Market Data

March 1, 2019

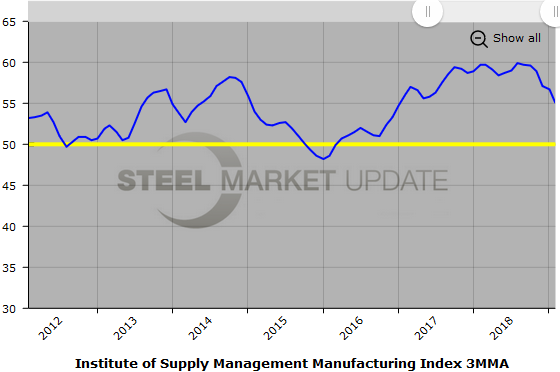

Manufacturing Slows as ISM's PMI Dips in February

Written by Sandy Williams

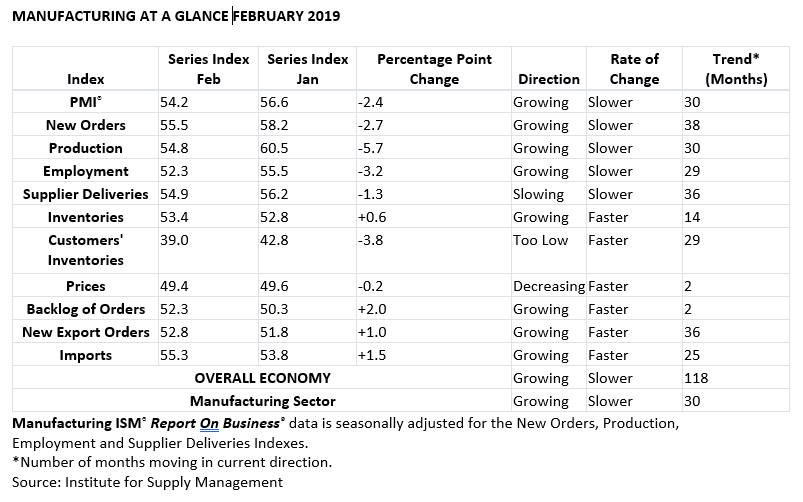

Manufacturing activity slowed its rate of growth in February, according to the latest Manufacturing ISM Report on Business. The headline PMI fell further than expected last month, coming in at 54.2, a 2.4 point decline, and below the general consensus of 55.0.

“Production expansion continued in February, but at a slower pace compared to January,” said Timothy Fiore, chairman of the Institute for Supply Management. “Production was not able to keep pace with customer-inventory demand and was not able to prevent a growth in backlog orders. Weather conditions causing factory shutdowns may have contributed to the weaker expansion performance.”

Indices for new orders and production fell 2.7 and 5.7 points, respectively. Customer demand expanded for the 38th month, but at a softer pace than January. The new export orders index registered a gain of one percentage point for a reading of 51.8 percent. Imports volume picked up in February due to activity before the Lunar New Year and attempts to avoid the now delayed tariff increase on Chinese goods that was slated for March 1.

Raw material inventories grew due to improved supplier delivery performance. Customer inventories, at an index reading of 39.0 in February, were consider too low but “represent future production-growth potential,” said Fiore.

The prices index decreased 0.2 percentage points to 49.6. The index lost 22.2 points during the past four months.

“Prices contracted for the second straight month,” commented Fiore. “Decreases were reported in aluminum, steel, steel-based products, various chemicals and plastic resins. Steel prices have returned to more normal levels. Price increases and shortages continue for passive electronic components.”

Panelists’ comments included:

- “Business so far this year is meeting, but not exceeding, our forecast. We are concerned about indicators showing a slight recession for the second half of the calendar year.” (Fabricated Metal Products)

- “Aerospace engine-related business continues to be strong. Energy and general industry-related business is flat to down.” (Miscellaneous Manufacturing)

- “Orders remain strong. Supplier delivery continues to be challenged on some commodities.” (Machinery)

- “Still fairly steady with production and services.” (Transportation Equipment)

- “Demand remains healthy at the beginning of 2019. However, growing concerns for what could be another round of tariffs in March are further escalating price increases of already constrained electronic components. Expect to see increased lead times and prices throughout Q1 and Q2.” (Computer & Electronic Products)

- “Strong start to the year, though weather has been a challenge.” (Chemical Products)

- “Uncertainty of steel prices due to Section 232 tariffs on imported steel and lack of resolution of the anti-dumping trade cases.” (Petroleum & Coal Products)

- “General business conditions started to slow at the end of January, continuing through February.” (Plastics and Rubber Products)

- “Economy showing general strength, especially in manufacturing. Cost pressures and tariff challenges persist but are manageable. General outlook is for stability and potential improvement in the second half of 2019.” (Food, Beverage & Tobacco Products)