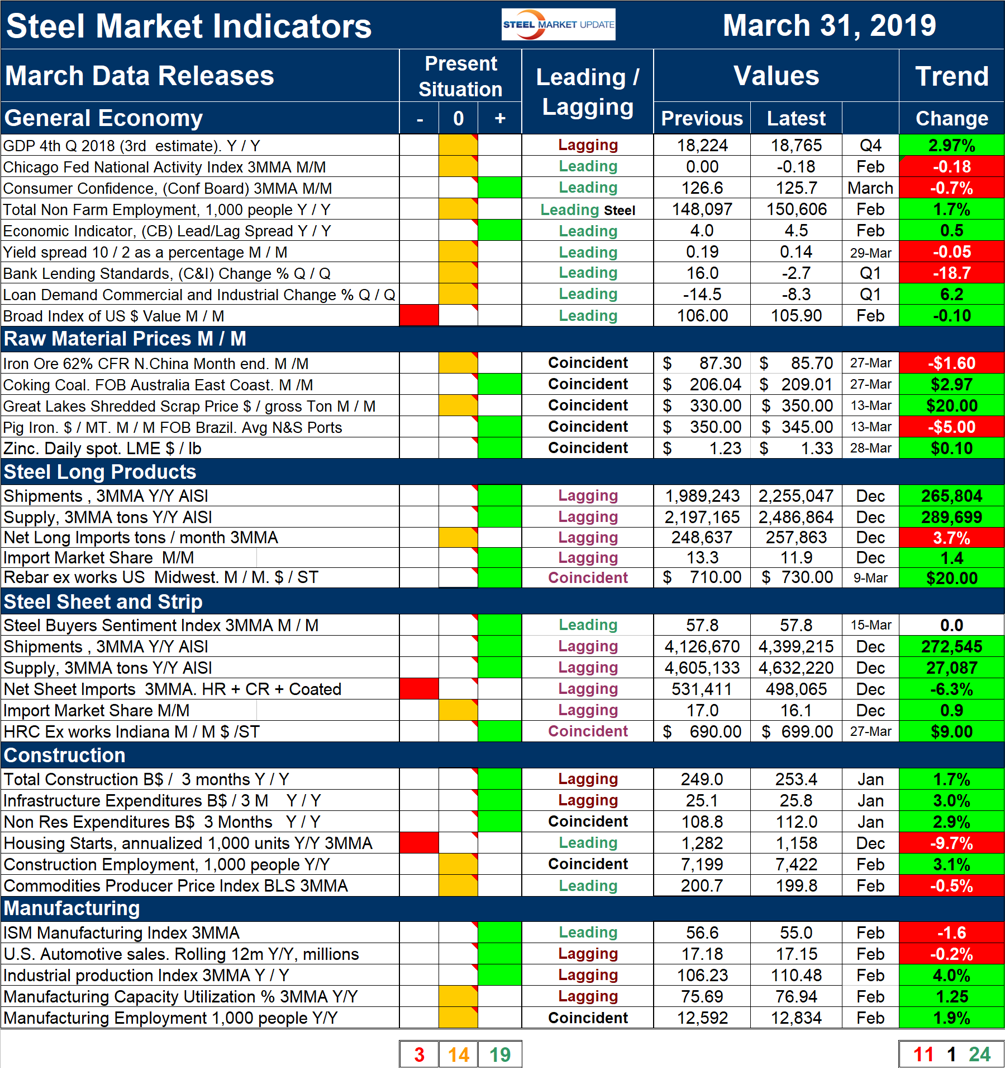

Please refer to Table 1 for our view of the present situation and the quantitative measure of trends. Readers should regard the color codes in the present situation column as a visual summary of the current market condition. The “Trend” columns of Table 1 are also color coded to give a quick visual appreciation of the direction the market is headed. All results are the latest available as of March 31, 2019.

Present Situation

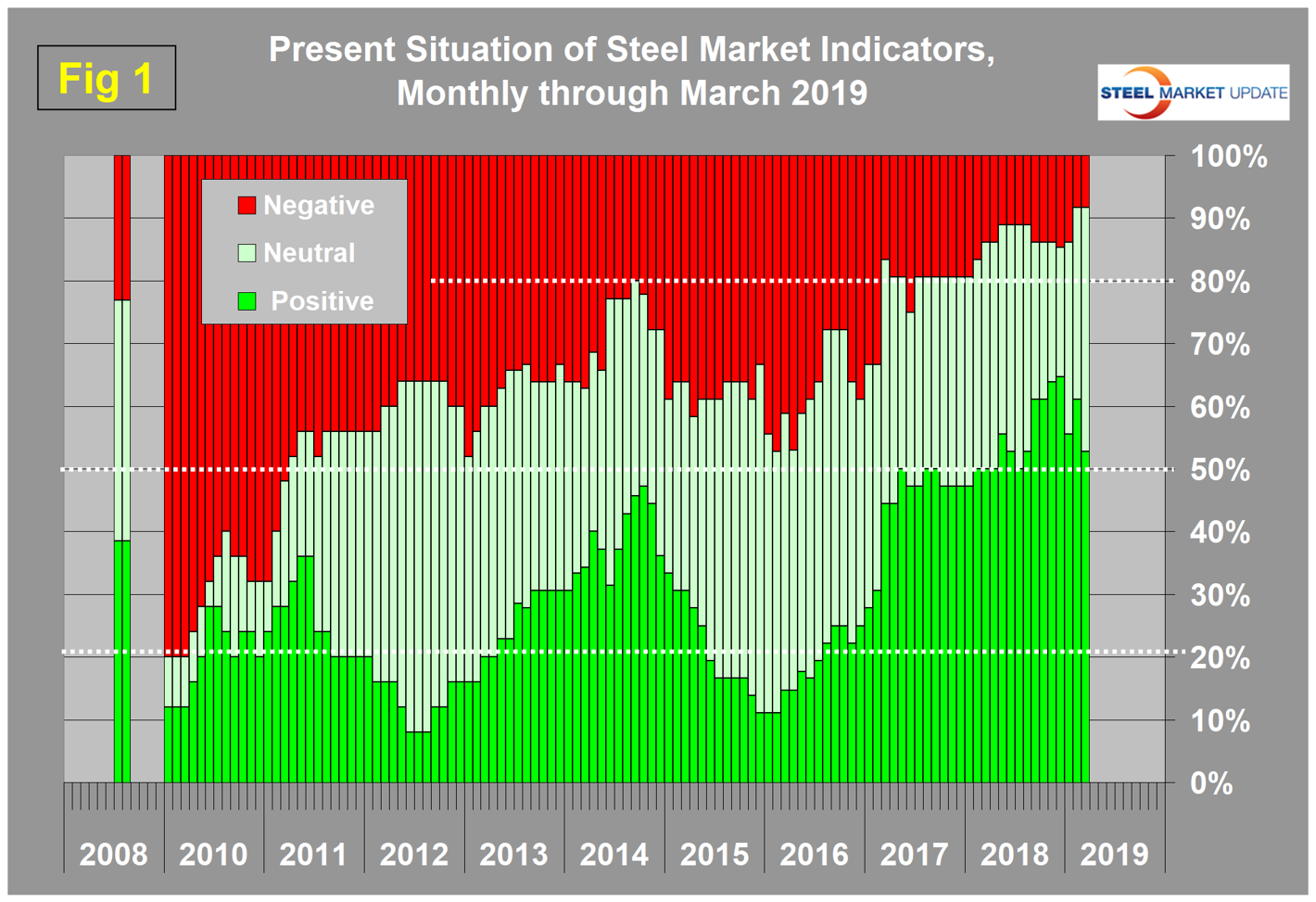

In our February analysis, the number of negatives declined to three and stayed at three in March. These results were the lowest negatives in the history of this analysis. There was a decrease of three in the number of positives and an increase of three in the number of indicators that we consider normal. Our intent in using the word normal is to say that this indicator is in the mid-range of historical data. Figure 1 shows our monthly assessment of the present situation since January 2010 on a percentage basis. In the general economy section, we revised GDP from positive to normal when the growth rate fell below 3.0 percent. In March, we revised our methodology for assessing the change in the number employed from an actual number to a growth rate. This resulted in a change from positive to normal for nonfarm employment. The only other change in the present situation was for the producer price index of commodities, which declined from positive to normal. We regard the commodity PPI as a leading indicator of industrial construction.

Trends

Most values in the trends columns are three-month moving averages (3MMA) to smooth out what can be very erratic monthly data. Trend changes in the individual sectors are described below together with some general comments. (Please note that in most cases this is not February data but data that was released in February for previous months.)

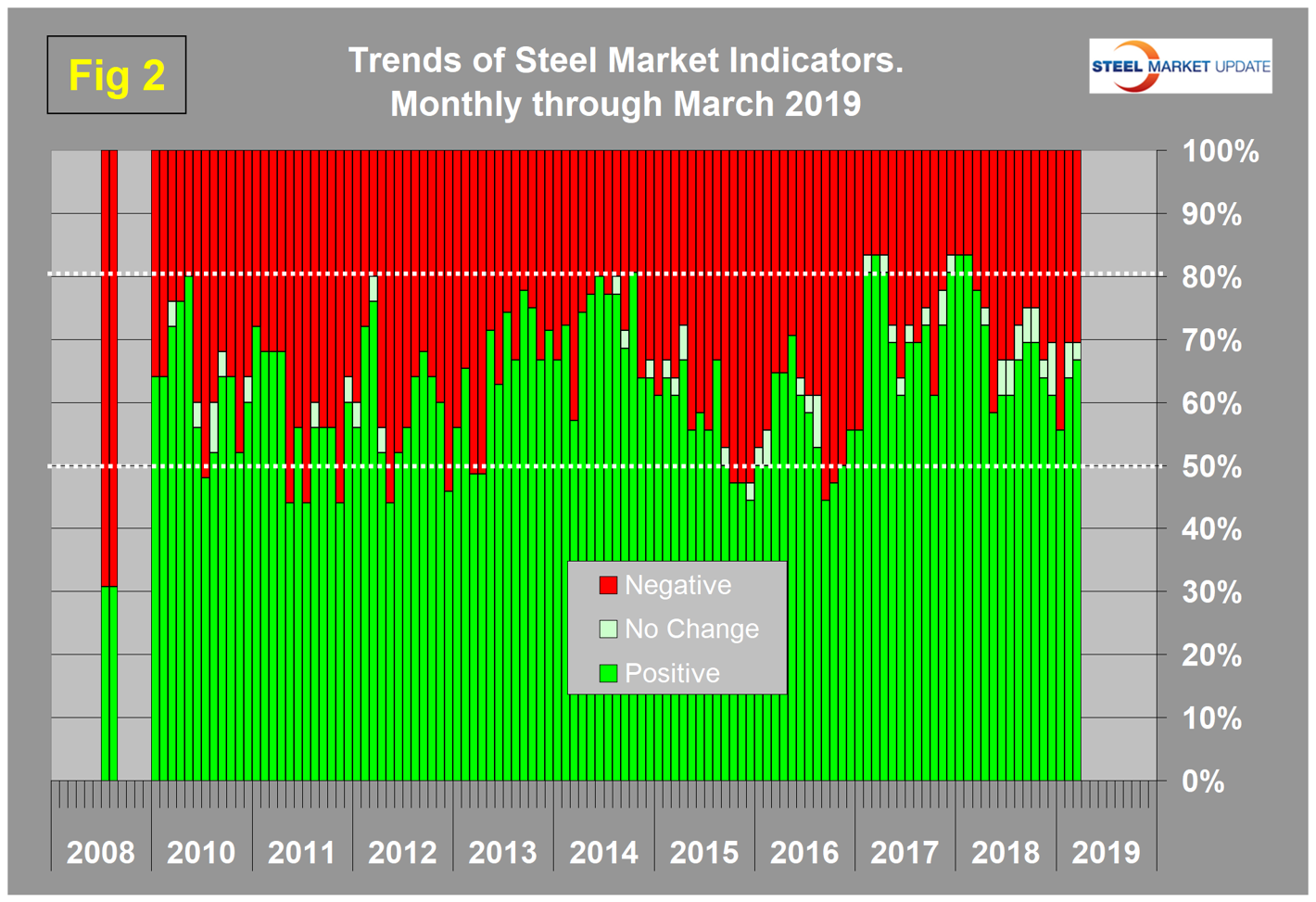

Figure 2 shows the trend of the trends and the pre-recession situation at the far left of the chart. Trends have recovered from the January slump to the point that in March exactly two-thirds of the 36 indicators were trending positive.

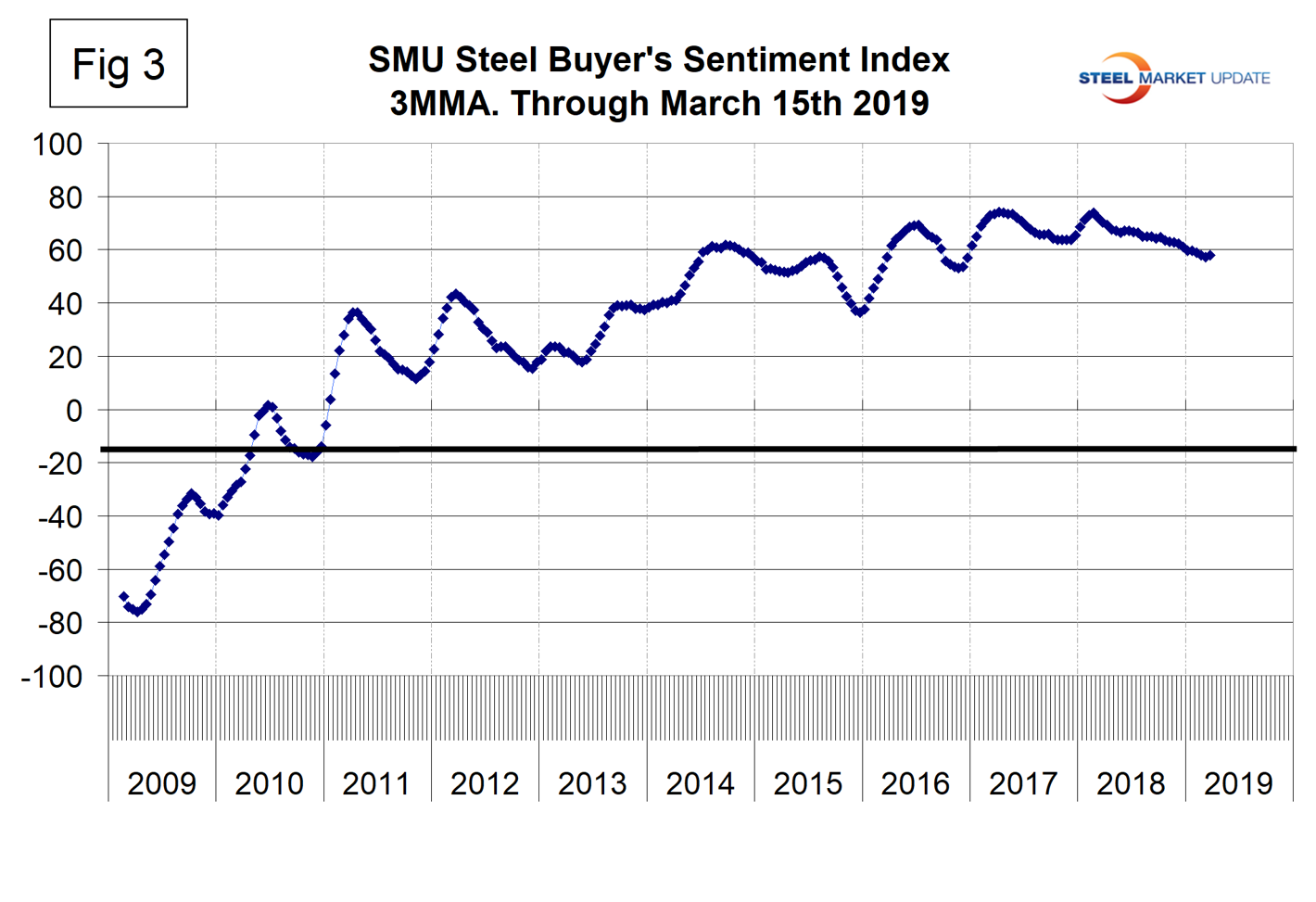

Our observations about trends in the March data are as follows: The prices of HRC and rebar reversed course and strengthened as did the price of Chicago shredded. Iron ore and pig iron both weakened. In the sheet and strip section, the steel buyers sentiment, which had deteriorated in February, was unchanged in March. There has been a gradual decline in buyers’ sentiment since February last year, but its value is still strong. This index reports on how buyers feel about their company’s opportunity for success in today’s market (Figure 3).

The only trend change in the construction and manufacturing sections was that automotive sales reversed course and declined. In the construction section, four of six indicators are trending positive and in the case of manufacturing three of five are trending positive.

The only trend change in the construction and manufacturing sections was that automotive sales reversed course and declined. In the construction section, four of six indicators are trending positive and in the case of manufacturing three of five are trending positive.

We believe a continued examination of both the present situation and direction is a valuable tool for corporate business planning. Figures 1 and 2 both show the pre-recession situation in August 2008. The trends analysis shows that the steel market was going over a cliff, but the actual values of the indicators at that time were still good with only 23 percent registering as historically negative.

Explanation: The point of this analysis is to give both a quick visual appreciation of the market situation and a detailed description for those who want to dig deeper. It describes where we are now and the direction the market is headed and is designed to describe the situation on a specific date. The chart is stacked vertically to separate the primary indicators of the general economy, of raw material prices, of both sheet and long product market indicators, and of construction and manufacturing indicators. The indicators are classified as leading, coincident or lagging as shown in the third column.

Columns in the chart are designed to differentiate between where the market is today and the direction it is pointing. Our evaluation of the present situation is subjectively based on our opinion of the historical value of each indicator. There is nothing subjective about the trends section, which provides the latest facts available on the date of publication. It is quite possible for the present situation to be predominantly red and trends to be predominantly green or vice versa depending on the overall situation and direction of the market. The present situation is subdivided into: below the historical norm (-), (OK), and above the historical norm (+). The “Values” section of the chart is a quantitative definition of the market’s direction. In most cases, values are three-month moving averages to eliminate noise. In cases where seasonality is an issue, the evaluation of market direction is made on a year-over-year comparison to eliminate this effect. Where seasonality is not an issue, concurrent periods are compared. The date of the latest data is identified in the third values column. Values will always be current as of the date of publication. Finally, the far-right column quantifies the trend as a percentage or numerical change with color code classification to indicate positive or negative direction.