Market Data

February 28, 2019

CRU on Metal Demand Drivers in the U.S. Economy

Written by Tim Triplett

By CRU Principal Economist Lisa Morrison

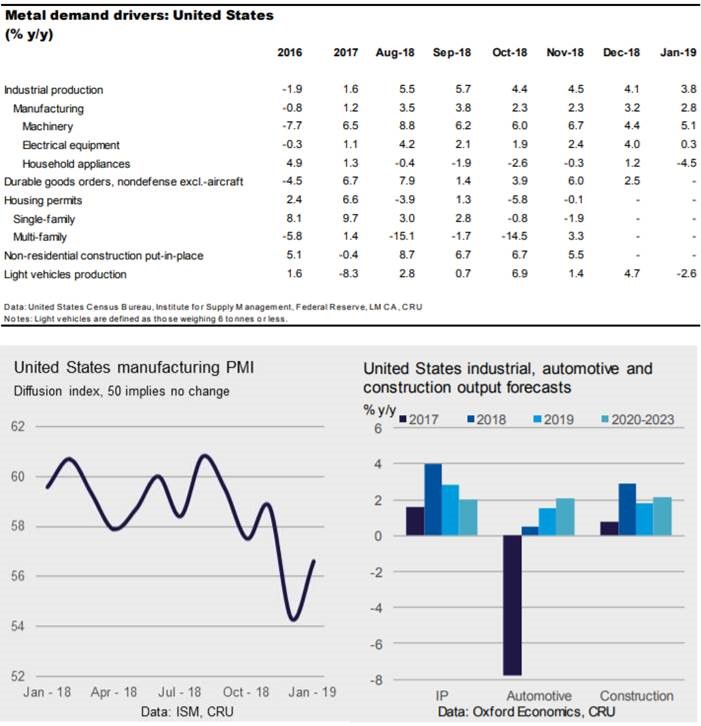

U.S. economic data for December and January are beginning to come in now that the federal government is funded for the remainder of this fiscal year, which ends Sept. 30.

December housing starts showed a weak end to 2018 as the total of 1.247 million units for 2018 was lower than we expected by about 20,000 units. Permits data, however, were more encouraging at nearly 1.33 million units, and we note the continuation of strong multifamily activity against a rather lackluster single-family sector. If the December data are indicative of 2019 overall, then our forecast for starts of 1.29 million units this year will hold.

The release of industrial production data was not affected by the shutdown, and the January report indicated that 2019 started off well for both manufacturing and oil & gas. We thus continue to expect IP growth of 2.8 percent this year, down from 3.9 percent in 2018.

Our vehicle production forecast for 2019 is unchanged at ~11.6 million units, but we note that sales have softened and there is downside risk to domestic demand. Speaking of downside risk, the Commerce Department delivered its report on the Section 232 investigation into vehicle imports to President Trump, but did not provide any insight as to the recommendations. The president now has until May 18 to take additional action.

Trade negotiations with China are progressing well enough that President Trump lifted the March 1 deadline for the escalation of tariffs on Chinese imports (to 25 percent). This was good news for the financial markets, and the dollar even weakened a little in response.

A new risk for us to monitor is whether the change in the 2018 tax law requires higher withholding by individuals in 2019, which could translate into lower consumer spending growth this year.